Which 1099 Type Do I Choose?

When paying your vendor bills or updating vendor payment history in Patriot Software, you need to choose a 1099 Type for each payment. There are a number of 1099 money types you can report payments as.

A 1099 Type determines which Form 1099 (Form 1099-MISC or Form 1099-NEC) money will be reported on.

Report nonemployee compensation on Form 1099-NEC. Nonemployee compensation is the most common 1099 type, as it is the amount you pay independent contractors. All other 1099 types are reported on Form 1099-MISC in the appropriate boxes.

Form 1099-MISC types:

- Rents

- Real estate rentals paid for office space

- Machine rentals (e.g., renting a bulldozer to level

your parking lot) - Pasture rentals (e.g., farmers paying for the use of

grazing land) - Rental assistance payments made to owners of housing projects

- Coin-operated amusements (e.g., video games, pinball machines, jukeboxes, pool tables, slot machines, etc.)

- Royalties

- Gross royalty payments (or similar amounts) of $10 or more

- Royalties from oil, gas, or other mineral properties before reduction for severance and other taxes that may have been withheld and paid

- Royalty payments from intangible property such as patents, copyrights, trade names, and trademarks

- Gross royalties (before reduction for fees, commissions, or expenses) paid by a publisher directly to an author or literary agent, unless the agent is a corporation

- Other income

- Enter other income of $600 or more required to be reported

on Form 1099-MISC that is not reportable in one of the other

boxes on the form - Prizes and awards that are not for services performed (e.g., merchandise won on a game show)

- Enter other income of $600 or more required to be reported

- Fishing boat proceeds

- Individual’s share of all proceeds from the sale of a catch or the fair market value (FMV) of a distribution in kind to each crew member of fishing boats with normally fewer than 10 crew members

- Report cash payments of up to $100 per trip that are contingent on a minimum catch and are paid solely for additional duties (such as mate, engineer, or cook) for which additional cash payments are traditional in the industry

- Medical and health care payments

- Payments of $600 or more made in the course of your trade or business to each physician or other supplier or provider of medical or health care services

- Payments made by medical and health care insurers under health, accident, and sickness insurance programs

- Substitute payments in lieu of dividends or interest

- Aggregate payments of at least $10 of substitute payments received by a broker for a customer in lieu of dividends or tax-exempt interest as a result of a loan of a customer’s securities

- Crop insurance proceeds

- Proceeds of $600 or more paid to farmers by insurance companies, unless the farmer has informed the insurance company that expenses have been capitalized under section 278, 263A, or 447

- Excess golden parachute payments

- Amount over the base amount (the average annual compensation for services includible in the individual’s gross income over the most recent 5 tax years)

- Gross proceeds paid to an attorney

- Gross proceeds of $600 or more paid to an attorney in connection with legal services (regardless of whether the services are performed for the payer)

- Are made to an attorney in the course of your trade or business in connection with legal services, but not for the attorney’s services, for example, as in a settlement agreement

- Generally, you are not required to report the claimant’s attorney’s fees

- Fish purchased for resale

- If you are in the trade or business of purchasing fish for resale, you must report cash payments of $600 or more to any person engaged in the business of catching fish.

- Non 1099 payment

- Payments that you don’t want include on a 1099

- Reimbursement (e.g., supplies)

- Payments made to a vendor by credit card. Please read, “Recording a Vendor Payment Made by Credit Card,” for more information.

Form 1099-NEC type:

- Nonemployee compensation

- Payments made to contractors, including fees, commissions, prizes, awards, and other forms of compensation for services performed for your trade or business by an individual who is not your employee

- Services performed by someone who is not your employee

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish

- Payments to an attorney (Attorneys’ fees of

$600 or more paid in the course of your trade or business)

For more information about 1099 types, check out the IRS’s Instructions for Forms 1099-MISC and 1099-NEC.

The choices in the 1099 Type dropdown list on the “Enter & Pay Bills” page under “Payables” correspond with the boxes on Forms 1099-MISC and 1099-NEC.

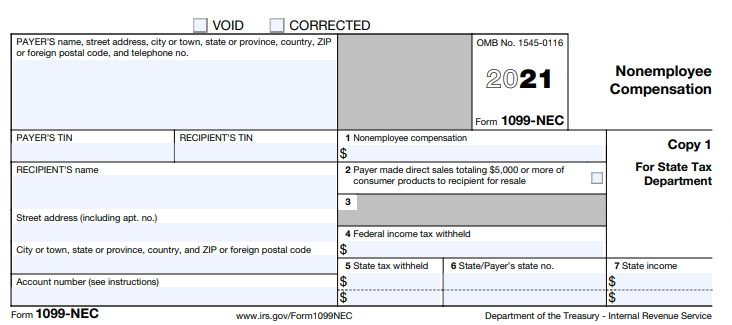

Here is a sample Form 1099-NEC showing how nonemployee compensation gets reported:

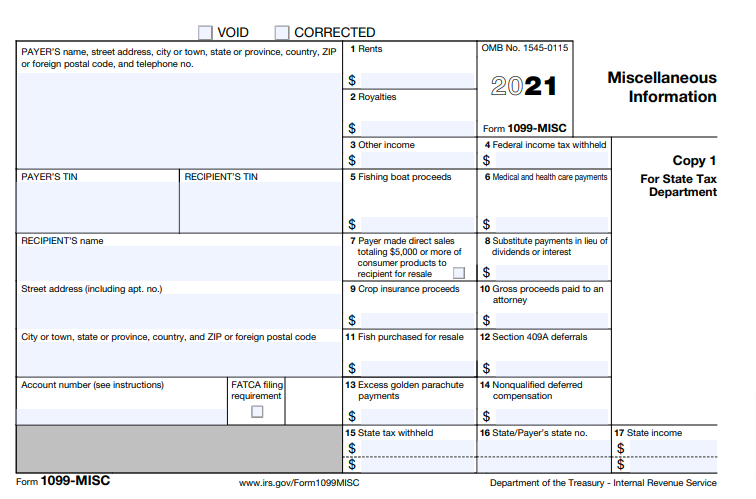

Here is a sample Form 1099-MISC showing how all other 1099 types get reported:

In some cases, you may need to report nonemployee compensation and other 1099 types. In those cases, you need to use both Form 1099-NEC and 1099-MISC.

For details on which form and box to select, see the IRS Instructions for Forms 1099-MISC and 1099-NEC.

For more information on the 1099-NEC, please see our blog article “Make Way for the Revived Form 1099-NEC in 2020.”

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.