Understanding your business tax obligations is not always easy. There are different ways a business can be taxed. One method of taxation is a pass-through tax. If you own a small business, you need to know about pass-through taxation.

What is pass-through taxation?

Some types of taxes skip over one entity and are passed onto another. The tax “passes through” the business, so the business does not directly pay the tax. Instead, another entity (such as the business owner or customer) pays the taxes. Most small businesses deal with pass-through taxes.

With a pass-through tax, income is only taxed once. Think about how money travels through a business. The money enters the business when a customer pays for a product or service. Once the business receives income, the money is added to the owner’s equity. The owner must distribute tax payments to the appropriate agency.

Types of pass-through taxes

There are several kinds of pass-through taxes. Usually, small business owners will come across the two most common types: sales tax and business income tax.

Sales tax

For some products and services, your locality might impose a sales tax. There are different sales tax rules for every state which may depend on sales tax nexus, and some states do not enforce sales tax. If sales tax applies to your business, you need to manage sales tax obligations.

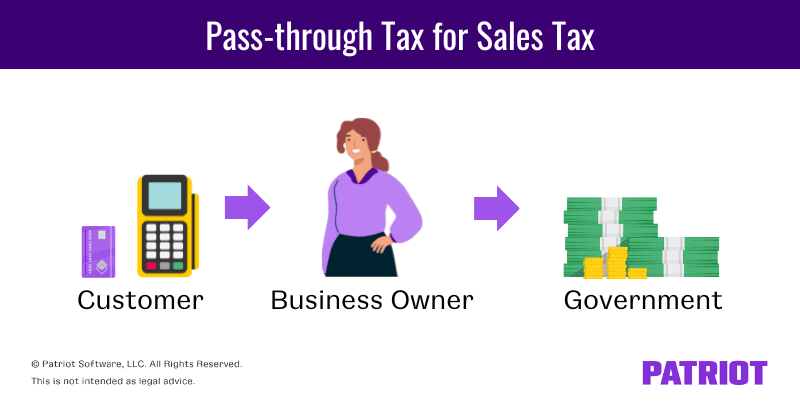

Sales tax payments pass through your business. Business owners don’t pay sales tax out-of-pocket. Instead, sales tax is a percentage of the customer’s total bill. You collect sales tax from customers at the point of sale and send it to the government.

Business income

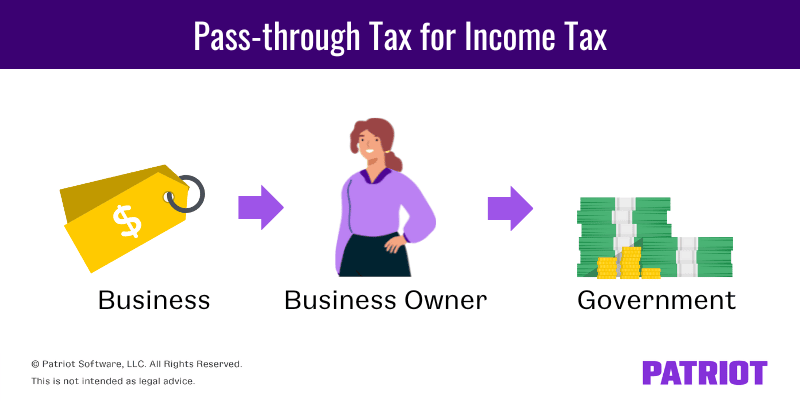

Income received from business activities are subject to taxes. For some businesses, tax liabilities on business income pass through the company. The owner pays taxes on business income with their personal tax return at their personal tax rate.

Now we’ve established two types of pass-through taxes. But, what is a pass-through entity?

Pass-through tax entities

Some business entities are pass-through tax entities. A pass-through tax entity does not pay income taxes. Each owner pays business income tax with their personal income tax form. The following types of business structures are pass-through tax entities:

Sole proprietorships

Sole proprietorships are owned by one person, the sole proprietor. Sole proprietors are entitled to all the business’s income. Owners of a sole proprietorship are also liable for all business debts, including tax liabilities.

Sole proprietorships report profits and losses with Schedule C. The owner attaches Schedule C to his/her personal income tax return.

Partnerships

Partnerships are owned by two or more people. Each owner is a partner and is entitled to part of the business’s profits and losses.

Generally, partners pay business income taxes based on how much of the company they own. The more ownership a partner has, the bigger the tax liability. All partners must include the business’s taxes and debts on their personal tax returns.

The partnership must report business income to the IRS. Partnerships use Form 1065 to show profits and losses.

The partnership gives each partner a Schedule K-1 of Form 1065. Schedule K-1 shows each partner’s share of profits and losses. The partners include information from their Schedule K-1 on their personal tax returns.

LLCs

LLCs are pass-through entities that combine aspects of partnerships and corporations. Single-member LLCs are owned by one person and file taxes like sole proprietorships. A single-member LLC is treated as a disregarded entity by the IRS.

Multi-member LLCs are owned by two or more people and file taxes like partnerships. LLC owners are only taxed at the personal level unless members elect to be taxed as a corporation.

S corporations

Owners of an S Corp are called shareholders. The IRS allows S corporations to have up to 100 shareholders. Each shareholder’s tax liability depends on their participation in business activities.

The S Corp reports profits and losses on Form 1120S. The business provides shareholders with Schedule K-1. The shareholders use Schedule K-1 to report their portion of business profits and losses on personal tax returns.

Benefits of pass-through taxation

With a pass-through tax, business income is only taxed once at the personal level. This is single taxation. A major benefit of a pass-through taxation is that business owners avoid double taxation. As the name implies, double taxation requires business income to be taxed twice.

The income is taxed once at the corporate level. Then, each owner’s income is taxed at the personal level. Essentially, the same income is taxed twice. Corporate tax rates are often less than personal rates. But, pass-through taxes help you avoid double taxation in the accounting process.

Do you need a simple way to track business income? Patriot’s online accounting software is easy-to-use and made for small business owners. We offer free, U.S.-based support. Try it for free today.

This article is updated from its original publication date of March 30, 2017.

This is not intended as legal advice; for more information, please click here.