What is The Work Number® from Equifax?

Patriot has partnered with Equifax to offer free automated income and employment verification services benefiting you and your company’s employees.

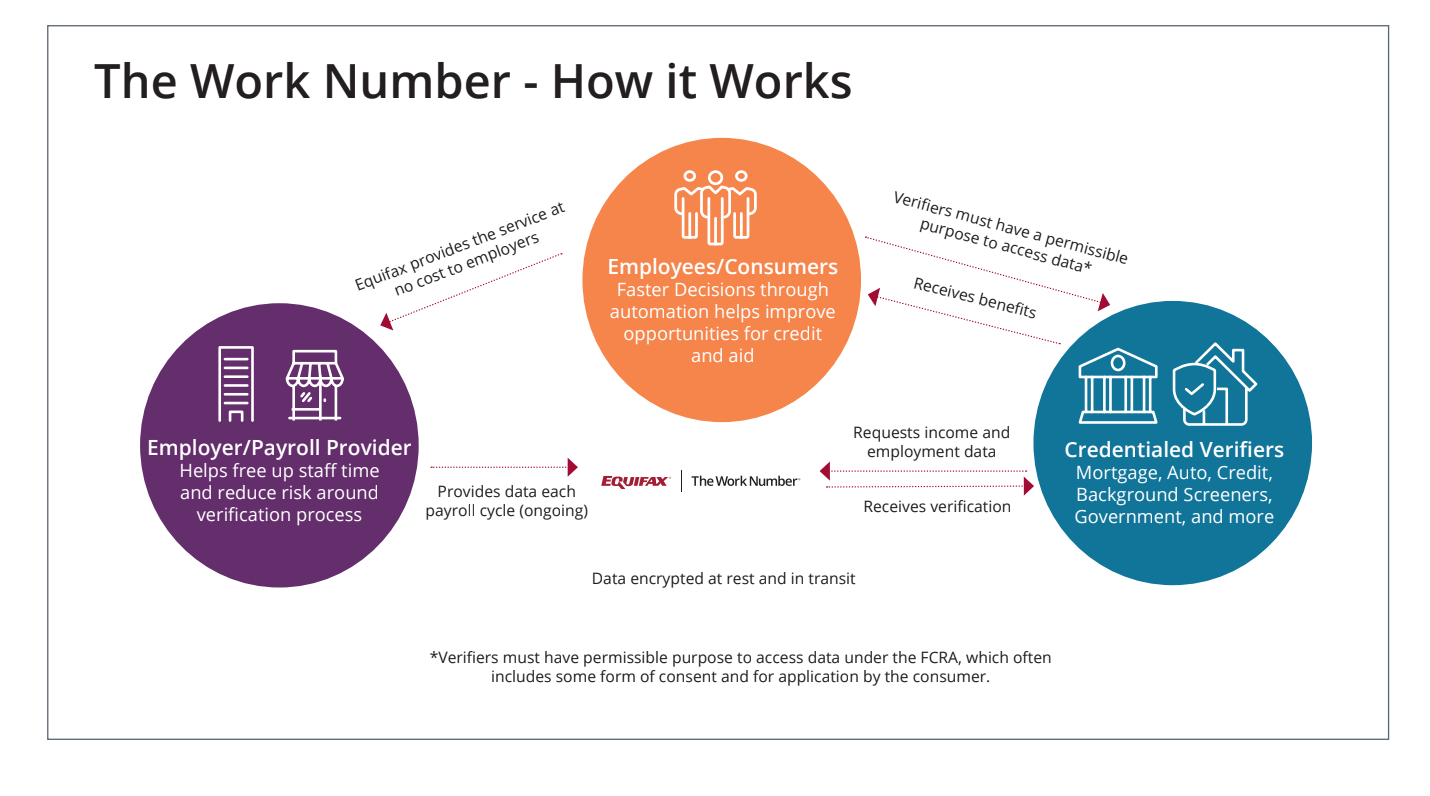

What is The Work Number® and how does it work?

The Work Number® from Equifax is an automated Income and Employment Verification Service that provides proof of income and employment for employees to help them qualify for loans, credit, and public aid.

It is used by lenders, property managers, creditors, social service agencies, and other requestors, collectively called “Verifiers”, who need to confirm individuals’ employment status and often income as well.

This service helps fulfill these requests for you by automating payroll information through Patriot Software for a higher degree of data accuracy.

The Work Number® is the nation’s largest database of employment information with over *2.9M employer contributors from businesses of all sizes and industries.

Over *65,000 credentialed Verifier organizations trust the service for its automated and direct payroll information.

Employers don’t pay Equifax or Patriot for this service — typically Verifiers pay a fee for each verification request.

What do employers need to do to get the service?

The Work Number® is an added-value offering from Patriot through Equifax. Companies will default to an “opt-in” status but may choose to opt out. Please read “How to Opt Out of The Work Number®” for more information.

What should employers do if they get a request for income and employment information from a lender or government agency?

If employers receive a call or an email from a bank, other lender, or creditor that is processing a loan or credit for employees or from a government agency confirming income to provide aid to employees, they should direct them to www.theworknumber.com.

Many lenders and government agencies already utilize The Work Number® today, and they often check the service before contacting the employer. However, they may call an employer first because they are not aware that the employer is now a part of the service or they have not used the service before. Instructions can be accessed at www.theworknumber.com.

What are the benefits for employees?

Employees can receive improved opportunities for loans, credit, and government benefits because lenders and government agencies are able to make faster decisions with automated employment information.

Additionally, outsourcing the proof of income and employment to The Work Number® provides greater privacy to employees by removing the employer from personal transactions.

Typically, employees provide consent for organizations to obtain their income information for a loan, credit, or benefit.

Do employees consent to their information being provided to Verifiers?

Verifiers obtain consent from employees for their employment and income information typically during the application process for access to a loan, lease, credit, or government benefit. If a Verifier requests an employee’s income information, the Verifier is required to certify to The Work Number® that they have a record of the employee’s consent specific to its request for income information. Verifiers and all transactions are subject to planned and random audits to help ensure proper usage of the data received.

Who can get information from The Work Number®?

Information from The Work Number® is deemed a consumer report under the federal Fair Credit Reporting Act (FCRA). Therefore, Verifiers must have a permissible purpose.

Each Verifier is vetted and approved by The Work Number® before they can access any data. In short, The Work Number knows who is requesting access to employee data, and only those with an FCRA-permissible purpose may access it. For income information requests, Verifiers must additionally certify they have a record of the employee’s consent.

Who is considered a Verifier?

Typically lending institutions, property managers, government agencies, or other organizations that have a permissible purpose, under the Fair Credit Reporting Act (FCRA), to confirm employment and income information about a consumer may be considered a Verifier.

What information does a Verifier get from The Work Number®?

The Work Number can provide different types of verifications for different purposes. For example, if a consumer is seeking a new job, the hiring employer might want to verify past employment, while a mortgage lender will typically need to verify income in detail before approving a loan. If a consumer applies for public aid from a social service agency, they too will typically need a verification of income.

What best practices does Equifax follow in data security?

Equifax is committed to providing clients with digital solutions that are not only aligned with best practices in security and privacy standards but are also easy to use and accessible on demand. Equifax holds ISO 27001, SOC1, and SOC2 certifications. Applicable systems are FISMA Moderate and/or PCI-DSS compliant. Equifax deploys advanced data encryption techniques, and maintains a strong vulnerability management program, routine physical and digital scanning/monitoring, sophisticated web application firewalls, and stringent user identity validation, typically through multi-factor authentication. Through CloudControl, the company’s first-of-its-kind supply chain visibility platform, customers have a real-time view into the security of the Equifax Cloud products and services they use.

The Work Number has an uncompromising stance on data security, leveraging multiple layers of protection – verifier credentialing, multi-factor authentication, on-site inspections, and auditing of data use. Protecting the data entrusted to them is their top priority.

The Work Number helps reduce your potential risk in responding to fraudulent requests, to providing more information than is permissible to a lender or government agency or making an error in the information provided.

Are there any costs for employers to outsource the service?

Participating employers receive The Work Number® service at no cost through Patriot.

Who pays for the service?

Lenders, creditors, and government agencies are willing to pay a nominal fee for their requests because they can access direct payroll information that they need to process a loan, mortgage, or aid instantly – 24/7. Verifiers pay for the speed and convenience that The Work Number offers over traditional methods of manually reaching out to employers.

For information on how to opt out of this value-added service, please read, “How to Opt Out of The Work Number®.”

*Equifax reported data 2023

Copyright © 2024, Equifax Inc., Atlanta, Georgia. All rights reserved. Equifax is a registered

trademark of Equifax Inc.

The Work Number ® is a registered trademark of Equifax Workforce Solutions LLC, a wholly owned subsidiary of Equifax Inc.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.