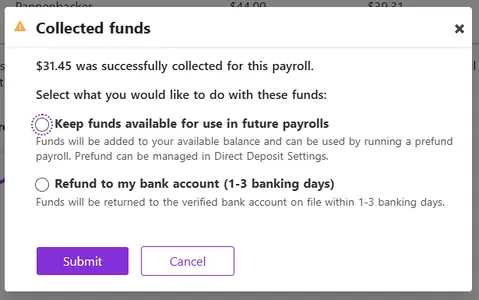

Now, when you void a payroll with direct deposit, you get to decide how the collected funds are handled.

In the past, voiding a payroll meant any collected funds would be returned to your bank account. While this seemed straightforward, it often created unnecessary delays, especially if you needed to rerun the payroll. Now, instead of waiting for funds to process back into your account and starting a new collection, we’ll give you the option to use those funds to prefund a future payroll.

This adjustment gives you the flexibility to quickly rerun payroll without worrying about additional collections or extra steps. It’s all about keeping things moving when time is of the essence.

With this newest feature, you’ll experience:

- Faster Payroll Resolutions

Correcting payroll is no longer a race against the clock. With funds ready to use, you can fix errors and rerun payroll immediately. - Fewer Delays for Employee Pay

Employees rely on timely paychecks. This new approach ensures they get paid without disruption, even if corrections are needed. - Streamlined Cash Flow Management

Keeping refunded funds in your prefund balance means less back-and-forth with your bank and fewer interruptions to your business’s financial flow. - Reduced Stress and Hassle

No need to worry about additional collections or juggling accounts. Everything stays organized and accessible in your prefund balance.

This update isn’t just about improving the process—it’s about empowering you. By giving you immediate access to successfully collected funds, we’re helping you stay in control, even when things don’t go as planned.

Learn more by reading our help article, “ Voiding Direct Deposit and Refund Options”