If you’re running a business by yourself, you may be considered a solopreneur. And like any other business owner, you need to familiarize yourself with accounting dos and don’ts. Read on to learn more about solopreneurship and tips for handling your books when you’re the one running the show.

What is a solopreneur?

A solopreneur, or solo entrepreneur, runs their own business and is the sole founder. Solopreneurs run their business independently without the help of a co-founder or employees.

Solopreneurs are not the same thing as self-employed individuals. Self-employed individuals can hire employees, while solopreneurs cannot.

Because they handle everything themselves, a solopreneur is responsible for all business duties, including accounting and recordkeeping.

As a solo entrepreneur, you get to call the shots. Not to mention, you’re your own boss and only employee. But because you’re in charge of all of the day-to-day responsibilities, you have to be willing to put in the hours and devote yourself to your startup.

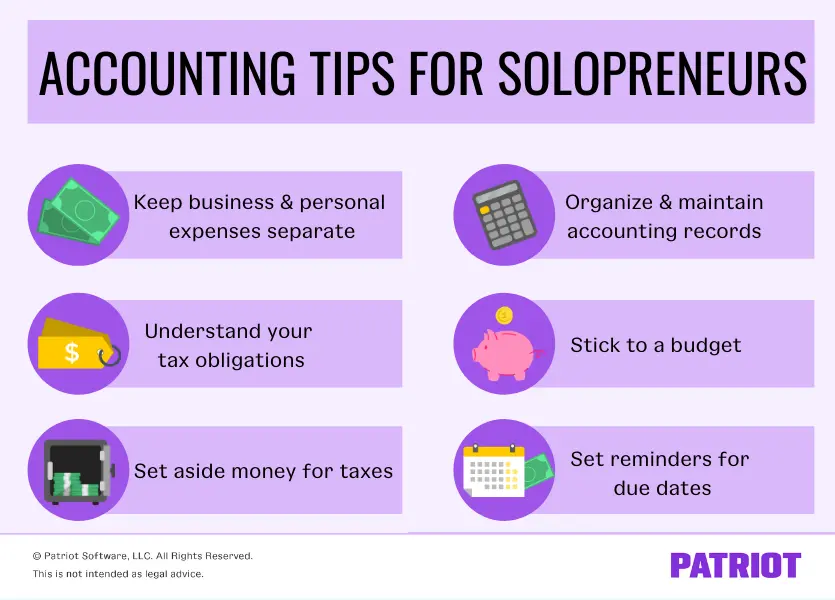

6 Accounting tips for solopreneurs

If you’re thinking about becoming a solopreneur, listen up. There are a number of accounting tasks you have to juggle when you’re running a business on your own. To become a successful solopreneur and keep your books in shipshape, take advantage of these six tips.

1. Keep business and personal expenses separate

Solopreneur or not, mixing business and personal expenses is never a good idea. Combining accounts could quickly cause confusion and a number of issues for your venture.

A separate bank account for business can help you better manage your budget, keep your finances in order, and organize accounting records.

As soon as you start your company, set up a business bank account to separate your business and personal expenses. It may seem like a hassle at first, but you’ll thank yourself later for keeping your expenses split up.

2. Understand your tax obligations

As a solo entrepreneur, one of your bigger responsibilities is handling business taxes. You have to know what they are, what forms to use, when taxes are due, etc. The list goes on and on.

When you start your business, do your research to find out what your tax obligations are. And, be sure you know them like the back of your hand.

Your tax obligations depend on your solopreneurship’s type of business structure. As a solopreneur, you can either be a:

- Sole proprietorship

- Limited liability company (LLC)

Brush up on the pros and cons of both structures to find out which one will best suit your business. Once you determine which one is best, find out your tax requirements, what form(s) you must use, and your business tax return due date.

3. Set aside money for taxes

This next tip goes hand in hand with Tip #2. When it comes to taxes, you don’t want to be left scrambling. To avoid any surprises, set aside money for taxes ahead of time.

Set aside money for your company’s taxes in your business bank account. You might even consider opening a separate account to hold your tax liabilities to ensure you don’t accidentally spend it.

Whatever route you take, make sure you’re setting aside the correct amount of taxes and taking the proper steps to avoid spending it prematurely.

4. Organize and maintain accounting records

Running a business by yourself means you need to ensure that your accounting records are organized and in tip-top shape. After all, you have nobody to blame but yourself if something in your records is incorrect or out of place.

To be a successful solopreneur, you need to maintain and organize your accounting records. You should:

- Keep thorough records (e.g., invoices, receipts, etc.)

- Leave an audit trail (e.g., documents)

- Track expenses

- Invest in an organization system (e.g., filing cabinet)

If you really want to stay on top of your accounting responsibilities, consider investing in accounting software. Software can help you track income and expenses and keep your records up-to-date and organized.

5. Stick to a budget

Ah, the business budget. You hear about it all of the time. But, do you know how to create a business budget and stay on track?

As a solopreneur, you need to create a budget … and stick to it.

Creating a business budget can help you set goals, spend wisely, and make adjustments to your spending habits.

To create a budget, look at your:

- Revenue

- Expenses

- Profits

Once you set your budget, try to stick to it as best as you can. Keep in mind that you need to make adjustments to your budget as operations change.

6. Set reminders for due dates

As a busy business owner, things will slip your mind from time to time. It’s part of the gig. But, one thing you don’t want to fall through the cracks are due dates.

To avoid missing any important deadlines (e.g., tax return due date), set reminders for yourself. Add due dates to your calendar to ensure you don’t miss them. Consider using a digital calendar, like Google Calendar, to keep track of important dates and set up notifications.

Did you just become a solopreneur? Great! Now it’s time to start tracking your income and expenses. Patriot’s online accounting software makes it a breeze to record your transactions and organize your books. Try it for free today!

This is not intended as legal advice; for more information, please click here.