How to Create, View, File, and Post 1099 Forms

In this article:

- Create 1099 Forms

- View 1099 Forms

- Choose a Filing Method and Post to Contractor Portals

- Will Patriot mail 1099s to contractors and vendors for me?

- Updates Needed After Finalizing and Posting 1099s

Background:

You can create Forms 1099 and 1096 for your contractors and vendors at year-end, choose how you would like to file (paper forms or e-filing,) and post digital 1099s to contractor portals.

💡 Businesses with 10 or more information returns (which include W-2 and 1099s ) MUST file electronically per the IRS.

Form 1099-NEC is due to the IRS by January 31 (both paper and electronic). If you file after the deadline, you are responsible for any IRS late penalties.

Form 1099-MISC is due to the IRS by February 28 (paper) or March 31 (electronic). But, give your vendors their copies by January 31.

Steps to Create, View, File, and Post 1099 Forms

Go to Reports > 1099 Contractor Forms > Create and File 1099/1096 Forms to create, download, and post your 1099 forms. On the page, we have a video to show you the process in action to help you get familiar with the steps listed below.

Step 1: Create 1099 Forms

- Ensure you have updated your contractor and vendor information and payments. You can also read Before You Create 1099s to make creating and filing your process seamless and stress-free.

- Verify all contractor information is correct before proceeding.

- Select the tax year from the dropdown menu at the top of the page.

- Click the Create 1099s button at the bottom of the page.

- The system will generate your 1099 forms.

- If you have many forms, you may receive an email notification when the process is complete (usually within moments).

- The date and time of the last creation will appear at the top of the page for reference.

Step 2: View 1099 Forms

Once 1099s are created, you can view them by downloading them. Here’s how:

Option 1: Use the “Download 1099 Forms” Box

- Click Download 1099 forms in the box labeled Distribute 1099 Forms.

- Choose to download either:

- 1099 Forms for individual contractors.

- Form 1096, which summarizes your 1099 submissions.

Option 2: Use the Contractor 1099 Activity List

- In the Contractor Activity List, check the box next to a specific contractor’s name or select all contractors using the checkbox at the top of the list.

- Click Download at the top of the table.

- A PDF will be downloaded to your computer for review.

For Printing 1099 Forms, check out our help article “How to Print 1099 Forms.”

Step 3: Make Updates Before Filing

Vendor Payments and 1099 Reporting

💡 If your vendor payment totals do not match your 1099 exactly, it could be because some payments were made by credit card. Payments made via credit card are not included in 1099 totals. For more details, read our help article: Recording a Vendor Payment Made by Credit Card.

If you need to update payment information:

- Make necessary updates. Here are some handy links to help articles:

In Payroll:

In Accounting:

- After making changes, return to Reports > 1099 Contractor Forms and repeat the “Create 1099 Forms” process.

- Verify the updated information before proceeding to file and post the forms.

💡 Did you choose the wrong 1099 Type? Use our handy Update 1099 Type tool to correct it. Read more on our help article, “How to Correct a 1099 Type.”

Step 4: Choose a Filing Method and Post to Contractor Portals

Click the “Get Started” button in the “File and Post 1099s” tile to select your filing method:

Option 1: Let Patriot E-File for You

Patriot will handle your filings to the IRS and states that participate in the Combined Federal/State Filing program and accept an e-file without additional paper forms needed. The software will flag all states needing a paper form for filing. To have us e-file on your behalf:

- Select Let us e-file for you.

- E-filing is included at no additional cost for Full Service Payroll customers.

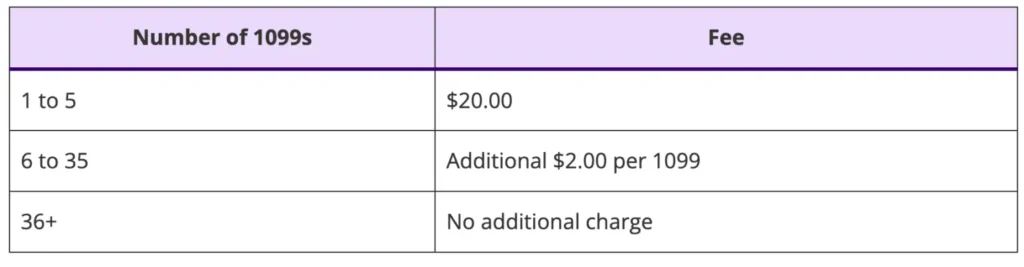

- Accounting and Basic Payroll customers will see the cost displayed before proceeding and agree to the pricing before proceeding.

Follow these steps:

- Confirm contractor and state information on the Combined Federal/State Filing screen.

- Change the state on this screen if needed using the dropdown.

- Review any states flagged as “E-File Not Supported” (e.g., Oregon, Pennsylvania) in which you will need to paper file 1099 forms outside of the software.

- Review contractor 1099 details on the Review & E-File page.

- Check the certification box (“I agree that all information provided is accurate to the best of my knowledge.”).

- Click Finish and Post 1099s. A confirmation message will appear once the forms are submitted and digital 1099s will be posted to the contractor portals.

- After filing, return to the Create and File 1099 Forms page to track the progress:

- Pending: Filing is in progress.

- Completed: Forms have been successfully filed.

- Print and distribute paper 1099 and 1096 forms as needed to

- Contractors who did not consent to a digital 1099.

- Mail to states flagged in the software a paper filing is needed.

Read our help articles for more information:

⚠️ Submit your 1099s for e-filing 2-3 business days before the actual due date to ensure timely filing!

The e-filing window is open through April 15, however, If you choose to e-file after the IRS deadline, you will be responsible for any late penalties.

Option 2: File Yourself Outside the Software

- Select File Yourself Outside the Software.

- Review all 1099 details

- Confirm accuracy by checking the certification box.

- Click the “Finalize and Post 1099s” to finalize your 1099s and post to the contractor portal.

- Download your 1099 and 1096 forms to:

- File with the IRS

- File with states flagged by the software that require paper 1099 filings.

- Distribute paper forms to contractors who did not consent to digital delivery.

Read our help article for more information, “How to Print 1099 and 1096 Forms.”

Will Patriot mail 1099s to Contractors and Vendors for me?

Patriot does not mail 1099s to contractors. It is your responsibility to ensure that 1099s are received by contractors.

Updates Needed after Finalizing and Posting 1099s

Follow the instructions for your scenario:

1. When you need to add payments to a contractor

- You can create additional payments and create a “modified 1099” to the contractor portal. A modified 1099 will only have the additional payments added since the original filing.

- When adding additional payments to a contractor’s 1099, the contractor must use both 1099s for their records and total them when filing their taxes.

- If your first method of filing to the IRS was e-filing, you can send another e-file to the IRS (and state if combined filing is supported) through Patriot.

- Update the contractor payments

- Repeat the process of creating and filing 1099s using your original filing method.

- The software resets each time and will charge based on the number of filings you have with each e-filing.

2. When you need to add another contractor and payments

- You can add additional contractors and their payments, post 1099s, and file/e-file again.

- Add the contractor to the software.

- Update the contractor payments

- Repeat the process of creating and filing 1099 in your original filing method.

- The software resets each time and will charge based on the number of filings you have with each e-filing.

3. When you need to remove payments from a contractor:

- You CANNOT remove 1099 payments from a contractor after you have filed.

- You must issue a corrected paper Form 1099 to the contractor and file outside of Patriot to the IRS using the original method you filed with (electronic, or paper.)

- Patriot does not support e-filing corrected 1099s at this time. We apologize for the inconvenience. Read the IRS help article on e-filing through IRIS.

4. When you need to update the contractor’s FEIN or SSN information:

- You must issue a corrected Form 1099 to the contractor and file outside of Patriot to the IRS using the original method you filed with (electronic, or paper.)

- Patriot does not support e-filing corrected 1099s at this time. We apologize for the inconvenience.

Check out the IRS help article on e-filing through IRIS. Also see our articles “The Ins and Outs of E-Filing 1099s With the IRS,” and “How to Issue a Corrected 1099 (MISC and NEC),” for more information.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.