How to Tax Supplemental Pay

In this article:

Background

Supplemental pay is any money that is not tied to an employee’s regular rate, such as a bonus or commission. When running a payroll, you have the option to tax supplemental pay in one of two ways:

- At the same federal and state tax frequency as the employee’s normal pay (i.e. weekly, biweekly, etc.)

- At the IRS supplemental federal and state tax rates

IRS Publication 15 explains the types of earnings that should be taxed at the supplemental tax rate. The current federal supplemental tax rate is 22%. Patriot Software will calculate the correct federal and state supplemental tax rate automatically.

Read our blog article: What You Need to Know About Supplemental Wages and Supplemental Tax Rates by State and When to Use Them for more info.

How to Tax Money at a Supplemental Rate

- Go to Payroll > Run a New Payroll.

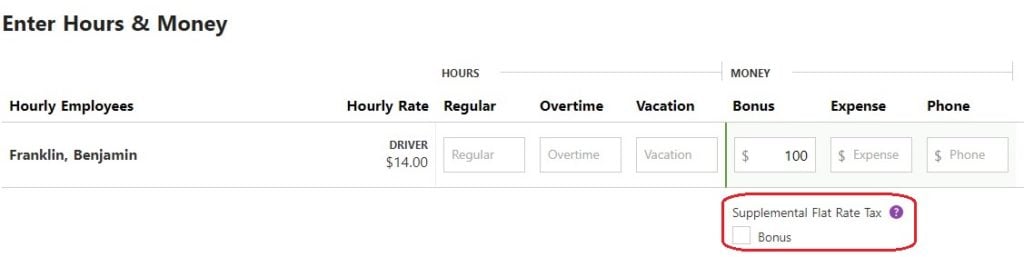

- For the employee you want to pay, enter the dollar amount in the appropriate money column.

- Check the box for “Supplemental Flat Rate Tax.“

- Proceed with payroll.

How to Change the Tax Pay Frequency of Supplemental Pay

To change the tax frequency of the supplemental pay to a different frequency than normal pay (i.e. a bonus payment, where the tax calculation is based on a monthly or quarterly frequency) you’ll need to change the employee pay schedule to the desired frequency. Only change the frequency when you are running the bonus or commission check as an off-cycle payroll and not with normal salary or hourly payroll.

- Change the employee’s pay schedule.

- Run an off cycle payroll to pay only the supplemental money.

- Change the employee’s pay pay schedule back to the original frequency after you run payroll.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.