If you want to keep your business running, you need to fork over some cash to buy goods and services. And sometimes, you might use credit to make these purchases, resulting in accrued liabilities.

Accounting lingo like “accrued liabilities” may sound complicated, but don’t panic. It’s actually pretty simple. Read on to learn the basics of accrued liabilities to keep your small business cash flow on track.

What are accrued liabilities?

Accrued liabilities, or accrued expenses, occur when you incur an expense that you haven’t been billed for (aka a debt). For example, you receive a good now and pay for it later (e.g., when you receive an invoice). Although you don’t pay immediately, you’re obligated to pay the accrued expense in the future.

Generally, you accrue a liability in one period and pay the expense in the next period. That means you enter the liability in your books at the end of an accounting period. And in the next period, you reverse the accrued liabilities journal entry when you pay the debt. This shows the expense paid instead of a debt owed.

You might also have an accrued expense if you incur a debt in a period but don’t receive an invoice until a later period.

Keep in mind that you only deal with accrued liabilities if you use accrual accounting. Under the accrual method, you record expenses as you incur them, not when you exchange cash. On the other hand, you only record transactions when cash changes hands under the cash-basis method of accounting.

Accrual accounting is built on a timing and matching principle. When you incur an expense, you owe a debt, so the entry is a liability. When you pay the amount due, you reverse the original entry. Then, the entry is shown as an expense paid.

The accrual method gives you an accurate picture of your business’s financial health. But, it can be hard to see the amount of cash you have on hand. So as you accrue liabilities, remember that that is money you’ll need to pay at a later date.

Examples of accrued liabilities

You can gain accrued expenses in a number of ways. Here are some common examples of accrued liabilities:

- Accrued interest: You owe interest on an outstanding loan and haven’t been billed by the end of the accounting period.

- Accrued wages: Your employees earn wages but are paid in arrears, which is in the following period (e.g., pay period in October with pay date in November).

- Accrued payroll tax: You withheld employment taxes from employee wages but owe them next accounting period.

- Accrued goods and services: Although you receive a good or service, the vendor doesn’t bill you until a later date.

- Accrued utilities: You used utilities for your business but haven’t yet been billed.

Recording accrued liabilities lets you anticipate expenses in advance. You recognize expenses earlier than you are billed. That way, you can accurately map out the money you owe.

How to record accrued expenses

Ready to record accrued liabilities in your books? If so, you need to create an accrued expense journal entry.

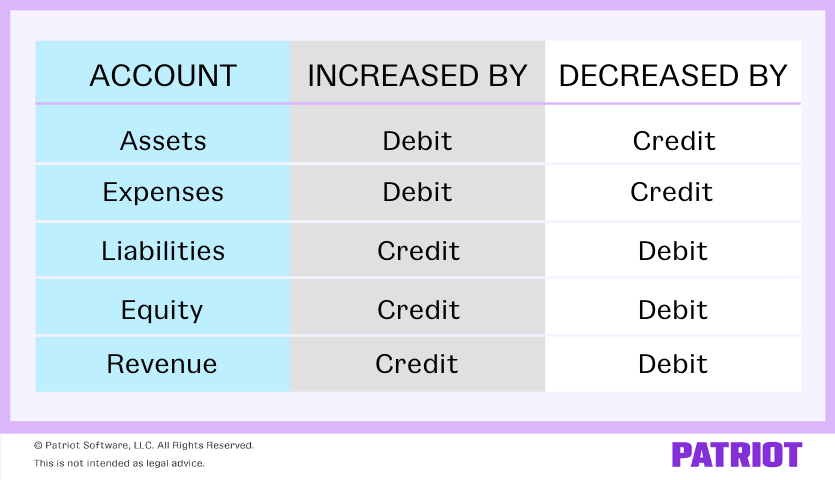

Use debits and credits in your accrued expenses journal entry. This means you must make two opposite but equal entries for each transaction. So, how do you use debits and credits for your accrual accounting entries?

Accrued liabilities work with expense and liability accounts. A debit increases expense accounts, and a credit decreases expense accounts. Oppositely, a credit increases liability accounts, and a debit decreases liability accounts.

Remember, accrued liabilities are reversing entries. They are temporary entries used to adjust your books between accounting periods. So, you make your initial journal entry for accrued expenses. Then, you flip the original record with another entry when you pay the amount due.

There are two steps to creating an accrued liabilities journal entry…

Step 1: You incur the expense

You incur an expense at the end of the accounting period. You owe a debt but have not yet been billed. You need to make an accrued liability entry in your books.

Usually, an accrued expense journal entry is a debit to an Expense account. The debit entry increases your expenses.

You also apply a credit to an Accrued Liabilities account. The credit increases your liabilities.

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Expense | X | ||

| Accrued Liability | X |

What happens when you make these entries? Your expenses increase on the income statement. And, your liabilities increase on the balance sheet.

Step 2: You pay the expense

At the beginning of the next accounting period, you pay the expense. Reverse the original entry in your books.

Debit the Accrued Liability account to decrease your liabilities. When you pay a debt, you have fewer liabilities.

Credit an asset account. In this example, credit the Cash account because you paid the expense with cash. A credit decreases the amount of cash you have.

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Accrued Liability | X | ||

| Cash | X |

When you reverse the original entry to show that you paid the expense, you must also remove it from the balance sheet. This decreases your liabilities. And because you paid it, your income statement should show a decrease in cash.

If you don’t adjust entries after paying expenses, you’ll have some issues in your books. Here are a few things that will likely happen:

- Liabilities will be understated on the balance sheet

- Expenses will be understated on the income statement

- Net income will be overstated

Bottom line: Your financial reports will make it look like you have more money than you do. Make sure you keep your entries up-to-date each time you pay a liability.

Accrued expenses vs. accounts payable

You might be thinking that accrued liabilities sound a whole lot like accounts payable. If you are, you’re right. Accrued expenses and accounts payable are similar, but not quite the same.

Both accrued expenses and accounts payable are current liabilities, which means they are short-term debts paid within a year. But, the difference between the two revolves around invoicing:

- Accrued expenses: Expenses incurred but not yet billed (i.e., you haven’t received an invoice yet).

- Accounts payable: Expenses you’ve incurred and received an invoice for. You owe the supplier money. This also includes costs you bought on credit.

This article has been updated from its original publication date of June 20, 2017.

This is not intended as legal advice; for more information, please click here.