Small business owners have a lot on their plates. That’s why it can be a little scary to realize that bookkeeping is yet another task you have to complete to keep your business running. After all, why can’t you skip it altogether and pass it on to an accountant? Well, there are a few reasons why every business owner should know a little bit about bookkeeping. So, why is bookkeeping important for small business?

The importance of bookkeeping for small business

Small business bookkeeping is a crucial part of running a company. Bookkeeping allows small businesses to organize, store, and analyze financial information. By using this financial information, you can accurately draw conclusions about the financial security of your business.

But, that’s not the only reason bookkeeping is important for small businesses. In fact, the IRS requires businesses to maintain certain records and use accounting to track income and expenses. The IRS requires you to maintain records of:

- Gross receipts

- Purchases

- Expenses

- Assets

- Travel, transportation, entertainment, and gift expenses

- Employment taxes (if applicable)

Without business bookkeeping, it’s hard to track and report the necessary information to the federal government. Not to mention, inaccurate reporting or failing to file can lead to penalties and fines.

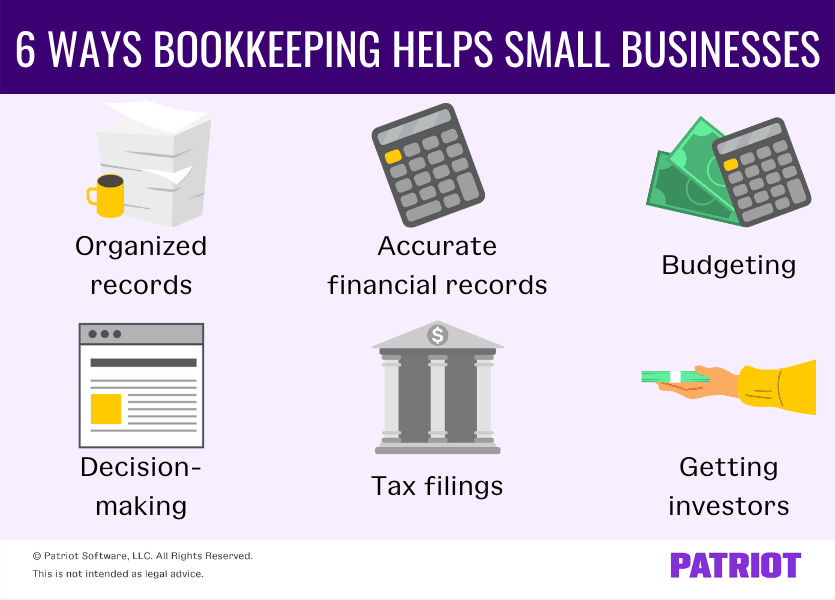

6 Ways small business bookkeeping can help

Now that you know why basic accounting for small business is so important, take a look at six ways it can help you.

1. Organizing records

Regardless of what’s going on in your company, the organization of your financial records is key. When it comes time to budget, apply for loans or grants, or see if you’re turning a profit, bookkeeping allows you to find the information you need quickly.

Basic accounting for small business lets you organize your information in one place. Without accounting, your financial data is spread out and cannot form a clear picture of your business finances. Bookkeeping gathers all of that information in one easy-to-read system.

Additionally, organized financial information can help you plan out bill payments. By seeing when your bills are due, you can organize expenses on your calendar.

2. Making decisions

There are many decisions business owners must make. And, simple bookkeeping for small business makes decisions easier.

Some decisions businesses may need to make include whether or not to:

- Apply for loans

- Submit grant applications

- Hire employees

The list goes on. By using accounting, business owners and their accountants can evaluate the data to make informed decisions. For example, can you afford to hire employees? Look through concrete information to determine if your business can afford to add someone to payroll.

3. Creating accurate financial records

The decisions you make in business are only as good as your information. By having organized information, you can create accurate financial records. Those records allow you to perform a variety of tasks.

For example, you need to know how much you spent last year on office supplies. You could gather up all of your receipts and spend hours adding together every last cent. Or, you can record each transaction in your books and pull the data with ease when you need it.

4. Filing taxes

Business taxes can be scary, time-consuming, and stressful. But, you have to file taxes when you own a business. If you use an accountant to file your taxes, your own accounting records can help with the tax filing process.

Instead of going through a filing cabinet of different documents, invoices, and receipts, you can present detailed records to your accountant. In turn, you and your accountant can save time. As an added bonus, you may even be able to identify potential tax write-offs.

After using your accounting to file your taxes, the IRS may choose to perform an audit. In case that happens, you’ll need accurate bookkeeping records. The IRS may request to see your records, and organized bookkeeping will save you time during the audit process.

5. Budgeting

Simple bookkeeping for small business helps with financial planning and budgeting. With clear, organized, and accurate records, you can review past information to come up with a plan for how to proceed.

Did you have a record year? Were sales slow but steady? Did your suppliers increase their costs and impact your cost of goods sold during the year? All of these things factor into how you plan out the next year.

When it comes time to budget, you need to have an accurate understanding of how your business performed in the past. Overspending during the year shows up on your books, and so do cost-saving measures. If you’re over budget, your accounting tells you. And if you’re under budget, you can see that, too.

6. Getting investors

Businesses need funding to succeed. That funding can come in the form of owner’s equity, grants, business loans, and investors. But, investors need to have a good idea of your business before investing.

If you don’t have accounting records, investors cannot determine the success or failure of your company. They need up-to-date, accurate information. And, that information needs to be readily accessible. If you don’t use bookkeeping, the data may not be at your fingertips just when you need it.

This is not intended as legal advice; for more information, please click here.