You might have heard about per diem pay before. But, are you familiar with Publication 1542? Learn more about Publication 1542 per diem rates and how to calculate per diem pay below.

Publication 1542

Per diem is a daily rate employers give employees to cover business-related traveling expenses. You can repay the actual expenses the employee incurs. Or, you can pay employees a standard per diem rate set by the IRS.

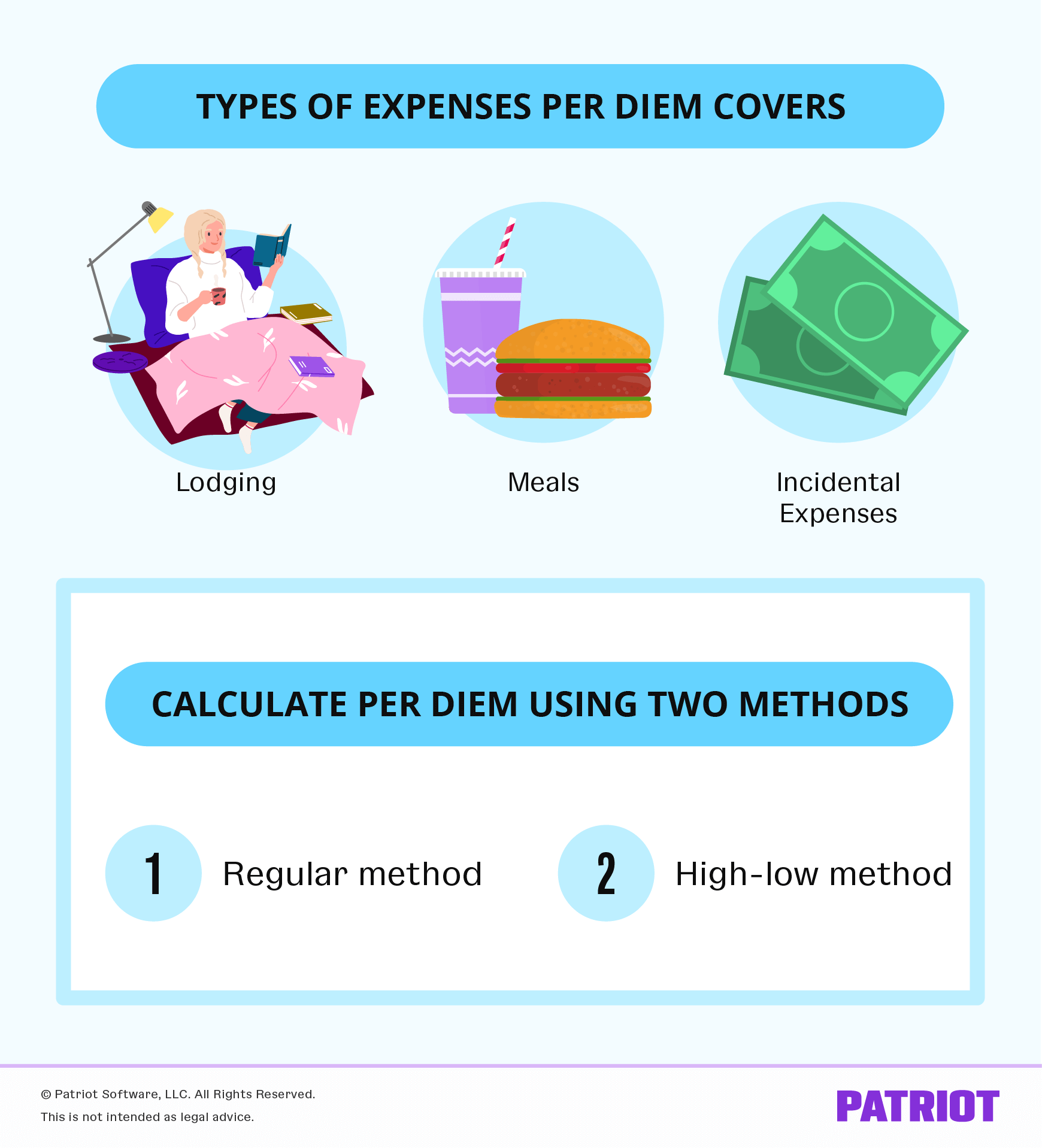

The per diem rates change each year depending on Publication 1542. The Publication 1542 per diem rate includes expenses for lodging and meals and incidental expenses (M&IE). Incidental expenses usually include tips for employees (e.g., hotel staff).

Rates are updated each year and go into effect on October 1. The General Services Administration (GSA) provides specific per diem rates. You can find current, past and upcoming per diem rates on the GSA website. However, these rates can vary throughout the year and are subject to change.

The per diem rates can vary by location. Rates increase in more expensive parts of the country, like big cities (e.g., New York City or Boston). Review Publication 1542 per diem rates and contact your state for more information.

Calculating per diem pay

There are two methods you can use while calculating per diem pay: regular federal per diem rate method or the high-low method. Check out how to calculate per diem pay using both methods below.

Regular method

The rates for the regular federal per diem rate method change based on the locality of where you send the employee. For travel within the Continental United States (CONUS), the GSA provides per diem rates for specific cities.

The 2024 regular federal per diem rate method is $166 per day ($107 for lodging and $59 for meals and incidental expenses).

The regular rate of $166 per day covers approximately 2,600 counties across CONUS. In 2024, there are 302 non-standard areas (NSA) that have per diem rates that are higher than the CONUS rate.

High-low method

Because federal per diem rates can change depending on location and time of year, the IRS allows you to use a simplified high-low calculation method.

The high-low method has one rate for high-cost localities and another for all other cities not considered high-cost in CONUS. Rates for the high-low method change annually.

Per Publication 1542, the per diem amount for the high-low rate includes:

- $214 per day for CONUS cities

- $309 per day for high-cost localities

Use the rate of $309 per day if an employee is traveling to a high-cost area. For example, use the high-low rate of $309 per day if your employee travels to New York City. Review IRS Notice 2023-68 for additional cities that are considered high-cost localities.

Pier diem rules

Per diem rates and rules can be complicated. Because of the many rules and laws surrounding per diem, you must know what regulations to follow.

You may be asking, Are employers required to pay per diem? The Fair Labor Standards Act (FLSA) does not explicitly state that businesses have to reimburse all employees for business travel.

However, refusing to cover these expenses could violate minimum wage or overtime laws. You must use per diem pay if wages after travel expenses go below minimum wage requirements.

The per diem is not taxable as long as you give the employee the maximum per diem amount per day or lower. The allowance is taxable if the per diem exceeds the maximum amount.

You must also know the time limitations of per diem pay. Per diem becomes taxable when the business trip lasts one year or more. Review the one-year rule on the IRS website before deciding to pay an employee per diem.

Do you need help keeping track of per diem pay? Patriot’s payroll software allows you to easily manage employee wages. With our three-step process, running payroll doesn’t have to be a hassle. Try it for free today!

This article was updated from its original publication date of September 13, 2010.

This is not intended as legal advice; for more information, please click here.