As a small business owner, you have likely heard of IRS Form 941. If you file IRS Form 941, do you know the steps you must follow for Form 941 reconciliation? Find out how to reconcile Form 941 and why reconciliation is important for your small business.

What is Form 941?

You must know what is Form 941 before you can learn how to reconcile Form 941.

As a brief recap, Form 941, Employer’s Quarterly Federal Tax Return, is one of the forms employers use to report federal income, Social Security, and Medicare taxes withheld from employee wages. Form 941 also reports how much you withheld for employer contributions for Social Security tax and Medicare tax.

If you have employees, you may need to file Form 941. You can either mail or file form 941 online every quarter.

The quarters and due dates for Form 941 include:

- January 1 – March 31 with a due date of April 30 (Quarter 1)

- April 1 – June 30 with a due date of July 31 (Quarter 2)

- July 1 – September 30 with a due date of October 31 (Quarter 3)

- October 1 – December 31 with a due date of January 31 (Quarter 4)

Form 941 reconciliation

The IRS compares your four 941 forms to your annual Form W-3, Transmittal of Wage and Tax Statements. You must reconcile Form 941 to verify your forms are accurate. Reconciling is comparing Form 941 information with your payroll records.

You must reconcile the following for Form 941:

- Compensation

- Federal income tax withholding

- Social Security wages and tips (employee and employer contributions)

- Medicare wages and tips (employee and employer contributions)

You can use spreadsheets, software, or a mixture of both to track and reconcile your forms. Check out the different methods below.

Utilizing spreadsheets

Staying organized is critical for accurately reconciling Forms 941 throughout the year. Consider utilizing a worksheet, spreadsheet, or document to track wages and payroll taxes withheld each quarter.

Creating your own spreadsheet allows you to reconcile Form 941 efficiently. And, you can use your spreadsheet to help with year-end reconciliations, too. However, you must carefully enter information to avoid errors.

While checking information, be sure your amounts for wages and payroll taxes for the quarter match with what you have on your spreadsheet. If the information does not align, recheck records and make necessary adjustments.

Using reports from payroll software

Another option to reconcile Form 941 is using a payroll software or system. Software keeps track of information for you, can be more accurate than managing records by hand, and has less possibility of user error.

Payroll systems provide you with essential reports, like payroll history, to assist you in reconciling and filing Form 941 each quarter.

Some systems may even provide you with a prefilled Form 941 so you don’t have to worry about entering the totals. However, you should verify the totals are accurate by reconciling before filing.

Mixture of spreadsheets and software

You might use a mixture of both spreadsheets and software to reconcile Form 941. Compare the spreadsheet to totals in your software for reconciliation.

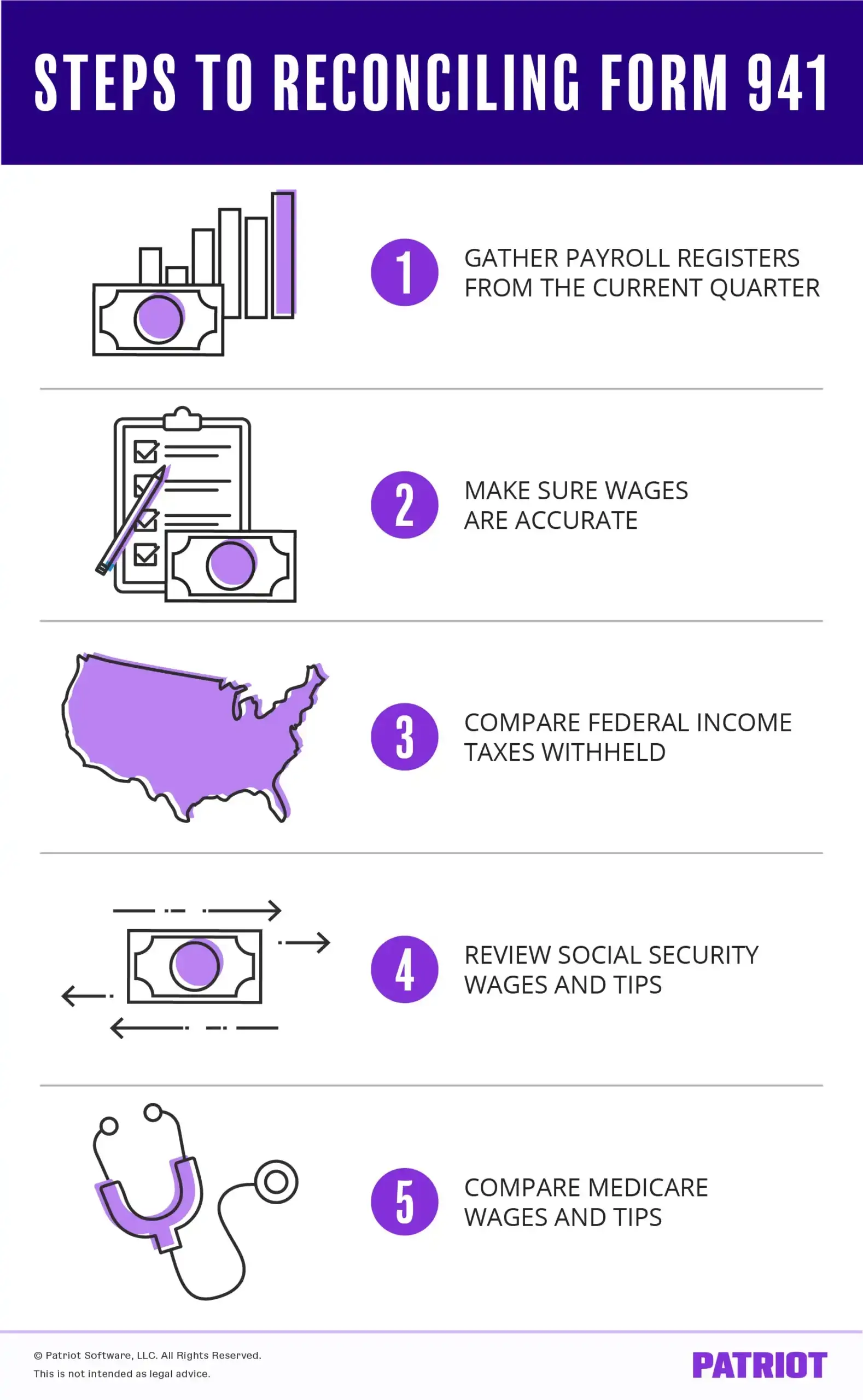

Steps to reconciling Form 941

Follow these five simple steps to reconcile Form 941.

1. Gather payroll registers from the current quarter

Whether you track payroll taxes and wages in a spreadsheet or software, the first step in reconciling Form 941 is printing or reviewing your payroll registers. Payroll registers consist of reports or information listing the quarter’s payroll taxes and wages.

2. Make sure wages are accurate

After you gather necessary reports, compare the wages listed on your payroll reports to Form 941. Do you see any discrepancies? How do the forms match up?

3. Compare federal income taxes withheld

You must compare withheld federal income taxes on Form 941 to your payroll records. Reviewing your reports verifies the numbers match.

4. Review Social Security wages and tips

Just like federal income tax, you need to compare Social Security wages and tips to ensure you entered them correctly. Compare Form 941 to your payroll reports. Examine both the employer and employee portions while reconciling.

5. Compare Medicare wages and tips

Finally, you need to review withheld Medicare tax. Like Social Security, you must check the employee and employer contributions to properly reconcile.

Why is reconciling Form 941 important?

It’s important to reconcile and, if necessary, make adjustments to prevent problems with filing Form 941.

Reconciling Form 941 can help you avoid discrepancies and possible penalties with the IRS. Also, if you don’t reconcile, your business books and filings may be inaccurate.

Check out the IRS website for more information about Form 941 reconciliation.

Are you stressing about Form 941? Patriot’s online payroll software will prefill Form 941 totals for you. And if you want us to file Form 941 for you, opt for our Full Service payroll service. Start your free trial today!

This article has been updated from its original publication date of February 6, 2019.

This is not intended as legal advice; for more information, please click here.