Nowadays, everything is online. From reviews to social media to shopping, it’s no secret that the online world is taking over. In fact, U.S. e-commerce grew by 44% in 2020. With the online market growing bigger every day, you may be thinking, It’s time to start accepting payments online for my business. If you’re in the “I want to accept payments online” mindset, read on.

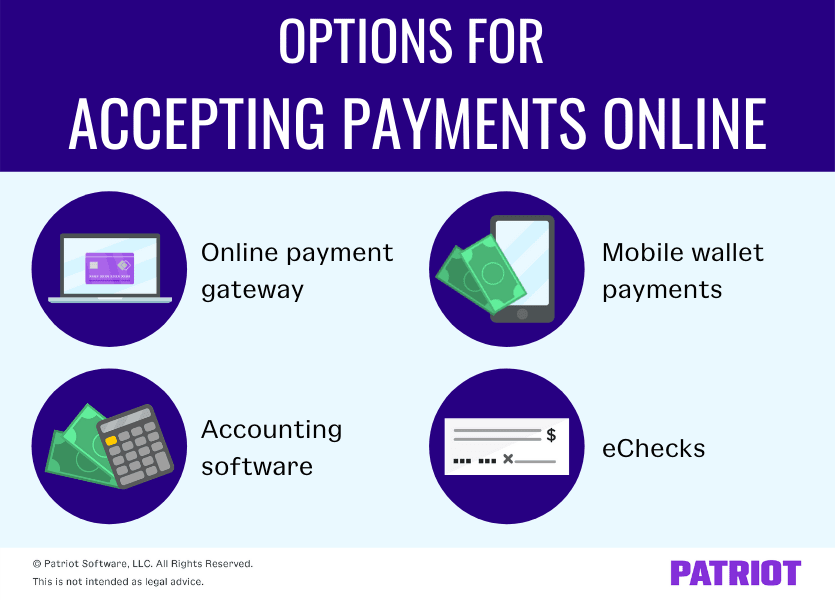

Options for accepting payments online

Before you can begin accepting payments online, you need to determine how. When it comes to accepting payments online, you have a few options other than simply accepting credit card payments. After all, we do live in a technological world now.

Here are some options you have for taking payments online from customers:

- Online payment gateway

- eChecks

- Mobile wallet payments

- Accounting software

Of course, you’re not limited to using just one of the above methods. You can use a mixture of methods to make it convenient for customers to pay you. Let’s dive into each, shall we?

Online payment gateway

A popular way to take payments online is by using a payment gateway. A payment gateway, also referred to as an online payment form, securely connects your online store to a checkout system.

Payment gateways are a great way to accept credit card payments online. Typically, you either embed a gateway in the checkout area of your online store or redirect customers to the payment gateway’s own website to complete the purchase.

Most businesses opt to have the gateway set up directly on their website as a form. That way, customers don’t have to worry about being redirected to a separate page. With the form, customers can pay directly on your website. And depending on what kind of gateway you set up, returning customers may be able to securely save their information (e.g., credit card number) for future use.

The good news is that payment gateways are generally simple to set up. You can work with a provider that specializes in online payment services.

eChecks

Another way you can accept payments online is with eChecks. An eCheck is an alternative to using credit or debit cards online.

So … how does it work?

An eCheck is a type of electronic funds transfer (EFT) that uses the Automated Clearing House (ACH) network to process payments.

eChecks work just like paper checks, except they’re electronic. Like a regular paper check, an eCheck deposits money from the customer’s bank account into your business’s account via an ACH.

Customers who use an eCheck just need to input the information from their paper check (e.g., routing and account numbers) into an online payment form or interface. Keep in mind that it generally takes a couple of days to receive an eCheck payment.

Mobile wallet payments

According to one study, nearly 4 out of 5 Americans use mobile payment apps for purchases. If you want to accommodate these individuals, consider accepting mobile, or mobile wallet, payments.

Not really sure what is a mobile wallet? Here’s a brief overview. A mobile wallet (e.g., Apple Pay) is an electronic wallet that stores payment information on a smartphone or mobile device. Mobile wallets are an alternative to carrying around and using cash, credit cards, and debit cards.

Because mobile wallets store bank card details on a device (e.g., smartphone), customers can make quick online payments. Mobile wallet payments make the shopping process more convenient for customers and allow them to get in and out with a couple of clicks.

Accounting software

If you’re not quite ready for one of the above, you may consider using accounting software to accept payments from customers online.

Depending on the software you get, you may be able to:

- Accept credit card payments from customers and record them in your account

- Send email invoices to customers with a button to pay

- Bill customers automatically

- Send recurring invoices to customers who receive the same invoice amount

If you’re looking to streamline your accounting tasks and take on accepting online payments, accounting software may be a good option for you.

Before committing to accounting software, do your research to find out what kinds of online payment options it has. And, check out what other features the software offers. You may consider getting basic accounting software to start out, especially if you’re looking to just use the online payment features.

You may also consider getting invoicing or billing software. But, keep in mind that accounting software can be more affordable than billing and invoicing software, especially if you are paying for multiple software packages (e.g., accounting and billing software). With accounting software, you can typically get more bang for your buck.

Accepting payments online: 3 steps

The steps you have to take to accept payments online vary depending on the method you use. However, you generally need to follow the steps below to get up and running:

- Determine how you will process payments

- Review your options (payment gateway, mobile wallet, eCheck, accounting software)

- Contact payment processors to find out features, pricing, fees, etc.

- Weigh the pros and cons of each option

- Set up your online payment method

- Contact a company to get started setting up your online payment method(s)

- Notify customers

- Inform customers of your new online payment option(s)

- Provide online payment steps to customers

Pros and cons of accepting payments online small business

On the fence about accepting online payments from customers? It’s a big, but sometimes necessary, step in today’s technological age. Before you make your decision, check out the pros and cons of accepting payments online below.

Here are a few pros to consider:

- Attract and reach more customers

- Offer more secure payment options

- Automate recurring payments

- Improve cash flow

- Quick for customers

Weigh these cons before deciding to accept payments online:

- Setup and transaction fees

- Potential fraud charges

- Technical problems

Like with any decision you make for your business, consider the advantages and disadvantages before you decide the route you’re going to take.

When a customer pays you, don’t forget to record the transaction in your books! Use Patriot’s online accounting software to streamline the way you record income and expenses and manage your books. What are you waiting for? Try it for free today!

This is not intended as legal advice; for more information, please click here.