Using Blended Overtime

Background

The Fair Labor Standards Act (FLSA) is the law that oversees wages paid to employees, including overtime wages. When you have employees who are being paid two or more different pay rates, you will need to determine whether your business is required to use blended overtime, or sometimes called weighted overtime.

This means instead of calculating overtime separately for each pay rate, you will add the earnings for all pay rates together to get the average pay rate, and then calculate overtime.

For further guidance on how overtime pay should be calculated, see the following resources:

Department of Labor Fact Sheet #23: Overtime Pay Requirements of the FLSA

Also for an example, see our blog article Calculating Weighted Overtime for an Employee With Multiple Pay Rates.

Using Blended Overtime in Patriot Software

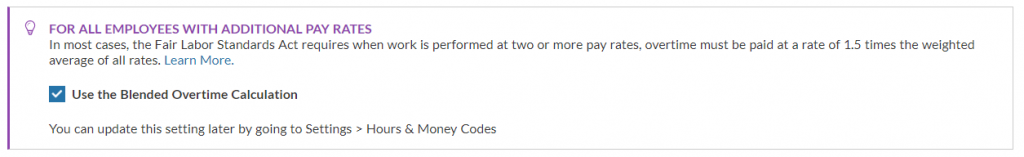

The first time you enter an additional pay rate for an employee, you will be prompted to confirm whether you want to use blended overtime when calculating overtime pay. This setting will apply to all employees.

You can also manage this setting under Settings > Hours & Money Types, underneath the Hours Type list.

Most businesses should keep this box checked to comply with FLSA regulations. There are some exceptions which would allow a business to calculate overtime differently, for example:

- Having an established agreement with the employee before any work is done to pay them overtime based on the regular rate of the position they have worked. In this case, uncheck the box and overtime will be calculated at 1.5 times each individual pay rate.

- Some employers choose to pay the overtime based on the higher regular rate to avoid any underpayments. In this case, you would need to pay all hours under the higher rate in the software.

When you use blended overtime when running a payroll in the software, the overtime dollars will be allocated proportionately to each pay rate and shown in the details on Payroll Step 2, employee pay stubs, and payroll reports.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.