As an employer, it’s your responsibility to collect, file, and deposit payroll taxes with the proper agencies (e.g., IRS). Depending on your payroll and tax liability amount, you may need to deposit taxes more frequently. If you tend to have a heftier payroll, you need to learn about the Next-Day Deposit Rule.

Before you can learn about the Next-Day Deposit Rule…

Before you can dive into the Next-day Deposit Rule, there are a few things you need to know (or brush up on).

Lookback period

How often you deposit your taxes depends on a lookback period. A lookback period is the time frame you use to determine your deposit schedule for FICA tax (Medicare and Social Security) and federal income tax. Your lookback period depends on if you file Form 941 or Form 944 (which we’ll get to more later).

Your tax liability during the lookback period determines what kind of filer you are. Generally, you can either be a monthly depositor or semiweekly depositor. Take a look at how the two differ:

- Monthly depositor: You report a tax liability of $50,000 or less during the lookback period

- Employers must deposit their taxes on payments made during the month on or before the 15th day of the following month (e.g., taxes collected in August are due by September 15)

- Semiweekly depositor: You report a tax liability of more than $50,000 during the lookback period

- Payday determines employers’ due dates

- If a payday falls on a Wednesday, Thursday, and/or Friday, employers must deposit taxes by the following Wednesday. If it falls on a Saturday, Sunday, Monday, and/or Tuesday, deposit taxes by the following Friday

Forms 941 and 944

To understand the Next-Day Deposit Rule, you need to know a little bit about Form 941 and Form 944. Let’s dive in.

Form 941

Form 941, Employer’s Quarterly Federal Tax Return, is a quarterly form employers use to report employee wages and payroll taxes (e.g., federal income and FICA taxes).

Form 941 filers use a four-quarter lookback period that starts halfway through one calendar year (July 1) and ends halfway through the next calendar year (June 30).

Form 941 filers must report their Social Security, Medicare, and federal income tax liabilities on a quarterly basis. To determine your lookback period for the year, calculate your total tax liability from July 1, XXXX – June 30, XXXX.

Form 944

Form 944, Employer’s Annual Federal Tax Return, is a form that eligible small businesses file annually to report federal income and FICA taxes on employee wages. Form 944 is the same type of form as Form 941 aside from the due date. You can only use Form 944 if the IRS tells you to.

If you file Form 944 for the current year or if you filed it in either of the previous two years, your lookback period is the second preceding calendar year (e.g., lookback period for 2021 is 2019).

Deposit schedules for Forms 941 and 944

If you file Form 941, you will be a monthly or semiweekly depositor. As a reminder, your total tax liability during the lookback period determines your deposit schedule.

Form 944 filers can also be monthly or semiweekly depositors. But because many Form 944 filers have a small tax liability, some filers only have to pay their federal taxes when they file their return. Take a look at the Form 944 deposit requirements chart below:

| Tax Liability | Deposit Requirement |

|---|---|

| Less than $2,500 for the year | You can pay the tax with your annual return. |

| $2,500 or more for the year, but less than $2,500 for the quarter | Deposit by the last day of the month after the end of a quarter. |

| $2,500 or more for the quarter | You must deposit monthly or semiweekly depending on your deposit schedule. |

IRS Next-Day Deposit Rule

At this point, you’re probably wondering, Where does this IRS Next-Day Deposit Rule come into play?

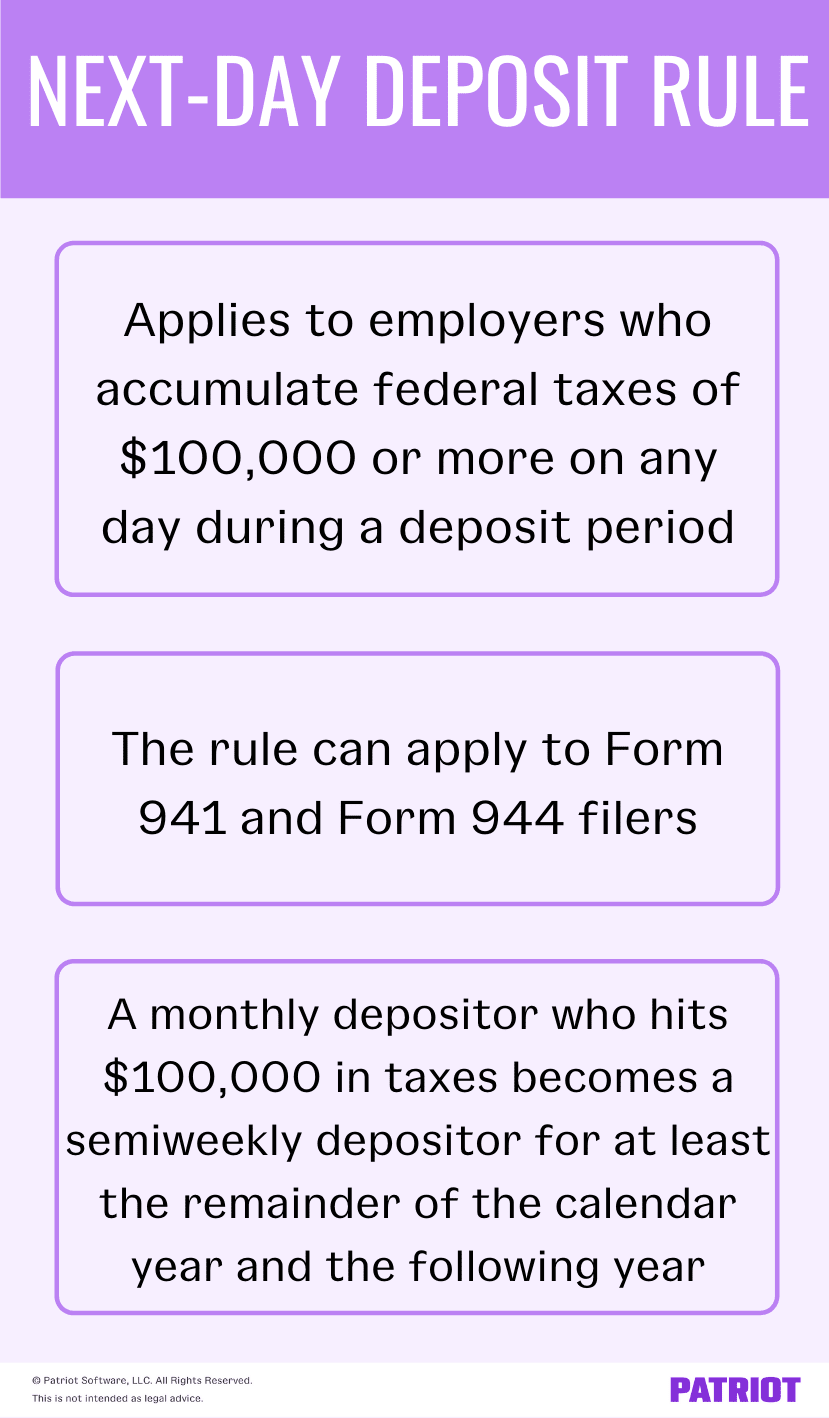

This Next-Day Deposit Rule only applies to certain employers who file Form 941 or Form 944.

The $100,000 next-day payroll tax deposit rule applies to employers who accumulate federal taxes of $100,000 or more on any day during a deposit period. The deposit period for monthly schedule depositors is a calendar month. For semiweekly schedule depositors, the deposit periods are Wednesday – Friday and Saturday – Tuesday. If you reach the $100,000 tax mark, you must deposit the taxes by the next business day.

The Next-Day Deposit Rule applies to “single” payrolls (e.g., one payroll with $100,000 in taxes) as well as multiple payrolls within the deposit period (e.g., one payroll with $40,000 in taxes and the other with $60,000 in taxes during the period).

If you’re a monthly depositor and you hit $100,000 in taxes (even if it’s just once), you become a semiweekly depositor for at least the remainder of the calendar year and the following calendar year.

What if you have more than $100,000 in taxes?

Once you accumulate at least $100,000 in a deposit period, stop accumulating at the end of that day and start a new accumulation the following day.

For example, say you accumulate $110,000 in taxes on a Monday. Because of the rule, you must deposit this amount by Tuesday. On Tuesday, you accumulate additional taxes of $40,000. Because the $40,000 is not part of the $110,000 deposit and is less than $100,000, follow the semiweekly deposit schedule and deposit the $40,000 on Friday.

How long should you accumulate taxes for?

For the $100,000 Next-Day Deposit Rule, don’t continue accumulating your tax liabilities after the deposit period.

Say you’re a semiweekly depositor and have an $85,000 tax liability on a Tuesday and a $20,000 liability on Wednesday. In this situation, the next-day rule doesn’t apply to you because the Tuesday liability has a separate deposit period (taxes due by Friday) than the Wednesday tax liability (taxes due by the following Wednesday).

What if the following business day falls on a weekend or holiday?

If the deposit’s due date falls on the weekend or a federal legal holiday, the deposit is due the following business day after the weekend or holiday. A statewide holiday does not delay the due date.

What happens if you don’t pay by the next business day?

If you make the tax deposit after the next business day, you may be subject to fees and penalties from the IRS (e.g., 10% of your total tax liability).

What about new employers?

A new employer’s taxes in the lookback period for any period before they started the business is zero. In the first year of business, new employers are monthly depositors. However, if you’re a new employer and the next-day rule applies to one of your payrolls, you will become a semiweekly depositor.

Where can I find additional information about the next-day rule?

For more information about the Next-Day Deposit Rule, check out:

Next-Day Deposit Rule: Examples

Interested in seeing the next-day rule in action? Check out a few examples of different scenarios below.

Example 1: Single payroll

Say you are a monthly depositor and had one payroll on a Wednesday with a payroll tax liability of $100,000. Because you have $100,000 in tax liabilities for the period, the Next-Day Deposit Rule applies to you.

You must deposit $100,000 by the next business day, Thursday. And, you are now a semiweekly depositor instead of a monthly depositor.

Example 2: Legal holiday

Say you accumulate a tax liability of $100,000 on a Friday. Normally, you would deposit by the next business day. However, the upcoming Monday is a legal holiday. Because the Monday deposit date falls on a legal holiday, you must make your deposit the next business day, Tuesday.

Example 3: Multiple payrolls

Let’s say you accumulated a tax liability of $50,000 on a Wednesday payroll. Then on Friday, you accumulate an additional $50,000 in tax liabilities for another payroll.

Your accumulated tax liability is $100,000. You must make your deposit by the next business day. Because weekends don’t count as business days, you must make your deposit by Monday.

You need to make sure your payroll taxes are always paid on time to avoid any penalties. To steer clear of problems and make payroll a breeze, use Patriot’s Full Service payroll software. Our payroll services handle your payroll tax filings and deposits for you. Say goodbye to worrying about payroll taxes by starting a free trial today!

This is not intended as legal advice; for more information, please click here.