How to Tax Supplemental Pay

Supplemental pay is any money that is not tied to an employee’s regular rate, such as a bonus or commission. When running a payroll, you have the option to tax supplemental pay in one of two ways:

- at the same federal and state tax frequency as the employee’s normal pay frequency (i.e. weekly, biweekly, etc.), or

- at the IRS supplemental federal and state tax rates.

To add Money to be taxed at a supplemental rate:

1. Payroll > Run a New Payroll.

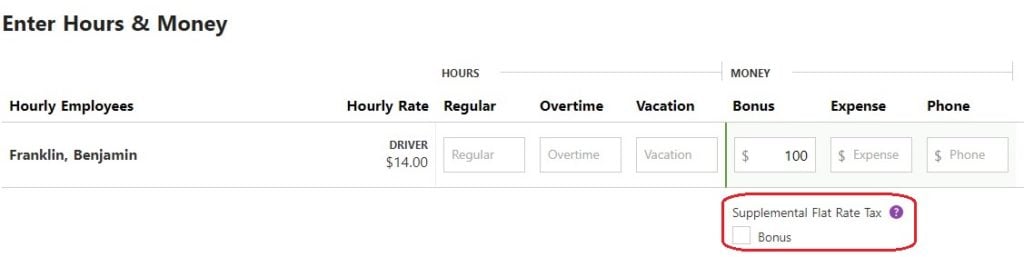

2. For the employee you want to pay, enter the dollar amount in the appropriate money column.

3. Check the box for “Supplemental Flat Rate Tax.”

Note: IRS Publication 15 explains the types of earnings that should be taxed at the supplemental tax rate. The current federal supplemental tax rate is 22%. Check with your state’s Department of Taxation to determine your state’s supplemental tax rate. Patriot Software will track and calculate the correct federal and state supplemental tax rate.

To change tax frequency of Supplemental Pay:

To change the tax frequency of the supplemental pay to a different frequency than the two options above (i.e. a bonus payment, where the tax calculation is based on a monthly or quarterly frequency):

1. Payroll > Employee List > choose the employee from the employee list.

2. Click the Pay Info link > Edit.

3. Change the employee’s pay frequency and click Save.

4. Run a separate payroll to pay only the supplemental money.

5. Change the employee’s pay frequency back to the original frequency after you run payroll.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.