Will Patriot File My Company’s Taxes and W-2s This Year?

In this article

Full Service Payroll: What Patriot Handles

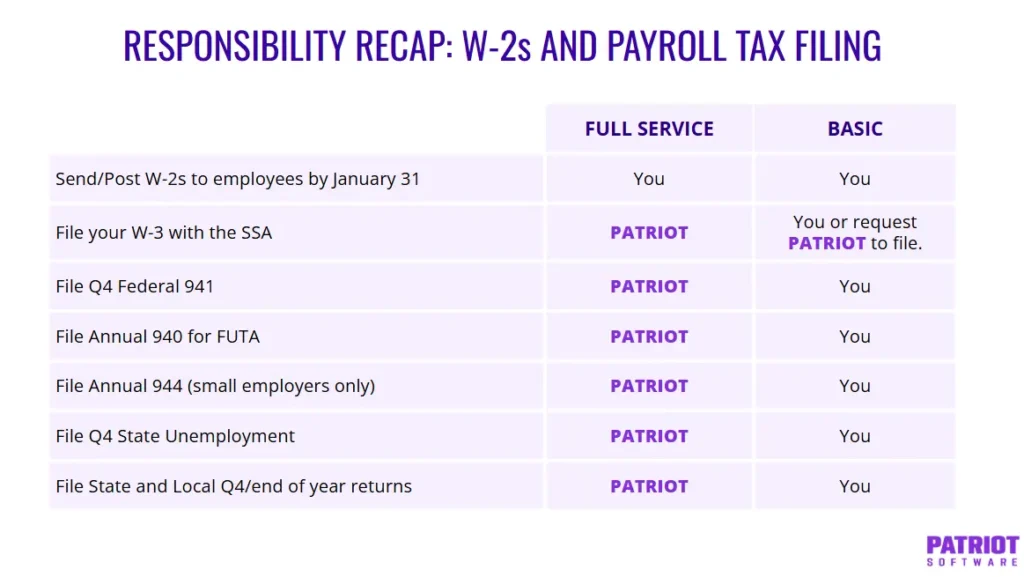

If you’re a Full Service Payroll customer and have completed your tax filing setup Patriot handles your federal, state, and, if applicable, local taxes. This includes deposits and filing taxes at the end of each quarter and year-end.

You can find all of your company tax filings completed by Patriot by going to Reports > Tax Filings > Company Tax Filings.

W-2 Forms

- You’ll need to generate W-2s in your software by going to Reports > Payroll Tax Reports > W-2 Forms. For step-by-step guidance, see the help article How to Download and Print W-2 Forms.

- Patriot will file W-2s to the SSA

- Patriot will file year-end W-2 reconciliation filings to any states or localities that require them.

- W-2 Mailing: Patriot does NOT mail W-2s to your employees.

- You will need to download and distribute your W-2s to employees, either by printing and distributing them via mail or hand delivery, or electronically by posting in the employee portal, (read Posting Electronic W-2s in Patriot’s Employee Portal for instructions.)

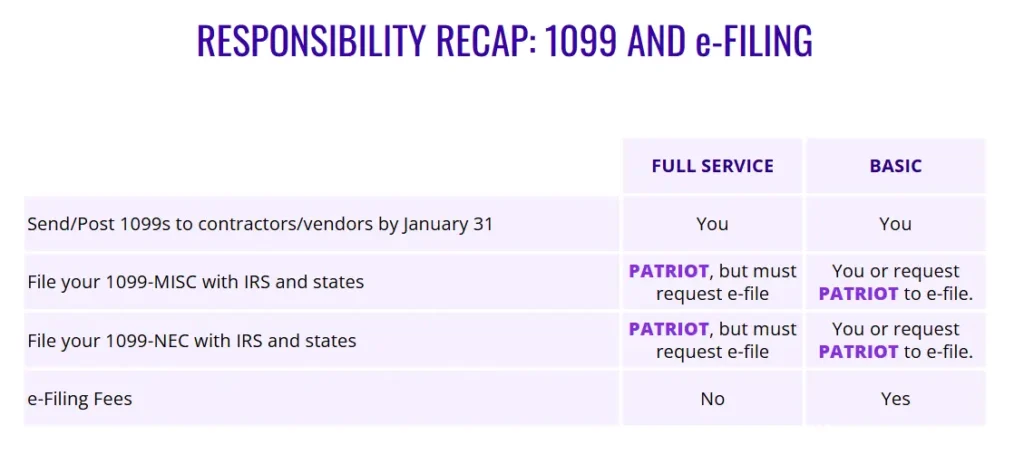

1099 Forms

- Patriot file 1099s to the IRS and states that participate in the combined federal state filing.

- You will need to file your 1099s for states that don’t participate in the combined filing or those who do participate but still require a paper filing. The software will notify you of these to make you aware.

- You’ll need to create 1099s and initiate the filing request.

- 1099 Mailing: Patriot does NOT mail 1099’s to your contractors.

- You’ll need to print 1099s paper 1099s or distribute them to your contractors by posting to the contractor portal.

Basic Payroll Responsibilities at Year-end

If you’re a Basic Payroll customer, you can request Patriot to file your W-2s for you. Otherwise, you’ll need to file your W-2s (and any other year-end tax forms) yourself. For more information, check out the help article Basic Payroll: Filing Your W-3.

W-2 Forms

- You’ll need to generate W-2s in your software by going to Reports > Payroll Tax Reports > W-2 Forms. For step-by-step guidance, see the help article How to Download and Print W-2 Forms.

- W-2 Mailing: Patriot does NOT mail W-2s to your employees. You will need to download and print your W-2s to employees, or electronically by posting in the employee portal. Please see “Posting Electronic W-2s in Patriot’s Employee Portal” for instructions.

- You can request Patriot file your W-2s to the IRS and any state that participates in the combined federal/state tax filing program for a small fee. See our help article, “Basic Payroll: Filing Your W-3,” for more info.

1099 Forms for Contractors

- You can request Patriot file your 1099s to the IRS and states that participate in the combined federal state filing electronically for a small fee.

- You will need to file your 1099s for states that don’t participate in the combined filing or those who do participate but still require a paper filing. The software will notify you of these to make you aware.

- You’ll need to create 1099s and initiate the filing request.

- 1099 Mailing: Patriot does NOT mail 1099’s to your contractors. You’ll need to print 1099s paper 1099s or distribute them to your contractors by posting to the contractor portal.

Recap of Filing Responsibilities

You will need to file your 1099s for states that don’t participate in the combined filing or those who do participate but still require a paper filing. The software will notify you of these to make you aware.

FAQ

You can find filing confirmation numbers by navigating to Reports > Payroll Tax Reports > Tax Filings.

Log in to your software account

Click the “My Products” link found under your company ID number on the top left.

If you’ve completed your tax filing setup, Patriot will have started collecting payroll taxes with each payroll you run.

°You can view your setup status for full service payroll under “My Products” located beneath your company name and PS Id number.

°If your setup isn’t complete, you’ll also see a reminder when you log in, a reminder on the payroll overview page, and again on step 2 of running payroll.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.