How to Add or Edit Employee Tax Information

In this article:

You will need to enter federal, and possibly state and/or local (if applicable) tax withholding information for each employee. Each employee should complete a federal Form W-4 Withholding Allowance Certificate, plus any required state and/or local income tax withholding certificates. You will enter each employee’s tax withholding information on their Tax Information page.

If you want to make an employee exempt from any taxes, you may find the help article, How to Make an Employee Exempt from Taxes helpful.

Employee Federal Withholding: Form W-4

- NOTE: For years 2020 and later, the IRS has issued a new Form W-4 for employee federal tax withholding. See FAQs about the 2020 Form W-4 on the IRS Website.

- Go to Payroll > Employees > Employee List > {Employee Name } > Taxes > Federal Taxes.

- Click “Edit.”

- Enter the information into the software as the employee entered it on their Form W-4. Click here for a blank Form W-4.

- Filing Status: Choose the correct filing status in the drop-down list as specified on the employee’s Form W-4.

- Multiple Jobs or Spouse Works: If the employee has checked the box in Step 2, check the box here in the software.

- Claim Dependents: Enter the total amount the employee has listed in Line 3 of their W-4.

- Other income (not from jobs): Enter the amount the employee has listed on Line 4(a) of their W-4. If they have left it blank, enter $0.

- Deductions: Enter the amount the employee has listed on Line 4(b) of their W-4. If they have left it blank, enter $0.

- Extra Withholding: Enter the extra tax withholding the employee has entered in Line 4(c) of their W-4. If they have left it blank, enter $0.

- Exemption from Withholding: If the employee has written “EXEMPT” below Line 4(c) of their Form W-4, choose “Exempt.” In most cases, employees must pay federal income tax, so you would keep this field “Not Exempt.” You can check out our article, What Does Tax Exempt Mean, to learn more about this scenario.

- Click “Save.”

Employees can make their own changes to their federal tax withholdings by completing an electronic Form W-4 in their employee portal. At the time an employee makes a change, their federal tax withholdings are automatically updated for the next time you run payroll. You will receive an email notification and can view their W-4 history on their Taxes page. For more information, see Employee Federal Tax Updates in Patriot’s Employee Portal.

Employee State Withholding

💡 State and local tax fields vary by state.

Here are articles that address some state-specific fields:

- Arizona Employee Tax Withholding Help

- Arkansas Employee Tax Withholding Help

- California Wage Plan Codes

- California Employee Tax Withholding Help

- Georgia Employee Tax Withholding Help

- Massachusetts Employee Tax Withholding Help

- Massachusetts – Reporting Owner/Officer Status

- Missouri Employee Tax Withholding Help

- Nebraska Nonresident Employee Tax Percentage

- Vermont Nonresident Employee Tax Percentage

- Go to Payroll > Employees > Employee List > Click the Employee Name > Taxes > State

- Click “Edit.“

- State Filing Options: These options depend on the work state. Enter the filing option as specified on the employee’s state income tax withholding form. Do not add extra spaces.

- State Additional Withholding: By default, the additional withholding will be zero dollars. Enter the dollar amount of additional withholding listed on the employee’s state income tax withholding form.

- Exemption from Withholding: If the employee has indicated they are exempt from paying state tax, choose “Exempt.” In most cases, employees must pay state income tax, so you would keep this field “Not Exempt.”

- Non-Resident Certificate: This field appears if the employee lives in a different state than the company location. Select “Yes” if the employee has a state non-resident certificate.

- Click “Save.”

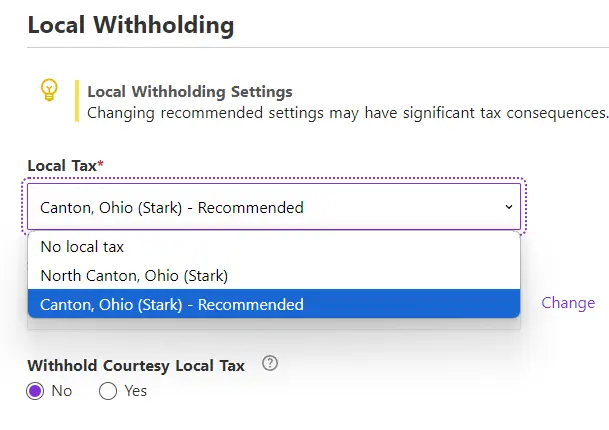

Employee Local Tax Withholding

Local Tax: The “Local Withholding” section will only appear in certain states.

- Go to Payroll > Employees > Employee List > Click the Employee Name > Taxes > Local Taxes

- Click “Edit.”

- Select the correct tax jurisdiction. The Local Tax drop-down list will be pre-filled with recommended settings based on the employee’s home address. Only change this if you are certain the employee is not in a different local jurisdiction.

- The software will calculate–or not calculate–taxes based on the local tax jurisdiction.

- Click “Save.”

About employee local tax settings:

- If the employer has selected the optional “Withhold Courtesy Local Tax” for the employee’s city of residence, this becomes a required field for all employees. This means the company will be withholding and remitting taxes for the employee.

- If the employee works from home this becomes a required field for this employee.

Employee School District Withholding Fields (OH and PA)

School District: The School District Tax applies only in parts of Ohio and Pennsylvania. The School District Tax field shows a drop-down of all school districts available in the county of the employee’s zip code.

- Go to Payroll > Employees > Employee List > Click the Employee Name > Taxes > Local Taxes

- Click “Edit.”

- Select the school district in which the employee resides. The school district drop-down list will be pre-filled with recommended settings based on the employee’s home address. Only change this if you are certain the employee is in a different district.

- Choose “No School District Tax” if this does not apply.

- Click “Save.”

Advanced Employee Tax Settings

- Payroll > Employees > Employee List > Click the Employee Name > Advanced Tax Settings > Edit.

Exempt From Taxes: In most cases, employees are required to pay income taxes, and employers are required to pay FUTA and SUTA tax on employees. These fields should only be marked ‘Exempt’ if the employee is not obligated to pay Social Security, Medicare, City Income Tax, or if the employer is not required to pay FUTA or SUTA on this employee. Otherwise, leave each selection ‘Not Exempt.’

When these tax types are marked ‘Exempt,’ the employee does not have any tax withheld or taxable wages calculated.

See our help article, “How to Make an Employee Exempt from Taxes,” for detailed steps.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.