Maybe you’re thinking about buying accounting software for the first time. Or, you’re finally ready to switch software providers. At some point, you may wonder how to choose accounting software. There are so many options out there that even knowing where to get started selecting the right accounting software can feel impossible. This article will help you learn how to choose accounting software that fits your needs.

How to choose the right accounting software for your business

How to choose the right accounting software for your small business can make your head spin. Your company has specific needs. And with so many software features, price points, commitment timelines (one-time charge or subscription), and everything else, it can be tough to keep things straight.

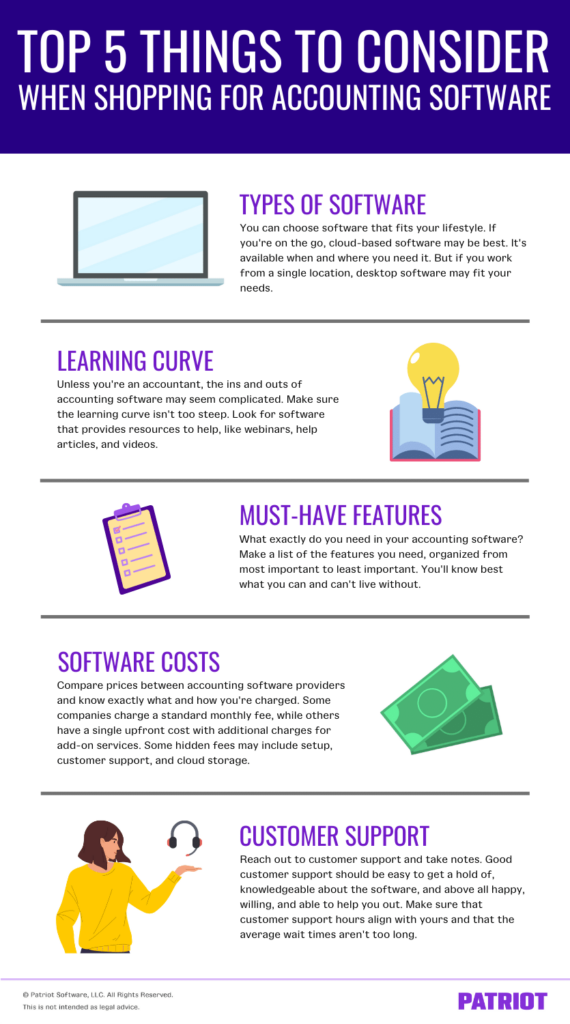

To sort through your options, consider the following five tips.

1. Choose accounting software that fits your budget

Before you get started, you should know the cost of accounting software varies. The amount often increases with the number of features the software provides. Want more features? You may have to shell out some more money.

It’s important to understand how the price compares to available features when choosing accounting software. The last thing you want is overpriced software with a bunch of features you’ll never use. Check and see if the software offers a free trial or self-guided demo before purchasing. If they do, you’ll get to know the software’s features before you commit.

Watch out for how you are charged for the software. Software companies often have different methods for charging users. Some software applications are sold at a large, one-time fee. Depending on the software, you might have to pay additional expenses for updates when they come up. If this is the case, you won’t be able to plan ahead of time for the new fee. If the update is needed, you’ll need to pay for it.

Other software programs work on a monthly or yearly subscription. They are often sold in packages with a tiered pricing structure that allows you to choose exactly what you need. If you choose software that charges a monthly fee, know the terms before subscribing.

Make sure that you understand your contract—is it flexible or iron-clad? If you break a contract, you could be charged a fee.

Last but not least: watch out for the hidden or additional fees. You don’t want to be surprised by extra charges for creating invoices, running reports, providing setup, customer service, and data storage.

2. The best accounting software is the one you know how to use

If you’re like many small business owners, you have a depth of knowledge in your specific field, not accounting. You don’t want to spend your workweek learning bookkeeping.

Sure, you might not technically be a bookkeeper, but you aren’t new to money management. You’ve been managing your finances ever since you first debated whether or not you should break your piggy bank or fill it up some more.

With that being said, accounting software comes with all different types of skill levels in mind. Some are simple and made for the nonaccountant. Others are more suited for accountants. In the end, it doesn’t matter who you are. You should look for software that offers free resources and customer support. That way, if you do need to learn something new, there’s an easy way to make sure you have the right information.

3. Decide the features you need for accounting software

The good thing about having so many features to choose from is that you get to find the accounting software that fits your needs like a glove.

Here are some common features you might come across:

- Create and track invoices

- Pay vendors

- Compile financial statements

- Process credit cards

- Integrate with bank accounts

- Record customer histories

We all love a good checklist. To help organize your search, make a checklist of all the features you need. Prioritize the list from the most necessary features to the least.

Find a software solution that supports both current needs and future needs. Find software that can grow with your business.

4. On-the-go owners must look for flexibility

If you find yourself loosely defining the word “office” to include cafes, airport lounges, and your favorite restaurant, you may want to look into cloud-based accounting software.

Cloud-based software stores information online so you can access the program anywhere with any device connected to the internet. There are a lot of upsides here: You aren’t tethered to a desk, and you don’t have to worry about losing accounting information if your computer crashes on you.

If you do choose desktop software, you should know the risks. That single computer and its hard drive become the center point of your workweek. And, the software is only available to you if your computer is in tip-top shape. Crashes, water damage, and power outages can wreak havoc on your accounting records.

5. Make sure that quality customer support is there when you need it

You may have questions or need help understanding your new software. And when that time comes, you’ll want a support team that can help quickly and easily. Quality customer support that is knowledgable and easy to get a hold of will be key to switching over to new software.

Here are some questions to keep in mind when thinking about customer support:

- Is the support free, or are there additional, even recurring fees?

- What time zone are they in? Make sure you don’t lose too much time between different time zones.

- Is the support team experienced and knowledgeable about the software and your needs?

- Is there more than one way to get ahold of customer support (e.g., phone, email, online chat)?

Answering these questions is easy. Give the customer support team a call and simply ask them. Have a pen or pencil handy—you may want to take some notes. You’ll be able to tell pretty quickly if they’re the right customer support team for you.

How to choose accounting software

The items listed above are just a starting point. You also need to consider the following:

- Reports: Look for easy-to-read reports that are shareable with your accountant, managers, or other trusted employees.

- Accounting method: Choose accounting software that matches your preferred accounting method.

- Security: Make sure that the software has your security interests in mind.

- Commitment: Choose month-to-month or annual commitments (whichever fits your needs).

- Reviews: Trust customers who’ve been using the software for weeks, months, and even years—let them tell you just how good the software is.

This article has been updated from its original publication date of February 4, 2017.

This is not intended as legal advice; for more information, please click here.