Workers’ Comp Made Simple

With Patriot Payroll’s® free workers’ comp integration

Protect Your Employees … and Your Time

Workers’ comp coverage that doesn’t turn into a to-do list

Employees covered, every payday

Workers' comp helps pay for medical care and lost wages if someone gets hurt on the job.

Workers’ comp codes and coverage are set up automatically

No extra forms, no digging through classifications. Your policy connects directly with payroll.

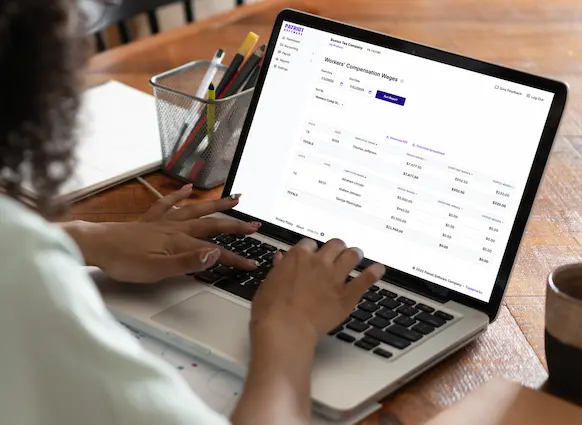

Payroll data is sent to the carrier for you

Forget manual wage reporting. Patriot shares the info NEXT to keep you out of spreadsheets and audit ready.

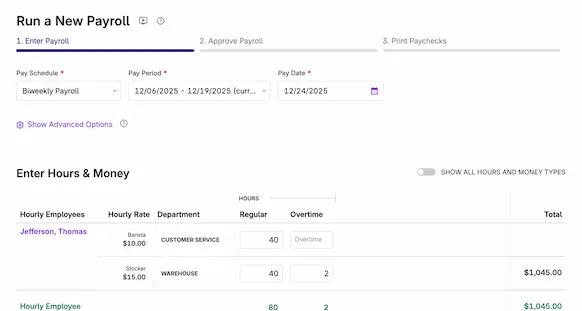

Pay-as-you-go premiums, calculated and paid per payroll

No separate invoicing or estimating—just accurate payments based on actual wages.

Workers’ Comp With All of the Compliance

And none of the fuss

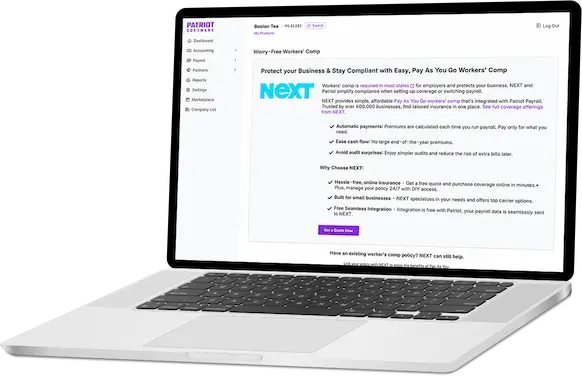

Most states require that employers get workers’ comp insurance. Patriot offers free workers’ comp integration with NEXT Insurance to simplify this process.

No upfront payments, or lump sums

Pay each payroll based on your payroll data, and avoid end-of-year large bills.

Multiple carrier choices

NEXT works with multiple private insurance carriers.

Free integration

Our free integration with NEXT keeps you compliant without extra steps or fees.

...[Patriot does] EVERYTHING! All of the government taxes, workers’ compensation—it is all taken care of accurately and on time.”

—Lynn, Trustpilot

Patriot Payroll + NEXT Insurance

How does it work?

When you use Patriot’s online payroll, getting started with our free workers’ comp integration is simple.

- Get a quote with NEXT and sign up for a workers’ comp policy

- Your policy is automatically set up in Patriot’s payroll

- Each time you run payroll, Patriot will send your payroll data to NEXT

- NEXT will calculate your premium and withdraw from your bank account

*Already have an existing PAYG policy with NEXT? You can easily transfer it to Patriot Software.

More Payroll Features to Simplify Your Life

Free USA-based Support

Enjoy the best payroll support around (we aren’t biased at all). Our free, USA-based support is available via phone, email, or chat.

All Pay Frequencies

Pay employees weekly, biweekly, semi-monthly, monthly, quarterly, semi-annually, and annually. And, you can run one-off payrolls effortlessly.

Auto Payroll

Cross payroll off your list. Set it up once and our automated payroll handles the rest.

Contractors in Payroll

Pay 1099 independent contractors with direct deposit or by check.

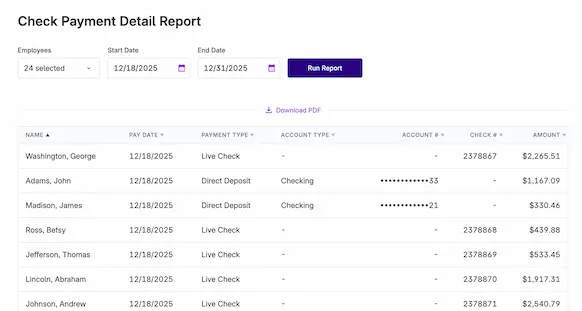

Comprehensive Reports

Review employee information, year-to-date payroll, tax liabilities, and more.

Unlimited Payrolls

Pay your employees as often as you want for one low monthly price.

Patriot Beats the Competition on Price, Value, & Support See how users rate Patriot against competitors.

Workers’ Comp FAQs

Patriot Software offers free workers’ compensation integration with our partner, NEXT Insurance.

As a Patriot payroll software customer, you can pay your workers’ compensation insurance premiums in smaller amounts based on each payroll instead of an annual lump sum.

With Patriot Software’s workers’ comp integration, NEXT will collect your premiums each time you run a payroll.

The integration between Patriot’s payroll software and NEXT’s workers’ compensation is free. Workers’ compensation premiums amounts vary depending on your industry and number of employees. You can request a quote directly from NEXT Insurance in your payroll account.

Workers’ compensation through NEXT is available in states that allow purchasing workers’ comp insurance from a private carrier.

Workers’ compensation through NEXT is not available in North Dakota, Ohio, Washington, and Wyoming, as these states require that you purchase your workers’ compensation insurance directly from the state.

Yes! If you are an existing client of NEXT Insurance with a workers’ comp policy, you can transfer your existing policy to Patriot. Learn more here. Learn more about our integration with NEXT Insurance here.

NEXT Insurance does offer other types of business insurance, such as general and professional liability coverage.