Running a business is always a risk. The risk of a lawsuit or bankruptcy can scare many would-be business owners before they even get started. These risks don’t have to affect you personally, but they may depending on how you structure your business. Limited liability protects an individual’s assets in the case of a lawsuit or bankruptcy. But, not all business structures benefit from limited liability.

Read on for a limited liability definition, who it covers, how it operates, and everything else you need to know.

What is limited liability?

What is limited liability? Limited company liability is a legal status that limits investor and owner liability to the size of their investment in the company. This protection covers an individual’s assets from lawsuits or debts at the company level. Limited liability means that a veil, so to speak, protects shareholders when they invest in a company—in many cases, individuals are protected by the corporate veil, regardless of what happens to the business.

There are some limitations to the protection limited liability offers. Limited liability does not protect:

- Money that is invested in the business (e.g. shares)

- Owners or shareholders from lawsuits and/or debt collection because of their conduct

- Directors that have personally guaranteed a company’s debts to lenders

- Against piercing the corporate veil

Two of the major benefits of limited liability in business are that it helps manage risk (you only risk what you choose to risk) and promotes investment in up-and-coming industries. Without the protection of limited liability, it could seem impossible to take the leap and finally start your business.

Limited liability isn’t available for all businesses. Sole proprietorships and general partnerships have unlimited liability, meaning that personal assets are not shielded from lawsuits or debt collection. In both of these business entities, owners are liable for debts simply because they are the owner.

Who has limited liability?

Again, not all business entities have limited liability. Those that do are separate legal entities, which include:

- Limited liability company (LLC)

- S Corporation

- C Corporation

- Limited partnership

Separate legal entities make a distinction between those involved in the company and the company itself. In other words, anyone involved with a separate legal entity is considered separate from the business for legal purposes, including lawsuits and debt collection.

Limited liability company

A limited liability company allows for pass-through taxation while offering limited liability to its members. There are two types of LLCs:

- Single-member

- Multi-member

LLCs can enter into contracts, take out loans, own assets, and be sued.

Each state has different rules for creating an LLC. Check with your Secretary of State’s website for more information.

S corporations

S corporations allow for pass-through taxation without being subject to a corporate tax rate. Only the shareholders of an S corporation are taxed. There can be no more than 100 shareholders.

C corporations

C corporations are the strongest form of limited liability available for a business and can be helpful if you are planning to expand. C corporations can enter into contracts, take out loans, own assets, and be sued.

C corporations are more complicated than other business structures. You must follow more regulations and tax requirements, keep track of more detailed records, and deal with double taxation. Double taxation means that both the business’s and shareholder’s income is taxed.

Limited partnerships

When it comes to limited partnerships, there are two ways you can structure your business: Limited partnership or general partnership. A general partnership doesn’t offer limited liability, but a limited partnership does to one member.

A limited partner isn’t responsible for the day-to-day operations of the business. If a limited partner doesn’t like how their partner is running things, there’s little they can do. If they get too involved in the day-to-day operations, they can even be held liable.

Limited partnerships do not pay income tax. Instead, any profits or losses are passed through to partners. A partner’s rate of taxation is determined by their percentage of ownership in the business. In some cases, a limited partner can own 98% of the business, while the general partner owns the remaining 2%. Even in this situation, the limited partner has no control over the business.

How does limited liability work?

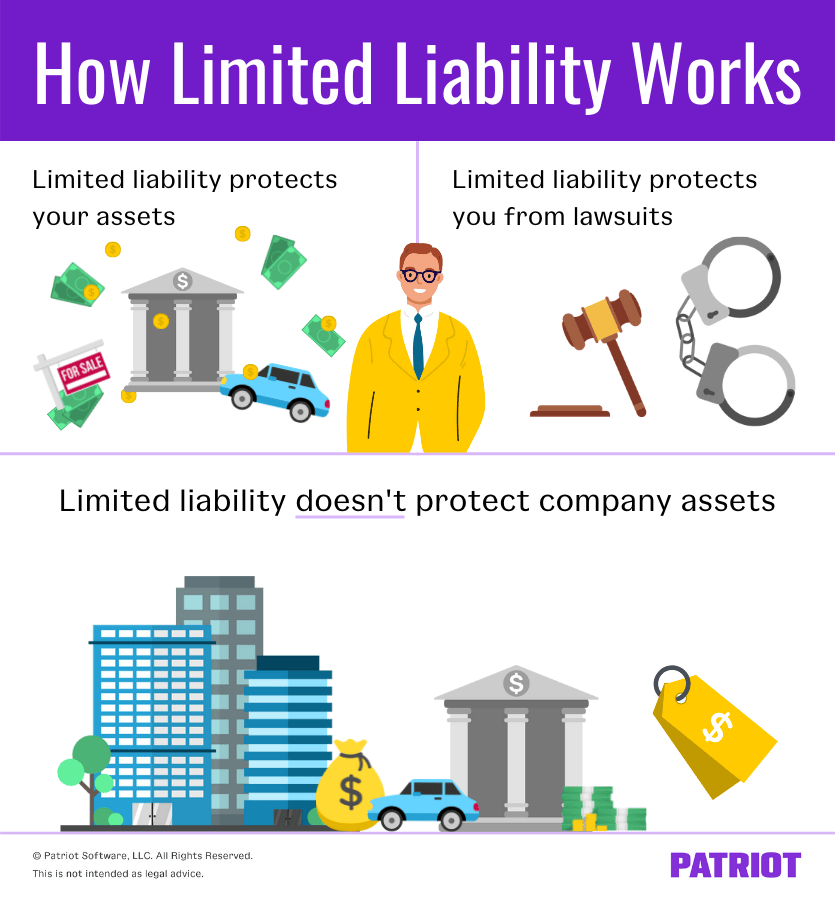

Limited liability does two things: It protects individual assets and individuals from lawsuits. In most cases, the business takes on these legal responsibilities.

How limited liability protects assets

Limited liability protects an individual’s assets from seizures seeking to repay company debts. Without limited liability, individual assets are up for grabs. Instead, limited liability restricts the assets that are available for seizure or liquidation of company assets.

Company assets can be classified as:

- Tangible: Physical items such as cash, equipment, inventory, land, and stocks.

- Intangible: Non-physical items such as patents, trademarks, copyrights, and business licenses.

- Current: Assets set to be converted into cash within a year, such as cash and inventory.

- Fixed: Assets that continue to bring long-term value after a year. These can be both tangible and intangible and includes assets such as land, buildings, and equipment.

Any of the above business assets are subject to seizure and liquidation in the event of a lawsuit or bankruptcy. Another way to think about company assets is whether they are dangerous or safe. Dangerous assets are usually tangible assets that can increase your risk of lawsuits. These assets have the potential to cause personal harm. Dangerous assets include:

- Commercial property

- Real estate

- Tools

- Equipment

- Motor vehicles

Safe assets, on the other hand, are intangible and offer little to no risk of personal injury.

Reducing the number of dangerous assets you have will also reduce your risk of lawsuits. You can also use specialized liability insurance for further protection in the case of an accident.

How limited liability protects individuals from lawsuits

Limited liability protects individuals from lawsuits. If an LLC is sued and owes money, personal assets and bank accounts are generally off-limits. If members are involved in illegal activities, things can change. When individual shareholders are held accountable for their actions, courts are said to pierce the corporate veil.

The corporate veil is another way to refer to limited liability. When the legal system pierces the corporate veil, the previous protections of limited liability no longer apply. Common factors for piercing the corporate veil include:

- Misuse of company funds. When one or more members use company money for personal reasons or mix company and personal bank accounts.

- Undercapitalization. When the business doesn’t have enough capital to properly operate. This often happens when a company’s debt is far larger than its capital.

- Fraud. When one or more members use the company to commit fraud

- Failure to follow corporate guidelines. When a company doesn’t keep proper records, hold annual meetings, and adopt and enforce bylaws.