As a business owner, you’re responsible for staying on top of your business’s books. If you have up-to-date and accurate accounting records, your company will be on the road to success. But if you fail to focus on your accounting tasks, your business can quickly sink before it has the chance to grow.

To help keep your books on a sound footing, learn some bookkeeping tips for small businesses.

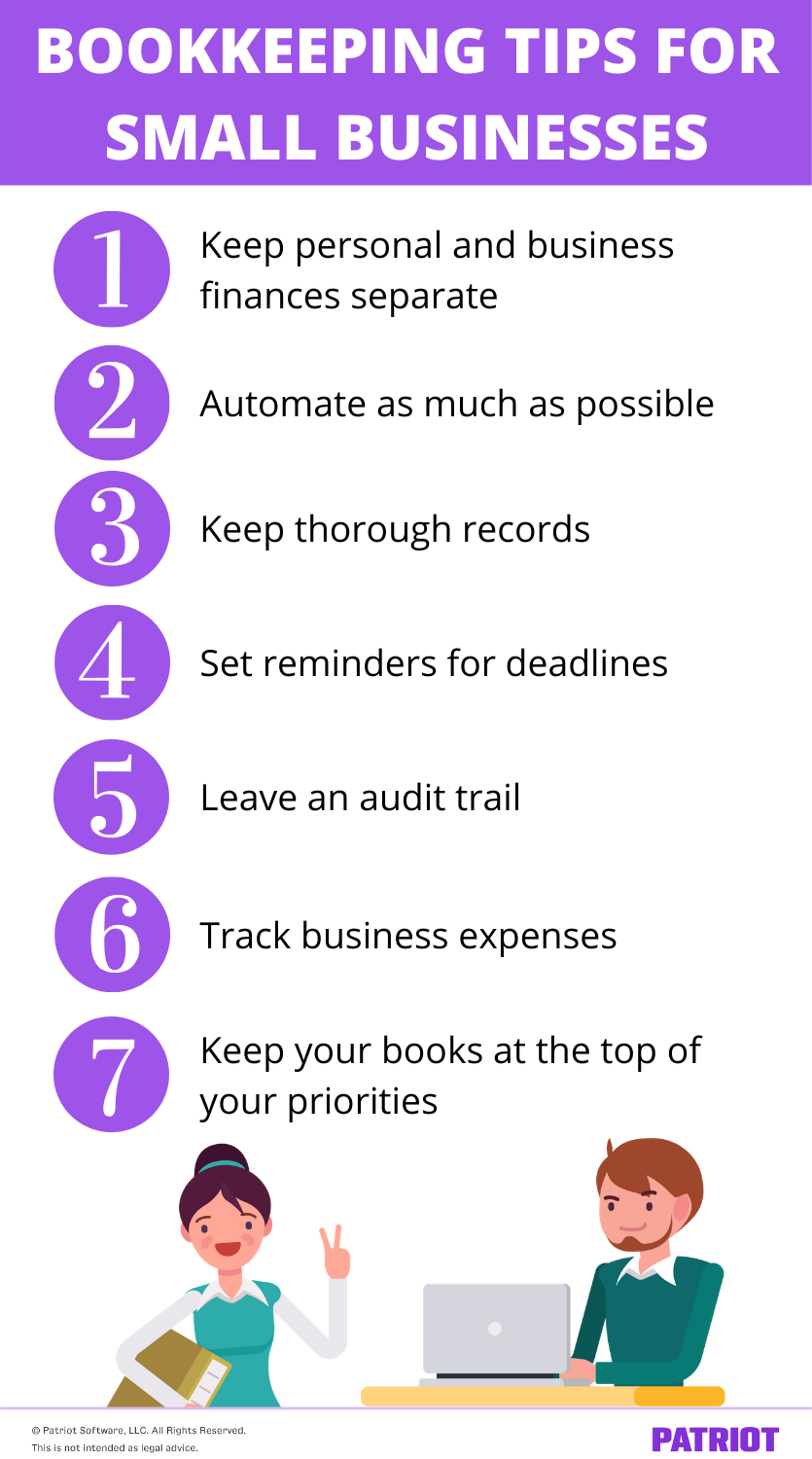

Bookkeeping tips for small businesses

To ensure your books are accurate from the moment your company is born, use these seven bookkeeping tips.

1. Keep personal and business finances separate

Co-mingling expenses might not seem like a bad idea at first, but it can quickly cause huge headaches for your small company.

From the get-go, you should set up a business bank account to keep personal and business expenses separate.

Your business can also benefit from setting up a business bank account. A business bank account can help you:

- Stick to your business budget

- Organize accounting records

- Keep your business finances in order

In some cases, separating funds is not something your business can opt out of. If your business is an LLC or a corporation, you must open a separate account for business.

2. Automate as much as possible

It’s no secret that automation can be a lifesaver for small business owners. The more you automate, the more time you will have for your business.

To streamline your accounting responsibilities, consider automating your accounting process with accounting software. With software, you can say goodbye to spreadsheets and manually crunching numbers.

While searching for accounting software, look at things like storage, accessibility, and security. Make a list of things that are must-haves for your business, like certain features, pricing, and reports.

Don’t rush into purchasing software. Do your homework to find out what software will best fit the needs of you and your business.

3. Keep thorough records

Organizing and keeping accounting records like business invoices, receipts, and expenses can make or break your business’s books. If you fail to keep accurate records, the financial condition of your company can suffer.

If you’re a fan of keeping paper records, store them in a secure and safe place (e.g., a locked filing cabinet). And, make sure you keep your paper accounting records organized using different labels and sorting strategies (e.g., chronological order).

If you’re not a fan of paper records, go electronic instead. Keep paperless versions of accounting information on your devices or in the cloud for safekeeping.

To ensure you protect your accounting records, consider keeping both a paper and paperless version. That way, you have a backup in case accounting information is destroyed, misplaced, or lost.

4. Set reminders for deadlines

As a busy business owner, it can be easy to lose track of time and miss deadlines. As soon as you know it, another month or year has gone by.

To avoid missing deadlines and keep your books ready come tax season, try setting reminders. Add business tax return due dates and other reminders to your calendar to ensure you don’t miss any upcoming due dates. You can even use a digital calendar (e.g., Google Calendar) to track important dates and set up reminders for yourself.

Plan ahead, and set time and money aside for your business taxes. That way, you can pay your tax liabilities on time and steer clear of deadline-related penalties.

5. Leave an audit trail

Remember the story of Hansel and Gretel? If so, you probably recall that they left a trail of breadcrumbs to find their way back home. Similar to leaving breadcrumbs, an audit trail helps you retrace your steps in accounting.

An audit trail is a set of documents that back up the transactions you record in your books. Your trail can help you track down transactions and verify they’re correct. Audit trail documents can include things like purchase orders, invoices, and estimates.

Creating audit trails in accounting can help your business prevent fraud, improve accuracy, and find missing transactions. To ensure your small business accounting records are as accurate as possible, consider keeping an audit trail.

6. Track business expenses

It can be difficult to anticipate certain expenses. Some expenses you can forecast, while others are unexpected. But if you plan and prepare for the unexpected, your business will be much better off in the long-run.

When it comes to your books, keep a thorough record of all your expenses, such as supplies, inventory, insurance, and utilities. And, come up with a game plan on how you will handle unforeseen expenses. That way, you can better predict larger expenses and not be caught off guard in the future.

7. Keep your books at the top of your priorities

As a small business owner, you have a million and one things to do. It can be tempting to push your books aside to focus on running your business. But if you want to keep your business on track for success and keep your financial ducks in a row, prioritize your books.

From day one, keep your books up-to-date and organized. If you avoid your books time and time again, you’ll find yourself buried in small business bookkeeping. Make time to review and update your books so you can avoid accounting tasks piling up.

Add transactions into your books on a regular basis (e.g., once per week). The more frequently you keep up with accounting, the less of a chore it will be.

Need an easy way to track your business’s income and expenses. Patriot’s online accounting lets you streamline the way you record transactions. Try it for free today!

This is not intended as legal advice; for more information, please click here.