Resolving a Tax Filing Issue

Background:

As a Full Service Payroll Customer, there may be times when our tax filing team is unable to file a tax return for you. This could be due to an invalid tax ID number or another issue that would require you to take action.

Here’s how to fix a tax filing issue:

- Click the notification icon in the software.

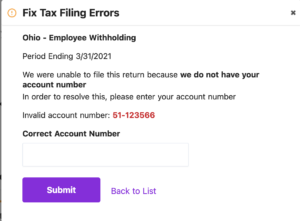

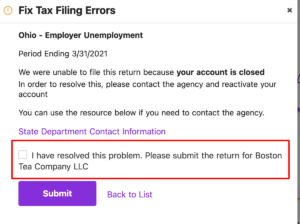

- A module will pop up displaying the type of tax filing and the period ending date of the issue.

- Click the “Fix Now” button.

- A message will appear with the tax filing error that occurred when Patriot attempted to file on your behalf.

- If an inaccurate EIN has been entered into the software, just enter the correct number in the EIN box. Then, click “Submit.”

- If you need to contact the government tax agency to resolve the issue, you can return later to indicate the issue has been resolved by clicking the checkbox reading “I have resolved this problem. Please submit the return for [your company name].”

- Once you submit, our tax team will be notified and will attempt to file your tax return again. You’ll be notified by email about the outcome of the resubmitted tax filing.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.