As a business owner and consumer, you’re likely familiar with sales tax. After all, the majority of states have some type of sales tax. But, you may be less familiar with use tax and how it works compared to sales tax. Want to find out the difference between sales tax vs. use tax? Keep reading.

Sales tax vs. use tax

Although sales tax and use tax have some similarities, they also have some key differences. Check out how the two types of tax compare and contrast by learning the following about each tax:

- What it is

- How it works

- Who pays the tax

- How to remit it (if applicable)

What is sales tax?

Sales tax is a type of pass-through tax. This means that the tax passes through the business and onto the customer. Forty-five states and Washington D.C. have some form of sales tax (e.g., state, local, or both). Alaska, Delaware, Montana, New Hampshire, and Oregon do not have any state sales tax laws.

Businesses collect sales tax at the point of sale when a customer is making a purchase. Customers are responsible for paying the sales tax on applicable purchases. However, the business owner is responsible for collecting and remitting the sales tax to the proper agency.

In some cases, customers may be exempt from paying sales tax on certain products (e.g., food or groceries). And, some states even have sales tax holidays that exempt certain items, like clothing and shoes, from sales tax for a day (or days), week, or weekend. However, sales tax rules and holidays vary by state and locality.

The amount of sales tax you collect depends on what state, county, or city your business has physical presence in, otherwise known as sales tax nexus. Sales tax nexus determines if your business has enough presence in a location to collect sales tax. For example, states look at factors like office location, employees, and amount of sales to determine if you have nexus.

Businesses located in a state with sales tax and that have sales tax nexus must collect the tax from customers on taxable purchases. Generally, sales tax is a percentage of the customer’s total bill (e.g., 6%). Again, the seller is responsible for collecting and remitting the sales tax.

To collect sales tax from customers, you must get a sales tax permit. Businesses required to collect sales tax must apply for a permit to operate. Apply for a sales tax permit before you begin making sales in your business.

Here’s your sales tax recap:

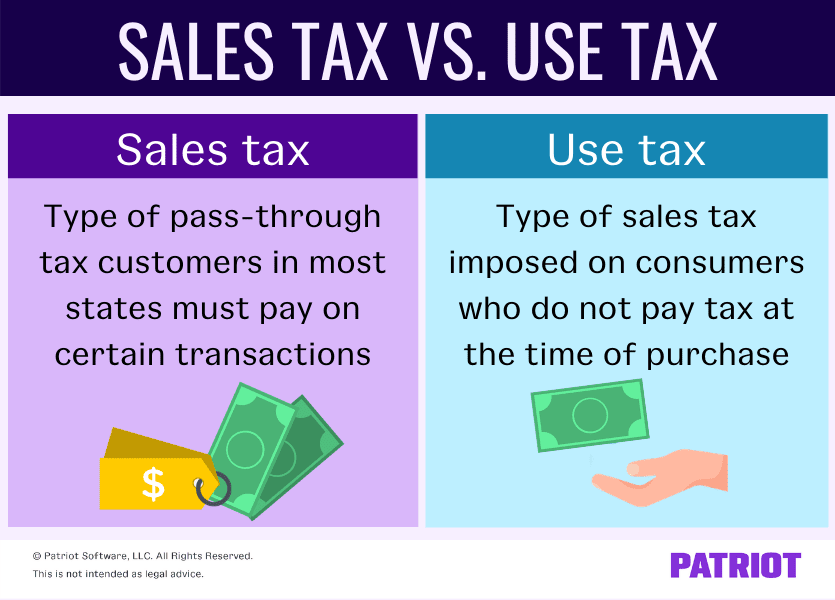

- What it is: Type of pass-through tax customers in most states must pay on certain transactions

- How it works: The business collects sales tax during the point of sale from the customer

- Who pays: Customers in applicable states and localities

- How to remit: Businesses with nexus in an area must get a sales tax permit and collect and remit sales tax to the proper government agency (e.g., state, local, etc.)

What is use tax?

Use tax is a type of sales tax the government imposes on consumers who do not pay tax at the time of purchase.

Unlike regular sales tax, you do not collect use tax from customers. Instead, customers are responsible for paying use tax directly to the state. If a customer is responsible for paying use tax, the rate is left up to the state where the buyer uses, stores, or consumes the product in. Generally, use tax rates are the same as sales tax rates.

Use tax typically only applies to out-of-state purchases where no sales tax was collected. In most cases, use tax applies when you sell a taxable item to a buyer in another state where you don’t have sales tax nexus. Because you don’t have nexus, you are not responsible for remitting sales tax on the purchase to your state.

Although some consumers are responsible for paying and reporting use tax, many do not. Because of this, the Supreme Court made updates to some sales and use tax laws in the South Dakota v. Wayfair case. Thanks to the rulings, states can now require business owners to collect sales tax on all products sold online, even if the business doesn’t have physical presence in the state (aka economic nexus).

If your business is in a state with updated laws, you may need to collect sales tax. If your state follows new use tax rules, consumers are no longer responsible for paying use tax. Check with your state for more information on use tax rules.

Here’s your use tax recap:

- What it is: Type of sales tax imposed on consumers who do not pay tax at the time of purchase

- How it works: Typically, the customer pays use tax on a taxable purchase if the seller is out-of-state and does not have to collect sales tax

- Who pays: Generally, the consumer/buyer in another state. However, some businesses may need to collect sales tax in place of use tax

- How to remit: Consumers who are responsible for paying use tax must remit it to the state

Narrowing down the differences between use tax versus sales tax

Phew, that was a lot of information to soak in. Here’s a brief recap on the similarities and differences between sales tax vs. use tax:

Both sales and use tax:

- Are types of sales tax

- Vary based on location

- Follow similar tax rate (e.g., 5% for either sales tax or use tax)

- Must be remitted to the proper tax agency by either the buyer or the seller

The following may vary depending on if you deal with use tax or sales tax:

- When the tax is paid (e.g., time of sale or later on)

- Who must pay and remit it (e.g., customer or business)

- How it’s paid (e.g., type of form, electronic payments, etc.)

Use vs. sales tax: Examples

Ready to see use and sales tax in action? Let’s take a look at a couple of examples below.

Sales tax example

If you have sales tax nexus, you must collect sales tax (state, country, and/or city). Say your business has sales tax nexus in Ohio. In Ohio, the state sales tax rate is 5.75%. The locality you’re in does not have any additional sales tax. This means you must collect 5.75% for sales tax on taxable purchases.

Use tax example

Say you run an online business in Wisconsin. You have nexus, or presence, in Ohio, Pennsylvania, and Minnesota. You sell to a customer in Florida, but don’t have nexus in that state. Because you don’t have nexus in Florida, you don’t need to collect sales tax from the customer. Instead, the customer is responsible for paying use tax to their state.

You sell to a customer in one of the states you do have nexus in, like Ohio. Because you have nexus in Ohio, you must collect sales tax from the customer. And because the customer is already paying sales tax on the purchase, they are not responsible for paying use tax.

Need an easy way to track your state’s sales tax and business transactions? Patriot’s online accounting software lets you streamline the way you record your business’s income and expenses. Plus, we have free USA-based support. Get started with a free trial today!

This is not intended as legal advice; for more information, please click here.