How to Run a Net Zero Payroll

Background

As a Patriot Software Payroll customer, you may want to run a payroll where the net pay to the employee is zero. Reasons for this could be to designate an entire pay to be paid for income taxes or a 401(k) account. You may also want to run a net zero payroll to account for what the employee has already received as a gift, such as cash or a gift card. For more details, see How Do I Record Employee Gift Cards?

How to Run a Net Zero Payroll in Patriot Software

Step 1: Determine the amount of adjustment

You are going to start a payroll, but cancel the payroll on Step 2.

- Go to Payroll > Run a Payroll for the employee(s) on Step 1, and click “Next Step” to move to Step 2. You are not going to complete this payroll, but click “View Details” to see the normal net pay without any adjustments.

- Make a note of this net pay amount. You will need to make an adjustment to the employee’s record.

- Now you will cancel this payroll on Step 2.

Step 2: Adjust the employee’s record

Depending on your goal (withhold taxes or make a deduction), go to the employee’s record and make an adjustment.

Step 3: Run the net zero payroll

After you have made adjustments on the employee’s record, run the payroll and confirm the employee’s net pay is zero. Due to rounding issues, this may take a bit of trial and error. If your net pay is not exactly zero, you will need to cancel the payroll and go back to the employee record to make another adjustment.

Step 4: Adjust the employee’s record back to the original settings

Be sure to go back to the employee’s record when you are finished running the net zero payroll and remove the adjustment, to prevent from being included in future payrolls.

Example A: Withhold more income taxes for a $0 pay

If the employee needs to have more federal or state income tax deducted so their net pay is zero, you can enter a dollar amount of additional federal or state withholdings.

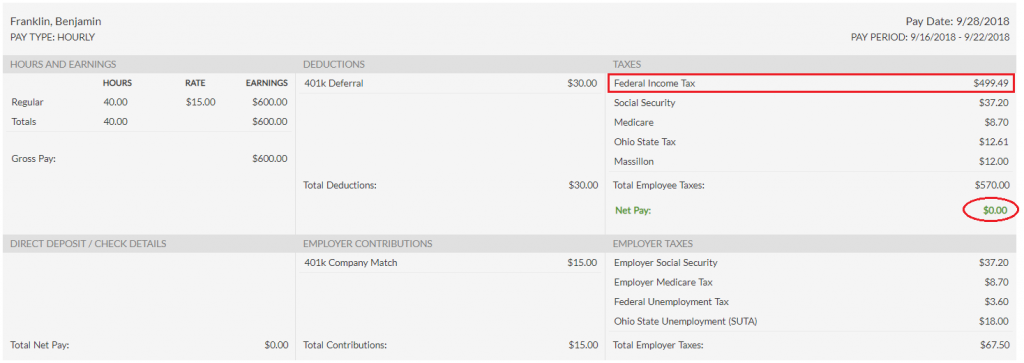

In this example, this is how Ben’s normal paycheck would look on Payroll Step 2 when you click “View Details.”

His normal net pay is $443.29.

Let’s say we want to increase Ben’s federal income tax withholding as much as possible so the net pay is zero.

Cancel this payroll and go to the employee list > click employee name > Taxes > Edit

Under the Federal Taxes Additional Withholdings box, enter the extra amount to be withheld for this check. Save when you are finished.

Now go back to “Run a Payroll” and pay Ben for the same hours and money as before.

On Pay Step 2, “View Details,” you’ll see that Ben’s federal income tax withholding includes the extra $443.29 in addition to his regular federal income tax, and his net pay is $0. You can proceed and finish this payroll.

Example B: Withhold more deductions for a $0 pay

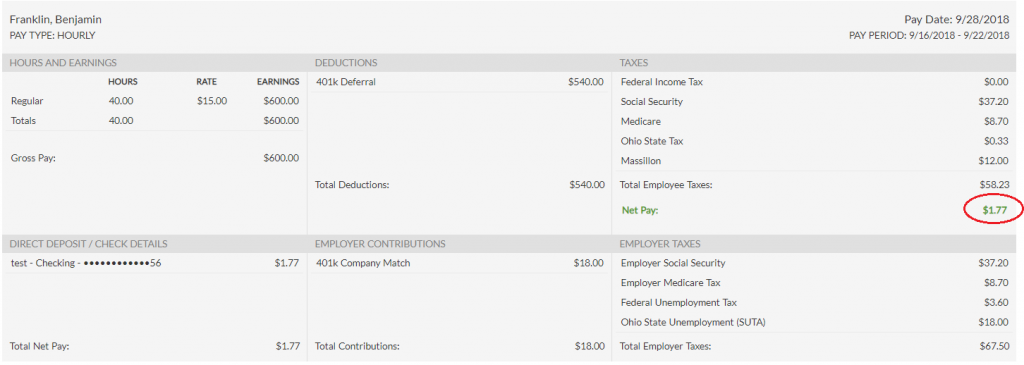

Let’s take the same employee, and increase his 401(k) deduction as much as possible so his net pay is $0. Using the same “normal” payroll:

We can either edit Ben’s “Deductions & Contributions” record and increase his 401(k) percentage deduction, or add a separate fixed dollar 401(k) deduction. Note you cannot set the employee’s 401(k) deferral percentage at 100%, since Social Security and Medicare Taxes need to be withheld on their taxable pay. The deduction will not be taken at all if there is not enough earnings for the required taxes. It’s realistic to start with a 90% deduction and adjust up or down.

Let’s start by changing Ben’s 401(k) % deduction to 90%. In Ben’s case changing his 401(k) deduction to 90% left $1.77 in net pay. This is the closest we can come to a $0 pay only using the percent deduction, as his deduction will not be taken if his deduction is changed to 91%.

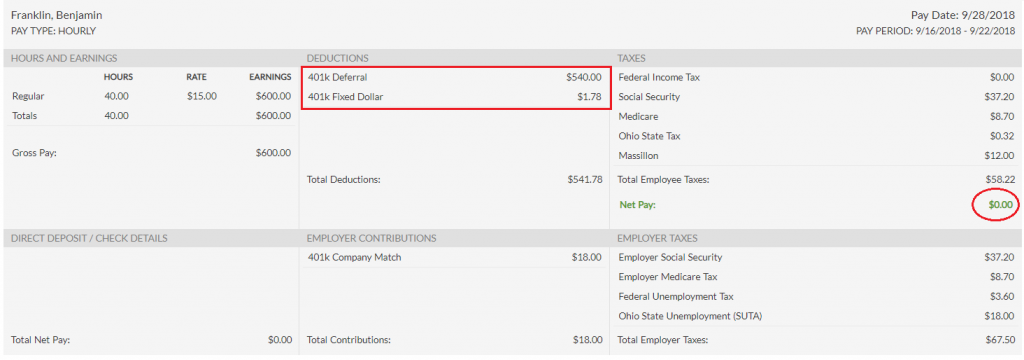

We can, however, add a fixed dollar 401(k) deduction to take the remaining $1.77.

- If your company does not already have a company-level fixed dollar 401(k) deduction, set one up first. See Company-Level Deductions in Patriot Software.

- Assign the fixed dollar 401(k) deduction to the employee, and enter the adjustment amount of the deduction. See Employee-Level Deductions in Patriot Software.

Due to rounding, deducting an additional $1.77 resulted in a $0.01 net pay, so if we change his fixed dollar 401(k) deduction to $1.78, his net pay is now $0. So there may be more trial and error until you get exactly $0 net pay.

Once you have finished the net zero payroll, remember to change the employee’s deductions back to their normal amounts for future payrolls.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.