When you become an employer, you can’t always play by your own rules. There are certain federal, as well as state and local, standards you must follow. The FLSA is one set of federal regulations you need to know about and comply with. What is the FLSA?

Read More What Is the Fair Labor Standards Act (FLSA)?

Michele Bossart

What Employers Need to Know About Taxable Wages

Part of being an employer is withholding taxes from your employees’ wages before giving them their paychecks. That’s why you need to understand taxable wages before you run payroll.

Read More What Employers Need to Know About Taxable Wages

Social Security Tax: Get to Know it Before Writing That Paycheck

Employers are responsible for withholding, remitting, and filing payroll taxes on behalf of their employees. And, there are some taxes you contribute on behalf of your employees. Social Security tax is one of those essential taxes that impacts both the employer and the employee.

Read More Social Security Tax: Get to Know it Before Writing That Paycheck

Tips vs. Auto-Gratuities (Service Charges): Why It Matters for Payroll

If your employees earn money directly from customers—at a restaurant, salon, hotel, or bar—you already know how confusing tip reporting can be. The IRS draws a very specific line between tips and auto-gratuities (aka, service charges), and the difference affects payroll taxes, employee reporting, and even year-end W-2s. Let’s break it down in plain English. […]

Read More Tips vs. Auto-Gratuities (Service Charges): Why It Matters for Payroll

Patriot Payroll Customers Can Now Add Health Benefits in Just a Few Clicks

Patriot Software, a leader in cloud-based payroll and accounting solutions, has joined forces with SimplyInsured, a digital benefits platform, to simplify one of the toughest jobs for small business owners: offering health insurance. The new integration embeds insurance shopping, enrollment, and payroll deductions directly inside Patriot’s payroll software.

Read More Patriot Payroll Customers Can Now Add Health Benefits in Just a Few Clicks

Patriot Software Unveils Another Huge Time-Saving Feature: Auto Payroll

CANTON, OH Patriot Software, a leading provider of accounting and payroll software in the USA, today announced Auto Payroll, a powerful new feature designed to eliminate repetitive administrative work for small business owners and accountants. The feature is available immediately to both Full Service Payroll and Basic Payroll customers. Auto Payroll is engineered for companies […]

Read More Patriot Software Unveils Another Huge Time-Saving Feature: Auto Payroll

How to Create a Chart of Accounts That’s “IRS Ready”

Tax season. Just hearing the words can send shivers down a business owner’s spine. But what if you could change that? What if instead of scrambling for receipts and trying to make sense of a year’s worth of transactions, you could simply generate the reports you need with a few clicks?

Read More How to Create a Chart of Accounts That’s “IRS Ready”

Less Paperwork, More Productivity: Patriot Payroll Launches New Employee Self-Onboarding

Canton, OH Patriot Software, a leading provider of accounting and payroll software in the U.S., announces a new value-added feature for all payroll customers—employee self-onboarding for new hires. Employee self-onboarding significantly cuts down on administrative burdens and offers businesses a swift and professional method to integrate new hire information into their payroll system. Many of […]

Read More Less Paperwork, More Productivity: Patriot Payroll Launches New Employee Self-Onboarding

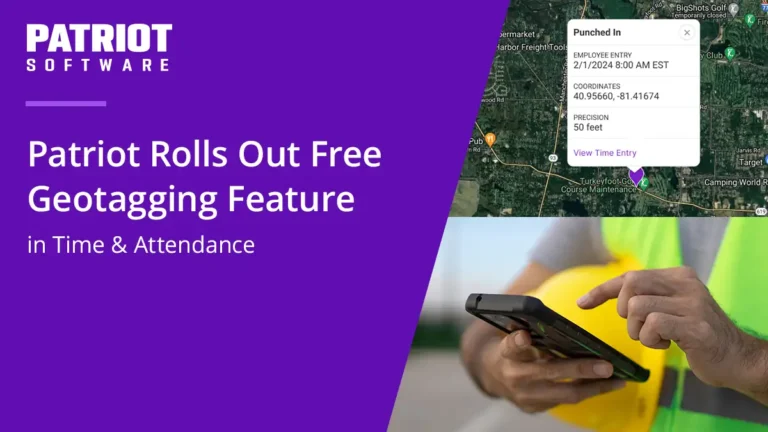

Patriot Software Bolsters Its Time & Attendance With Geotagging

Patriot Software’s powerful new geotagging feature gives employers map-based visibility of where their employees are punching their time cards.

Read More Patriot Software Bolsters Its Time & Attendance With Geotagging

Pay Frequency: How Often Should I Pay My Employees?

Pay frequency, or how often you pay your team, is one of the first decisions you must make when you hire your first employee.

Read More Pay Frequency: How Often Should I Pay My Employees?