If you have a business bank account, you should regularly receive a paper or electronic statement. These business bank statements provide valuable information for managing your business finances.

So if you’re tossing your unopened business bank account statements in a drawer or—worse—the trash, this one’s for you. Read on to learn what is a bank statement and how to use it.

What is a business bank statement?

A business bank statement is a summary of all transactions in your business bank account. It lists each transaction individually so you can see a breakdown of your income and spending related to that account.

Each bank statement covers a certain amount of time—typically a month. Your financial institution sends you the statement at the end of each statement period. You can receive a paper copy through the mail or an electronic copy through an email or your online account.

If you have multiple bank accounts, you should receive multiple bank statements showing the transactions for each. For example, you might have a personal checking account, a business checking account, and a payroll account.

Parts of a bank statement

There’s a bit of information on business bank account statements. Understanding the parts of your statement is key to using your statement in business.

Common bank statement details include:

- Bank information

- Business information

- Account information

- Statement dates

- Account summary

- Transaction summary

- Bank messages

Bank information

Your financial institution’s contact information is on each bank statement. It should list the financial institution’s name, address, and customer support details (e.g., phone number and website).

If there is a specific number for reporting discrepancies, your statement might include it.

Business information

Your statement also lists your business’s information, including your name, business name, address, and phone number.

Account information

This part of your statement has basic and sensitive information about your bank account. It includes your account name and account number.

Statement dates

Each statement tells you the period it covers. For example, it might say Statement for Month # to Month #, Year.

Account summary

A business bank statement also summarizes your account for the period. It includes information like:

- Beginning balance

- Ending balance

- Total withdrawals

- Total deposits

The bank statement summary page is typically located above your transaction summary breakdown.

Transaction summary

And now for the main event: your transaction summary. The transaction summary takes up a majority of the space on the bank statement.

This part of your company bank statement lists every account transaction in chronological order. For each transaction, the statement lists the:

- Date

- Description

- Amount

- Account balance after the transaction

Bank statement descriptions might also list what kind of transaction you made and where you made it.

Bank messages

Last but not least, you might see a little note somewhere on certain bank statements. Some financial institutions include messages and news.

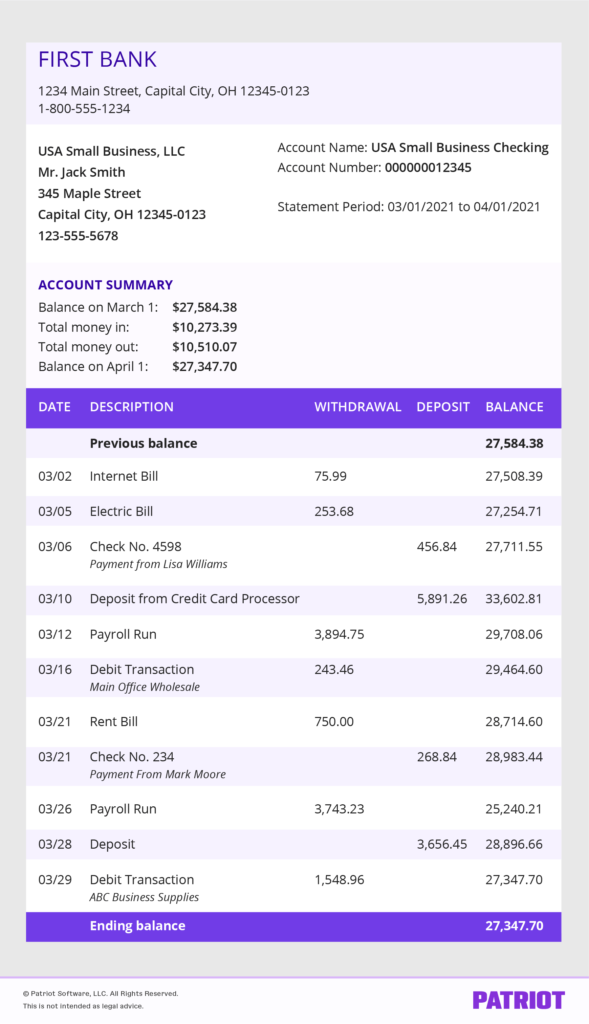

Business bank statement example

Every bank is different. But if you want to get an idea of what a business account statement looks like, take a look at this sample:

6 Ways to use your business bank statements

Bank statements can be invaluable tools for your business. There are a number of ways these digital or paper statements can keep you organized and accurate.

Here are six ways you can use your business bank statement.

1. Filling out your tax returns

When it comes to filing your business tax returns or employer tax returns, you need to gather documents for accuracy. This includes your bank statements.

You can use your bank statements as supporting documents for business tax forms. Reference your statements to ensure you are reporting your taxes correctly. If you are audited, you can use the bank statements as proof that your tax returns are accurate.

2. Applying for a loan

Lenders want proof of your business’s incoming money. As a result, you may have to show your bank statements to the lender when you apply for a business loan. The lender reviews the statements to determine if you are a good fit for a loan.

If you received a Paycheck Protection Program (PPP) loan, loan forgiveness isn’t automatic. You need to apply if you want your loan forgiven. You may need to include bank account statements on your PPP forgiveness application.

3. Reconciling your bank statements

You can use your bank statement to make sure your accounting books are accurate. This process is known as bank statement reconciliation.

Through bank statement reconciliation, you compare your bank statement with your accounting books to catch and fix inconsistencies.

4. Tracking uncashed checks

Do you regularly write checks when making payments? If so, you know what happens when vendors take a while to cash them—you may forget about them and overspend.

You can use a business bank statement to keep track of uncashed checks. Your statement shows you whether the recipients cashed the checks or if you still need funds to cover them. You might do this by comparing your bank statement to your check register.

5. Budgeting for your business

When you go over your bank statements, some spending habits might jump out. You might realize you are spending a lot of money at certain places. Or, you might discover an overlooked source of steady income.

Streamline the process of creating your business budget by taking advantage of the data on your bank statements. You can estimate your future transactions based on your past transactions.

6. Finding errors and unauthorized transactions

Worried about transaction errors? What about hackers making purchases using your account? By reviewing your business bank statements, you can find errors and unauthorized transactions.

You might find reporting mistakes or learn that someone stole your account information. By regularly looking for discrepancies, you can quickly report them to your bank.

This article has been updated from its original publication date of February 11, 2015.

This is not intended as legal advice; for more information, please click here.