Payroll experts and accountants: This one is for you. We are thrilled to introduce our latest feature, “Taxability by Money Type,” designed to address special money type taxability issues with unparalleled flexibility. This feature allows you to easily manage unique tax considerations, such as clergy housing, by tailoring specific situations as needed.

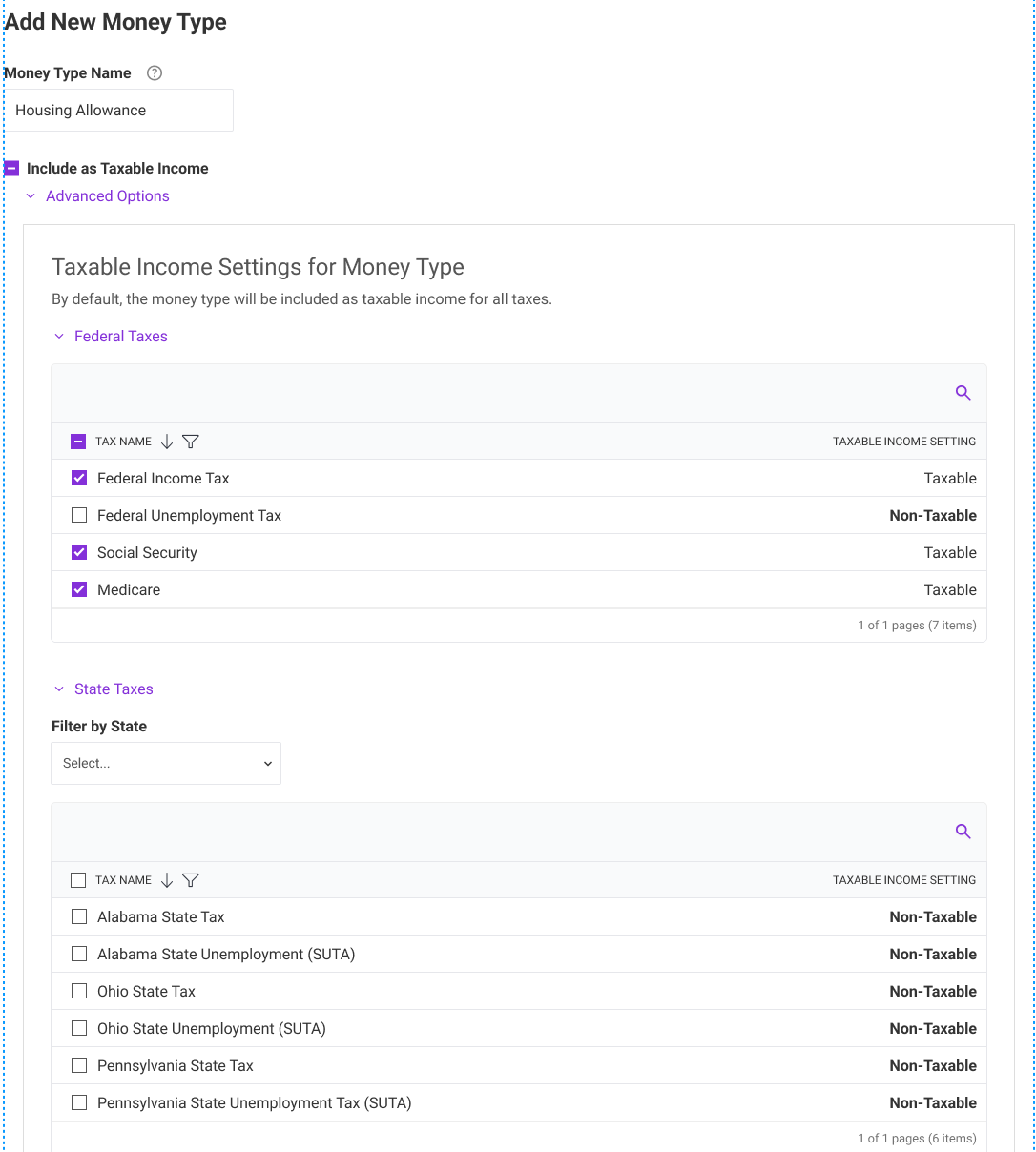

Here’s how it works: When you create a new taxable money type, we’ve added advanced options to select or deselect specific income taxes that apply to the employee’s special tax scenario. You’ll experience a streamlined approach to managing special taxability issues like never before. There is no need to call our US-based support team for quarterly or end-of-the-year payroll edits. It’s a win-win!

Here’s a friendly tip, folks: before diving into these advanced features, make sure to consult your accountant. Messing with income taxes haphazardly can cook up a whole lot of tax trouble – and that’s a recipe nobody wants!”

To learn more about this feature and how to implement it, check out our help article “How to Set Up Money Types.“