Would you like your business to earn more? Of course you do! When you learn how to increase net profit, your business will have more money after expenses and become more stable.

Read More How to Increase Net ProfitKaylee DeWitt

What Is Quick Ratio? Learn How to Swiftly Calculate This Metric

Does your business have enough liquid assets to cover short-term liabilities in a pinch? To find out, you can use the quick ratio. Keep reading to learn the quick ratio definition, how to calculate your ratio, and more.

Read More What Is Quick Ratio? Learn How to Swiftly Calculate This Metric

How to Gross up Payroll

If you want to pay an employee supplemental compensation, such as a bonus or a relocation payment, you must withhold payroll taxes just like with regular wages. But, what if you want an employee to receive a specific amount after taxes? That is when you gross-up payroll figures. And to do that, you need to […]

Read More How to Gross up Payroll

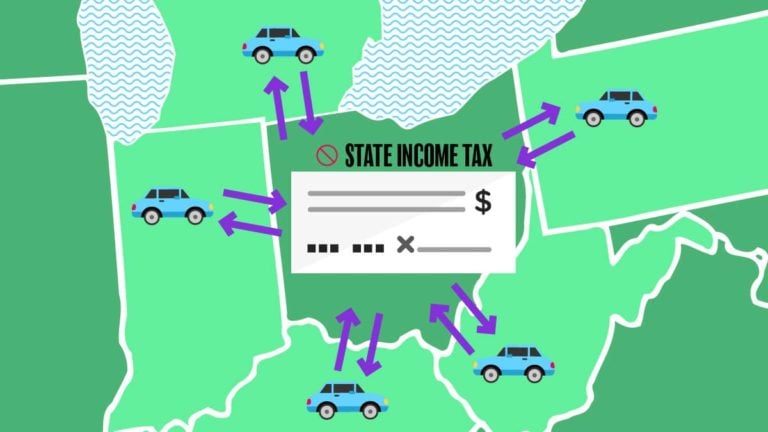

Which States Have Reciprocal Agreements … and What Does That Mean?

Do you have an employee who lives in one state but works in another? If so, you typically withhold state and local taxes for the work state. The employee would still owe taxes to their home state, which could turn into a hassle for them. Or could it? Cue reciprocal agreements.

Read More Which States Have Reciprocal Agreements … and What Does That Mean?

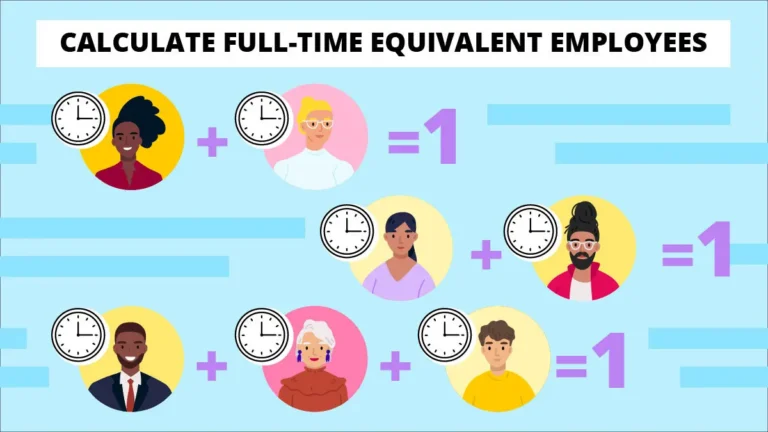

How to Calculate a Full-time Equivalent Employee

As an employer, at some point or another, you may have stumbled across the term “full-time equivalent employee.” Maybe you noticed it while researching information about the Paycheck Protection Program loan. Or, maybe you came across it while looking into COBRA. Whatever the case may be, you should know how to calculate a full-time equivalent […]

Read More How to Calculate a Full-time Equivalent Employee

How to Set up Payroll for a Small Business

Hired your first employee? Check. Set a start date? Check. Ready to process payroll? Not quite yet. Before you can start paying your employees, there are a few steps you need to know and some terms to learn. This handy payroll 101 guide explains how to set up payroll the right way so you can […]

Read More How to Set up Payroll for a Small Business

Payroll Compliance Checklist (By Payday, Month, Quarter, and Year)

Payroll compliance isn’t a once-per-year task you can easily check off. Remaining compliant is a big job. You must make sure your business is compliant with all payroll laws year-round. You can make payroll compliance easier and less stressful by doing tasks throughout the year. In fact, there are some tasks, like filing taxes, that […]

Read More Payroll Compliance Checklist (By Payday, Month, Quarter, and Year)

How to Do Payroll Yourself

If you’re thinking about hiring employees, you need a plan for payroll. But with the added expense of wages and benefits, you might not be too keen on the high price tag that comes with outsourcing payroll. Fear not; you can learn how to do payroll yourself. Here’s what to gather, the steps to follow, […]

Read More How to Do Payroll Yourself

7 Common Payroll Errors That Trigger Heavy IRS Penalties (and How to Avoid)

Payroll mistakes are more than clerical slip-ups. They can trigger steep IRS penalties, interest, and audit scrutiny. The most common issues involve late tax deposits, worker misclassification, incorrect forms, and bad data. For example, failure to deposit penalties escalate from 2% – 15% of the unpaid amount, plus interest.

Read More 7 Common Payroll Errors That Trigger Heavy IRS Penalties (and How to Avoid)

Everything You Need to Know About New York PFL

When you become an employer, part of your responsibilities include handling payroll taxes. On top of remitting taxes, you also might employ workers in a state with a paid family leave program, such as New York.

Read More Everything You Need to Know About New York PFL