While some businesses can start in a basement, garage, or kitchen, others require commercial property in the beginning. And, many companies outgrow their original location, so they need to look at commercial property. But, should you buy or lease property for your business? There are pros and cons to buying vs. leasing commercial property. Review the benefits and drawbacks before making a decision.

An overview of buying vs. leasing commercial property

Before discussing the pros and cons of commercial property purchases or leases, it’s important to understand the difference.

Lease: A lease is a contractual agreement between a business owner and a property owner or landlord where the business owner rents the property. Under the contract, the business owner renting the property is the tenant. And, the tenant agrees to pay the landlord regular payments for a specific amount of time to use the property for their business. Generally, lease agreements include terms that detail tenant and landlord responsibilities for the property. Some contracts also include clauses detailing what changes tenants can and cannot make to their leased property.

Purchase: Buying property means that the business owner owns the property and does not answer to a landlord. Individuals either use their own equity or take out a mortgage loan to purchase the property. When purchasing property, business owners can freely make cosmetic and structural changes to the property to customize it for their needs.

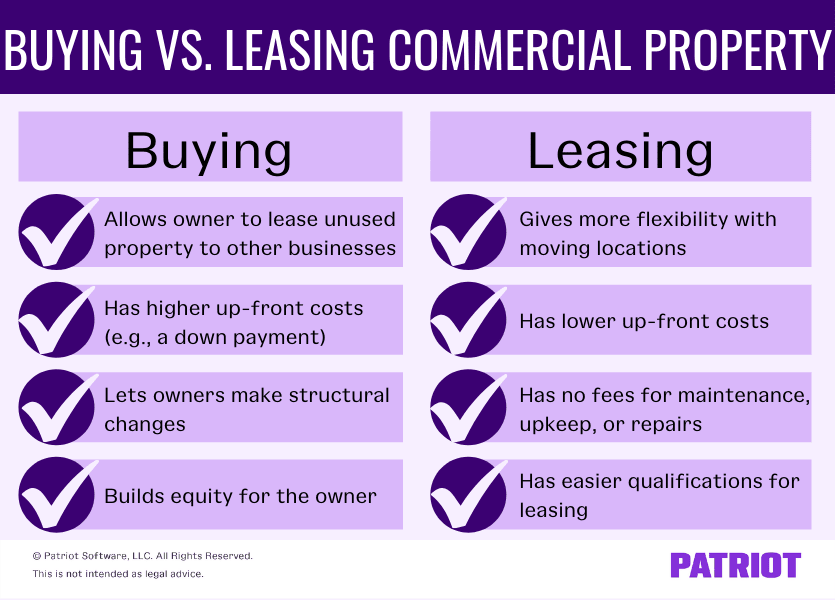

Pros and cons of buying commercial property

Many individuals already know the advantages and disadvantages of purchasing a home. But, buying commercial property is not the same as buying a house. So, the pros and cons of investing in commercial real estate are different from buying a home. Take a look at some of the benefits and drawbacks of purchasing commercial real estate.

Pros:

- Control of the property (e.g., can make structural changes)

- The value of the asset (i.e., property) can increase over time

- Businesses can receive tax breaks for interest, depreciation, and non-mortgage expenses

- Equity builds over time

- Property can be sold or refinanced

- Businesses can lease out unused space to other companies for additional income

- Fixed mortgage payments for the duration of the loan

Cons:

- Higher upfront costs

- Potential difficulty with qualifying for loans

- Higher liabilities for the business (e.g., owners are responsible for possible injuries on the property)

- Potentially higher monthly costs (e.g., maintenance costs)

- Personal liability (e.g., repay business mortgage loans if the business cannot)

- Potential decrease in value over time, resulting in a capital loss if you decide to sell

Pros and cons of leasing commercial property

Like renting any other property, there are also pros and cons of leasing commercial real estate. Some pros and cons may be similar to renting other property, but there are some notable differences.

Pros:

- Fewer upfront costs

- Fixed monthly cost for the duration of the lease agreement

- No fees for maintenance, upkeep, or repairs, if applicable

- Tax deductions for the entire cost of the lease payment

- Tax breaks for property insurance, property taxes, utilities, and maintenance, if applicable

- Easier qualifications for leasing the property

- More flexibility with leaving the property

- Negotiation opportunities for a lease-to-own option

Cons:

- Leased property does not appreciate for the tenant

- Cost of rent can increase with each contract renewal

- Tenants cannot sublease unused property to other tenants

- Monthly rent payments may be more expensive than mortgage payments

- No control over the length of the lease

- May face early termination clauses with high fees

- Must continue to pay rent if you go out of business to avoid penalties

Is it better to rent or buy commercial property?

Now that you know the pros and cons of buying vs. leasing commercial real estate, you may be asking which one is better for you and your business. The answer to that question is: it depends.

You might consider purchasing property if you:

- Want to lease out a portion of your property to another business.

- Have the cash for a down payment, plus at least six months of mortgage payments.

- Plan to make structural or cosmetic changes to the property.

- Want to build equity.

Purchasing is more expensive than leasing, so here are a few things you need to have funds for:

- A down payment

- Building inspection

- Closing costs

- Appraisal fees

- Origination fees

- Potential repairs the seller does not cover

Consider leasing commercial real estate if you:

- Do not qualify for business mortgage loans.

- Cannot afford the costs of a down payment, plus six months of mortgage payments.

- Do not plan to make changes to the leased property.

- Plan to move or want the flexibility to move business locations.

Finding commercial real estate for purchase can also be more difficult than locating commercial property for lease. Weigh the pros and cons to both rent vs. buy commercial real estate options. And, consider how it will impact your business before making a final decision.

Small Business Administration and commercial property

The Small Business Administration (SBA) offers two leases for purchasing commercial real estate: 7(a) loans and 504 loans. To qualify, you must meet the requirements for the loans.

SBA 7(a) loans provide financial assistance for small businesses with special requirements. Your business may be eligible if you:

- Are a for-profit business.

- Meet SBA small business guidelines.

- Do business, or propose to do business, in the USA or its possessions.

- Have reasonable invested equity.

- Use other, alternative financial resources before applying for assistance, including personal assets.

- Demonstrate a need for a loan.

- Plan to use the funds for a sound business purpose.

- Are not delinquent on any existing debts to the federal government.

An SBA 504 loan is a long-term, fixed-rate financing option for up to $5 million. Loans are available through Certified Development Companies (CDCs), which are the SBA’s community-based partners. To be eligible, businesses must meet all three of the following conditions:

- Be a for-profit business in the USA or its possessions

- Have a tangible net worth of less than $15 million

- Have an average net income of less than $5 million after federal taxes for the two years before applying

Contact the SBA for more information.

Recording lease vs. buy commercial real estate in your books

Whether you buy or rent commercial property, you must record the transactions in your general ledger.

Recording a lease

To record lease transactions in your books, create an expense account for the rent payments in your chart of accounts. Then, increase the Rent Expense account and decrease the Cash account. Debits increase expense accounts, and credits decrease cash accounts. Your books should look like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Rent Expense | Rent payment | X | |

| Cash | X |

Recording a mortgage

Mortgage payments differ from rent payments because you must also record accrued interest on the loan.

Record the initial loan in your books as an increase in an asset (property) and an increase in liabilities (mortgage loan). To increase your asset account for the property, debit the account. To increase your liability account for the mortgage, credit it.

Your books will look like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Assets | Property | X | |

| Mortgage Loan | X |

When you pay the mortgage payments, you must record those payments in your books. Decrease both your Cash account and your Mortgage Payable account when you make payments.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Mortgage Payable | X | ||

| Cash | X |

Recording a purchase

Say you have the funds to purchase the property outright without a loan. To record a purchase, you increase your Asset account for the property and decrease your Cash account:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Asset | Property purchase | X | |

| Cash | X |