Partner Client Company Reports

Patriot has created several reports specifically for our Accountant Partners, so you can quickly see an overview of your client accounts. Note: users will only be able to view reports for the client accounts they have permission to access.

Go to Report > Advisors > Client Company Reports

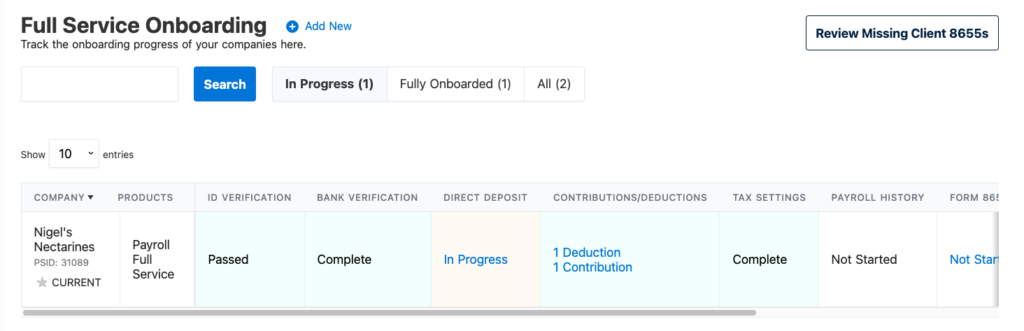

Full Service Onboarding

Patriot Partners and their staff can use the Full Service Onboarding Report to view each new full-service account’s onboarding step and its status.

- Click the client name to switch to their client account.

- Click any of the links in the onboarding report to go to the settings page if you have had the employee entered via an import, or back to where you left off in the wizard if you have manually entered the customer.

- You can search by the Patriot Software id number or company name in the search bar and clicking “Search.”

- Click the tabs at the top of the report to show the accounts “In Progress”, “Fully Onboarded” or display everyone by clicking “All.”

- Easily view full service accounts that are missing their IRS form 8655 by clicking the button at the top of the report, “Review Missing Client 8655s”

The report lists several important steps that must be completed to have your client successfully onboarded with the Full Service Payroll. Below are the columns with possible display statuses.

| COLUMN | DISPLAY STATUSES |

| Company | Company name and ID number |

| Products | All active products selected |

| ID Verification | Not Started Passed Failed |

| Bank Verification | Not Started Complete Pending Failed |

| Direct Deposit | Not Started Cancelled In Progress Pending Submitted Denied Verified Awaiting Penny Verification N/A (used when direct deposit not requested ) |

| Contributions/Deductions | Displays # of deductions Displays # of contributions |

| Tax Settings | Not Started In progress (used for state settings only) Complete |

| Payroll History | Not Started (used when no payroll history is added, or if you have indicated that you do NOT have payroll history. The latter will not allow a clickable link.) In Progress Complete |

| Form 8655 | Not Started Pending Receipt (Please upload this file) Processing Request Verification Failed – Please review Verified Pending Verification (File uploaded) Additional Permissions Required |

| State Forms | Not Started Complete Failed In Progress N/A (used if not required for state filing) |

| TPA | Not Started Complete Failed In Progress N/A (used when not required for state filing) |

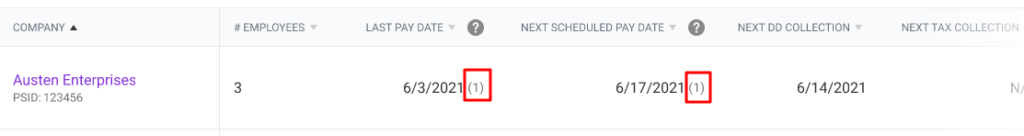

Payroll Info Report

This report displays all client payroll information at a glance. By default, only companies with active products will display. You can search by any of the fields displayed. To download the report, click the Download Spreadsheet link.

The Payroll Info report lists the following information for your client accounts:

- Company tax filing name – Click the company name to go to the client’s account

- Number of employees

- Last pay date* (the most recent payroll run for a date in the past)

- Next scheduled pay date* (the most recent approved payroll for a date in the future)

- Next direct deposit collection date

- Next tax collection date

- Pay frequency*

- Pay type*

*The number of employees included in this field is in the parentheses

Payroll Tax Settings Report

This report displays all client tax settings information at a glance. By default, only active companies display. You can search by any of the fields displayed. To download the report, click the Download Spreadsheet link.

The Payroll Tax Settings report displays the following information for clients:

- Company tax filing name – Click the company name to go to the client’s account

- Federal EIN (FEIN)

- Federal filer type

- Federal deposit frequency

- State

- SUTA tax rate

- SUTA tax effective date

Employee Payroll Report

The Employee Payroll report shows all employees paid. You can search by any of the fields displayed. To download the report, click the Download Spreadsheet link.

Enter the Start Date and End Date you wish to view. Then, click “Run Report.”

The Employee Payroll report displays the following information for employees paid in the selected period:

- Company tax filing name – Click the company name to go to the client’s account.

- Employee name

- Gross wages

- Employee tax

- Employer tax

- Net pay

- Deduction amount

- Contribution amount

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.