How to Enter Indiana Employee Tax Information

Background

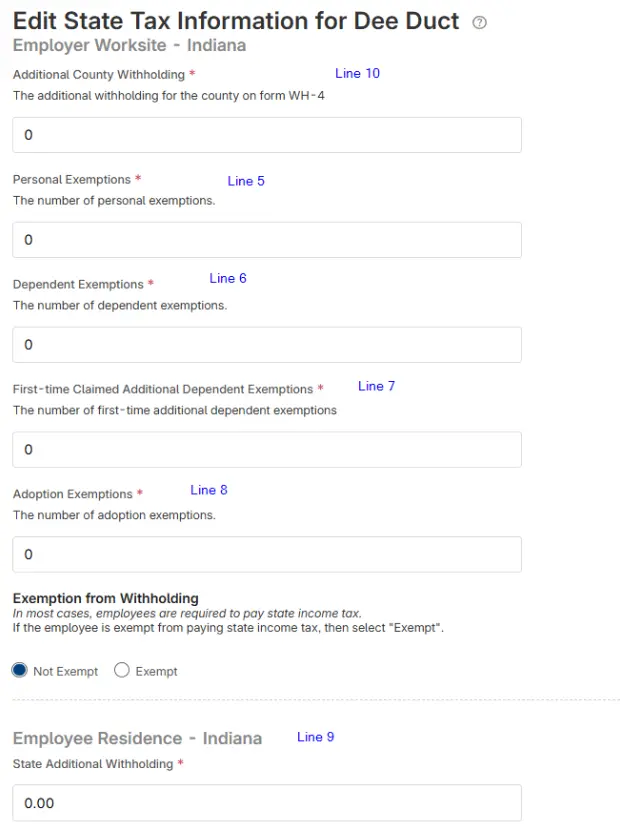

When you add a new employee who lives or works in Indiana, you’ll need to enter their state withholding information based on their Indiana WH-4 (Employee’s Withholding Exemption and County Status Certificate).

Download the official Indiana WH-4 (State Form 48845)

The WH-4 tells how much state and county tax should be withheld from the employee’s pay. Employees should give you a new form if their filing status or exemptions change. If their exemptions decrease, Indiana requires a new WH-4 within 10 days.

Have the employee’s completed Indiana WH-4 handy. You’ll use the numbers from that form to fill in the State Withholding section in Patriot.

- Go to Payroll › Employee › Employee List › (select the employee) › Taxes

- Find the State Withholding section.

- Click Edit.

- Patriot field: Additional County Withholding

- Enter the optional dollar amount on IN WH-4 Line 10, Additional County Withholding, if the employee wants extra county tax withheld.

- Use a whole-dollar amount or 0.

- Patriot field: Personal Exemptions

- Use the number on IN WH-4 Line 5, Add lines 1, 2, 3, and 4. Enter the total here

- Represents the total sum of personal exemptions the employee claims for themselves.

- Non-resident aliens can claim one total exemption and skip the other lines

- Patriot field: Dependent Exemptions

- Use the number on IN WH-4 Line 6, Dependent Exemptions

- Patriot field: First-Time Claimed Additional Dependent Exemptions

- Use the number on IN WH-4 Line 7, First-Time Claimed Additional Dependent Exemptions

- These are dependent children claimed for the first time this year.

- Applies only in the first year a new dependent child qualifies.

- Patriot field: Adoption Exemptions

- Use the number on IN WH-4 Line 8, Adoption Exemptions

- Patriot field: Exemption from Withholding

- Mark this only if the employee is legally exempt from Indiana withholding.

- They must meet strict state criteria — for example, no Indiana tax liability last year and none expected this year.

- Most employees are not exempt.

- Patriot field: State Additional Withholding

- Use the number on IN WH-4 Line 9, State Additional Withholding

- Use a whole-dollar amount or 0 if left blank.

- Patriot field: Non-Resident Certificate (conditionally shown)

- Applies only to residents of reciprocal states Kentucky, Michigan, Ohio, Pennsylvania, or Wisconsin who work in Indiana).

- If the employee qualifies under reciprocity, they would instead file Indiana Form WH-47 and check this field accordingly.

- Click Save.

Indiana doesn’t require employers to send WH-4 forms to the state unless specifically requested, but you should keep the signed copy for your records.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.