Covid-19 has left its mark not only on small business owners but also on their employees. Now, employers can opt-in to defer employee Social Security taxes for qualified employees making less than $4,000 biweekly (or equivalent amounts for other pay schedules) for payrolls until December 31, 2020.

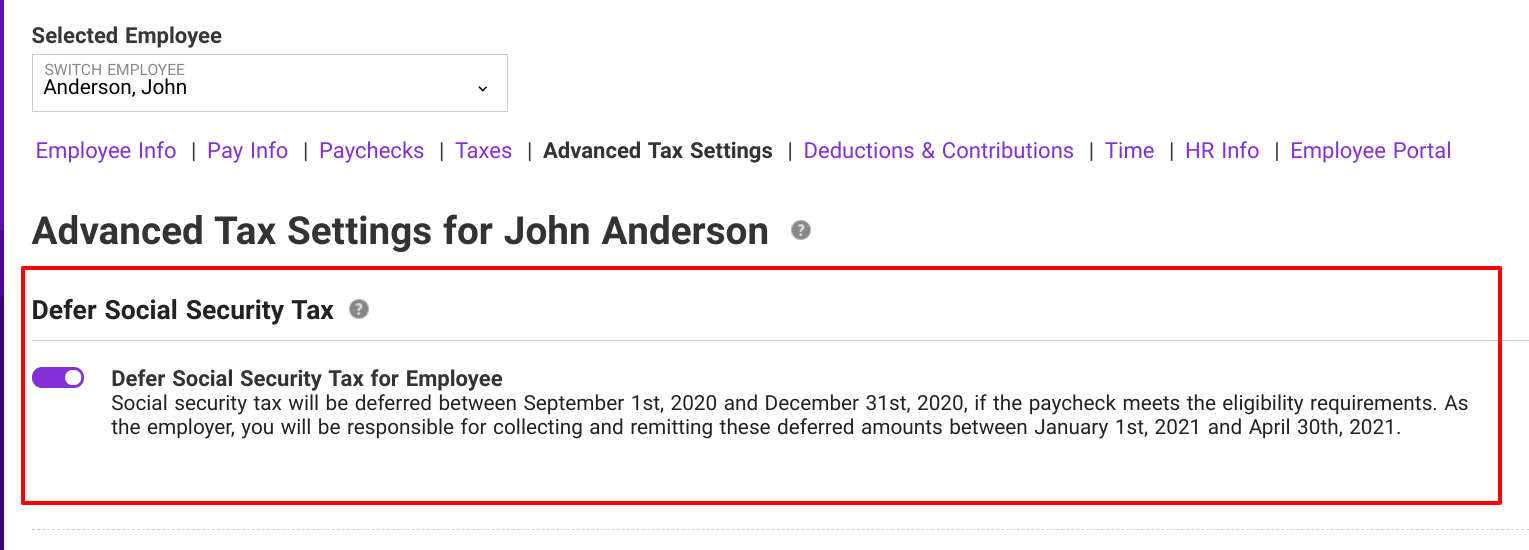

Employers can choose to turn on the employee Social Security deferrals for all or just selected employees.