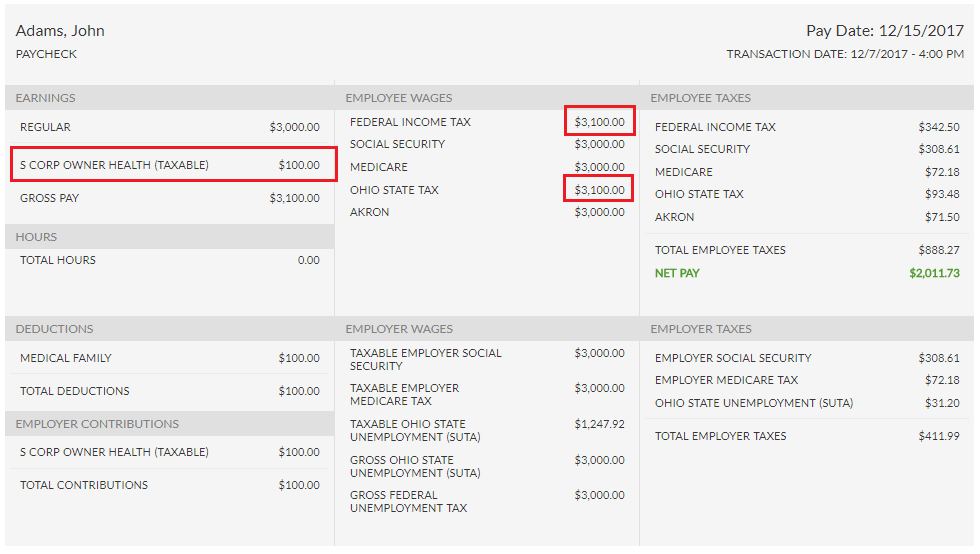

Employees who are greater than 2% shareholders of S Corporations must report company-paid health insurance premiums as taxable wages for federal and state income tax purposes. Patriot now offers two ways to update shareholder taxable wages:

Option1: Set up a taxable contribution to happen every payroll. For more details, see How To Add S Corp Health Insurance Premiums To Each Payroll.

Option 2: Add a one-time lump sum of company-paid premiums for the year. For more details, see Adding a One-Time S Corp Shareholder Health Premium Update.