Many business owners dream about finding ways to reduce their tax liabilities. With IRS Form 8832, you may be able to do just that by changing your tax classification. Read on to learn what is Form 8832 and whether you can use it to switch up your business’s tax classification.

What is IRS Form 8832?

Tax Form 8832, Entity Classification Election, is a form certain businesses can use (which we will get to later) to elect or change how they are classified for federal tax purposes. Businesses receive a default tax classification, which can result in paying more business taxes than necessary. If you are eligible to use the entity classification election form, you can change your tax election status and potentially lower your tax liability.

IRS Form 8832: Q&A’s

Now that you have a little background information about Form 8832, it’s time to get down to the nitty-gritty. Check out the answers to all of your 8832 Form questions below.

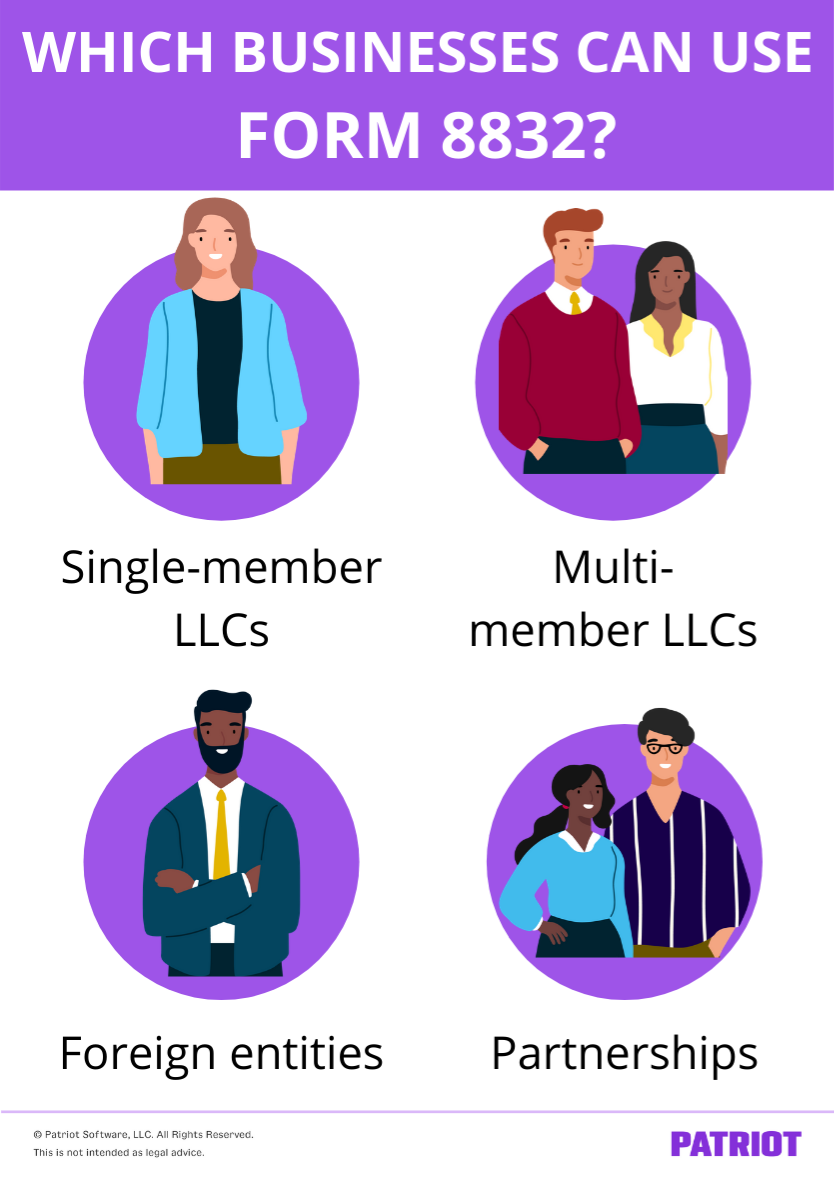

Which businesses can use Form 8832?

Not every type of business can use Form 8832 to change their business’s tax classification. The following are considered eligible businesses for filing Form 8832:

- Partnerships

- Single-member LLCs

- Multi-member LLCs

- Certain types of foreign entities (Page 5, Form 8832)

The above entities can use Form 8832 to elect to be taxed as a C corporation, partnership, or sole proprietorship.

If you’re currently a limited liability company (LLC) taxed as a corporation, you can also use Form 8832 to revert back to a previous tax classification.

Eligible businesses that don’t fill out the form will be taxed based on their default tax status. If you are content with your current or default tax classification, do not fill out Form 8832.

Keep in mind that your business can only change its tax classification once every five years.

Who is not eligible to file Form 8832?

Sole proprietorships are not eligible to file a Form 8832 election.

If your business is a corporation that wants to be taxed as an LLC, don’t file Form 8832. Instead, contact your Secretary of State to find out how to convert your corporation.

Additionally, if your business is an LLC that wants to be taxed as an S Corp, you must file Form 2553 instead of Form 8832.

How do you fill out Form 8832?

Before you begin filling out your form, you need to gather some information. Take a look at what to have handy for Form 8832:

- Business name, address, and phone number

- Employer Identification Number (EIN)

- Owner’s name and Social Security number (if the business only has one owner)

The form has two parts: Election Information (Part I) and Late Election Relief (Part II). Part I asks a series of questions pertaining to your tax status election. Depending on your answers, you may be able to skip some lines.

Part II is only for businesses seeking late election relief. To be eligible for late election relief, all of the following must apply:

- The IRS denied a previous Form 8832 filing because you didn’t file on time

- You haven’t yet filed your taxes because the deadline hasn’t yet passed or you’ve filed your taxes on time

- You have reasonable cause for not filing your form on time

- It has been less than three years and 75 days from your requested effective date

Where do you send the form?

After you complete your Form 8832, send it to the appropriate IRS office for review. Where you send the form depends on what state your business is in.

Taxpayers in Connecticut, Delaware, D.C., Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, West Virginia, and Wisconsin must send their completed form to the following address:

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

Businesses in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Tennessee, Texas, Utah, Washington, and Wyoming must send their form to the address below:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201

Businesses cannot e-File Form 8832. Mail your filled-out form to one of the addresses listed above.

The IRS will either accept or deny your Form 8832 request and notify your business within 60 days. A letter indicating acceptance or denial of your request will be mailed to you based on the address you provided on your form. If 60 days go by and you don’t hear back, the IRS suggests you call them at 1-800-829-0115 to check on the status of your form.

What’s the Form 8832 deadline?

There is no formal deadline for Form 8832. You can file when you start your business or at any point during your business’s lifetime, whichever you prefer. However, the filing date does matter. When you file the form can impact when your new tax classification kicks in.

According to the IRS, your new classification cannot take effect more than 75 days before the filing date on Form 8832. And, your new tax classification can’t start more than one year after you file the form. If you don’t enter a date on the form, the filing date is the effective day.

To ensure you select the proper date for your tax classification to take effect, consider consulting an accountant.

What else should I know about Form 8832?

If you’ve heard of Form 2553 before, you may be wondering, What’s the difference between Form 8832 and Form 2553? Both forms allow certain businesses to request a new tax classification. The biggest difference between the two forms is the type of tax classification you request.

Again, Form 8832 allows businesses to request to be taxed as a corporation, partnership, or sole proprietorship. However, Form 2553 is the form corporations and LLCs use to elect S Corp tax status. If you’re filing Form 2553, do not file Form 8832 (or vice versa).

Form 8832 resources to review

To learn more information about IRS Form 8832 instructions and requirements, check out the IRS resources below:

Regardless of your company’s tax classification, you need an easy and reliable way to track your business’s income and expenses. With Patriot’s accounting software, you can streamline your accounting process and get back to your business in no time. Give it a go with a free trial today!

This is not intended as legal advice; for more information, please click here.