With so many details and rules, the Family and Medical Leave Act (FMLA) can easily puzzle employers. You have to know your employees’ FMLA rights as well as your own. So, what are your employer rights under FMLA?

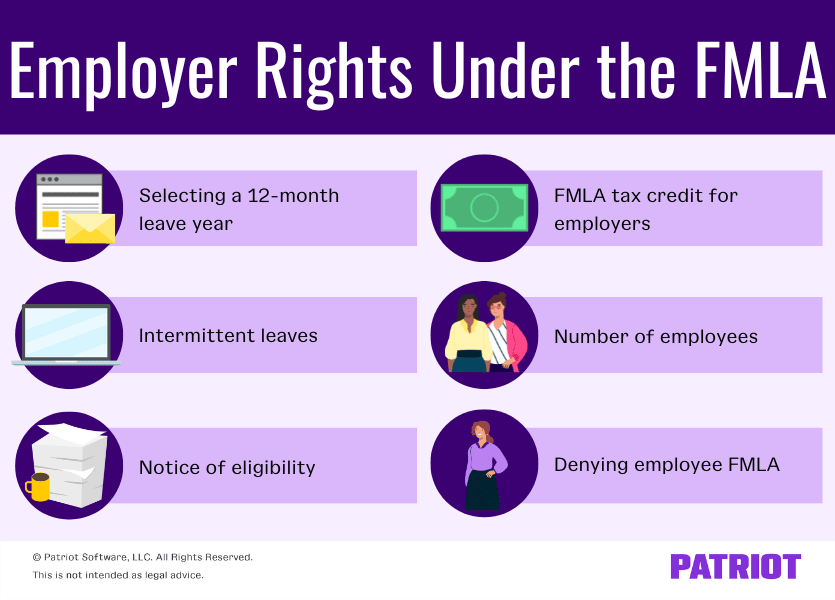

Employer rights under FMLA

If you aren’t familiar with the FMLA, here’s a brief recap. The FMLA is an act that requires employers to grant eligible employees unpaid time off for specific health and family reasons.

Employees can receive up to 12 weeks of unpaid leave annually. And, employees’ positions are protected when they’re on FMLA leave. Both full-time and part-time employees are eligible for FMLA leave.

Employees can use FMLA leave for many reasons, including:

- Parental leave for birth, adoption, or foster care placement of a child

- The care of a spouse, child, or parent with a serious health condition

- A serious health condition that prevents an employee from performing their job

- A situation that requires attention because of the military deployment of a spouse, child, or parent

Some employers are covered by FMLA while others are not. Typically, businesses with 50 or more employees must follow FMLA rules. In some cases, smaller businesses with fewer than 50 employees must also follow the FMLA (e.g., integrated and joint employers).

Just like employees, employers also have certain rights when it comes to FMLA. Read on to learn more about your FMLA employer rights and responsibilities.

Selecting a 12-month leave year

Employers are responsible for tracking employees’ FMLA leave and determining a 12-month leave year.

Employers have the freedom to choose which method they want to use to determine the 12-month period. These methods include:

- Using a 12-month calendar year

- Using a fixed time frame for the 12 months

- Counting forward 12 months from when the employee first uses FMLA leave

- Using a rolling 12-month period where you count backward 12 months from the date the employee most recently used FMLA leave

Although employers have the right to select whichever above method they would like, they must use the same method for each employee.

To learn more about each method, visit the Department of Labor’s website.

You can also reference the DOL’s Fact Sheet #28H for help calculating your 12-month period.

Intermittent leave

When it comes to FMLA leave, some employees can take intermittent leave. Intermittent leave is when an employee does not take all 12 weeks of FMLA leave at once. Instead, employees can break FMLA leave up by days or weeks and spread it out over time.

Employers have the right to grant intermittent leave in certain cases, like when an employee needs medical therapy or treatments during work hours.

You can also agree to an intermittent leave plan for employees for things like the birth or adoption of a child.

Want to impress your friends at a dinner party?

Get the latest payroll news delivered straight to your inbox.

Subscribe to Email ListNotice of eligibility

When an employee requests FMLA or when you determine an employee’s leave may qualify for FMLA, notify the employee.

Employers must notify employees within five business days about FMLA leave eligibility. As an employer, you have the right to choose how you notify the employee. You can notify them orally or in writing.

You can also use an optional form, WH-381, to notify your employees.

FMLA tax credit for employers

The FMLA tax credit is a tax liability reduction that eligible employers can receive for paying wages to employees for FMLA leave. Employers have the right to this tax credit for tax years 2021 and 2022.

Employers can claim the FMLA tax credit if they meet the requirements. Not all employers who offer FMLA can claim the tax credit.

To qualify for the tax credit, you must meet all five of the following IRS requirements:

- You offer paid FMLA leave to all eligible employees

- You pay at least 50% of the employee’s wages while they’re on FMLA leave

- You provide at least two weeks of paid FMLA to full-time employees

- Your state does not require FMLA pay

- Your business has a written policy in place

The credit your business can claim depends on the percentage of wages you provide for paid FMLA. The minimum tax credit you can take is 12.5%. The maximum tax credit you can take is 25%.

Contact the IRS to find out more about your employer rights to the FMLA tax credit.

Number of employees

As mentioned, any business (e.g., public, private, or nonprofit) with at least 50 employees must follow FMLA rules.

Small businesses with less than 50 employees might also need to offer FMLA leave to employees. In most cases, a business with a fluctuating worker base or integrated and joint employers must follow the FMLA.

Employers who do not fall under the above categories are not required to offer FMLA leave. However, you can still opt to do so.

Certain small businesses with fewer than 50 employees have the opportunity to decide whether or not they will provide FMLA leave to their employees.

Denying employee FMLA

Some applicable employers have the right to deny FMLA for employees. As an employer, you can deny FMLA benefits under certain circumstances. In most cases, being able to deny FMLA leave comes down to:

- Having too few employees

- Not meeting FMLA eligibility requirements

- Employees not having a qualified need or reason for FMLA leave

Too few employees

An employer can deny FMLA if they have fewer than 50 employees and are not required to offer it.

Not meeting FMLA eligibility requirements

Employees who work for a covered employer but don’t qualify for FMLA may be denied FMLA leave. To become eligible, an employee must:

- Be employed with the covered company for at least 12 months

- Work at least 1,250 hours during the 12 months prior to the leave

- Work at a location with at least 50 employees or with 50 employees within a 75-mile radius

Not having a qualified need or reason for leave

You can deny an employee FMLA leave if they do not fall into an eligible need category (e.g., adopting a child) or do not have a reason that qualifies for FMLA (e.g., serious health condition).

Other life circumstances, even serious ones, do not always qualify for FMLA leave. You can deny an employee if they do not have a condition or need that matches FMLA requirements.

As an employer, you have the right to deny or approve FMLA for certain situations that don’t fall under the eligible need or reason categories.

Include what your business covers for FMLA in your employee handbook. And, discuss FMLA requirements with employees during your onboarding process.

Need a quick way to run payroll? Look no further. Patriot’s payroll software lets you run payroll in three easy steps. And our free, U.S.-based support is only a phone call, email, or chat away. What are you waiting for? Get started with your self-guided demo today!

This article is updated from its original publication date of July 29, 2019.

This is not intended as legal advice; for more information, please click here.