How to Calculate Federal Income Tax

There are two possible methods that employers and payroll companies can use to calculate FIT:

- Percentage method

- Wage bracket method

If you are curious about how the calculations are determined, follow along to learn how the software calculates federal income taxes.

Patriot uses the PERCENTAGE method for automated payroll systems. You can find the percentage method tax tables in IRS Publication 15-T.

- Page 9 has a worksheet to calculate the taxable wages.

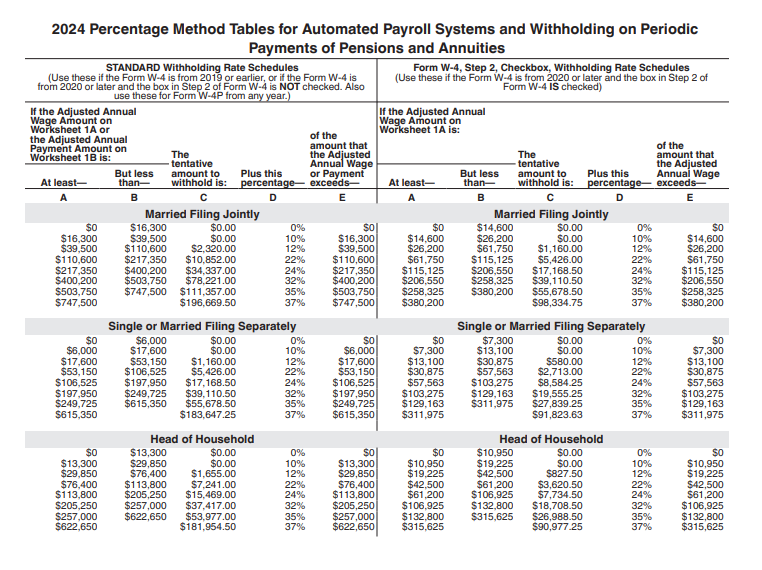

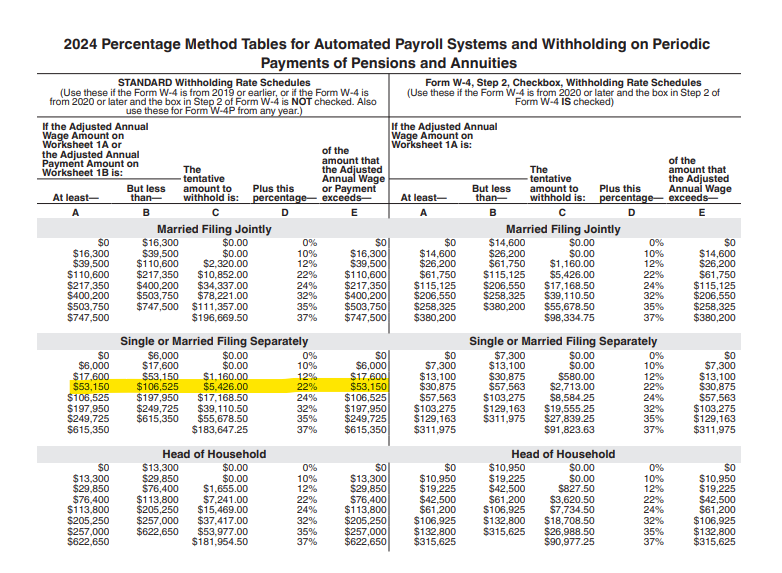

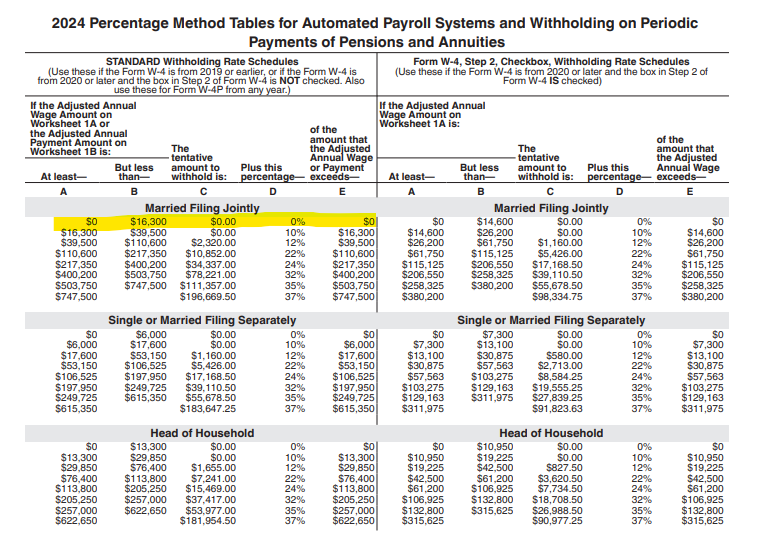

- Page 11 contains the tax tables. We’ll explain how these work soon, but note six separate tables are used, depending on the following variables:

- The employee’s tax filing status as indicated on their Form W-4 (married filing jointly, single or married filing separately, or head of household).

- Whether the employee checked the box for two jobs in Step 2 of their new W-4 form (note the three tables in the right column are only used if they have checked the box in Step 2). If they used the 2019 earlier W-4 form or if the box in Step 2 is unchecked, use the three tables on the left.

- Also, notice in the table that if the employee’s wages are low enough, no federal income tax will be withheld

Now, let’s look at some examples of how to figure out federal income tax withholding. This will require some math, so grab a pencil and your thinking cap!

Let’s say we have an employee with the following:

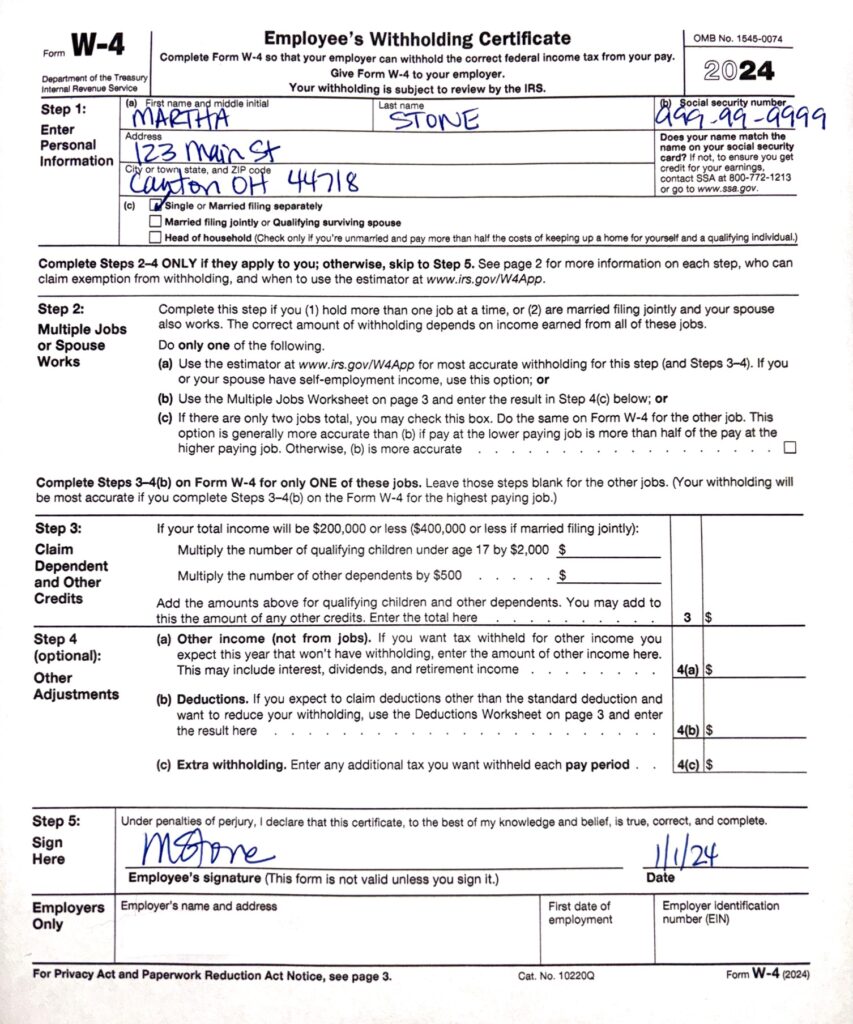

- Paid biweekly

- No pre-tax deductions (e.g., 401(k) or health insurance)

- Using a 2020 or later Form W-4

- Single

- No other jobs (didn’t mark the box in Step 2 of the W-4)

- No dependents (nothing in Step 3 of W-4)

- No other adjustments (nothing in Step 4 of W-4)

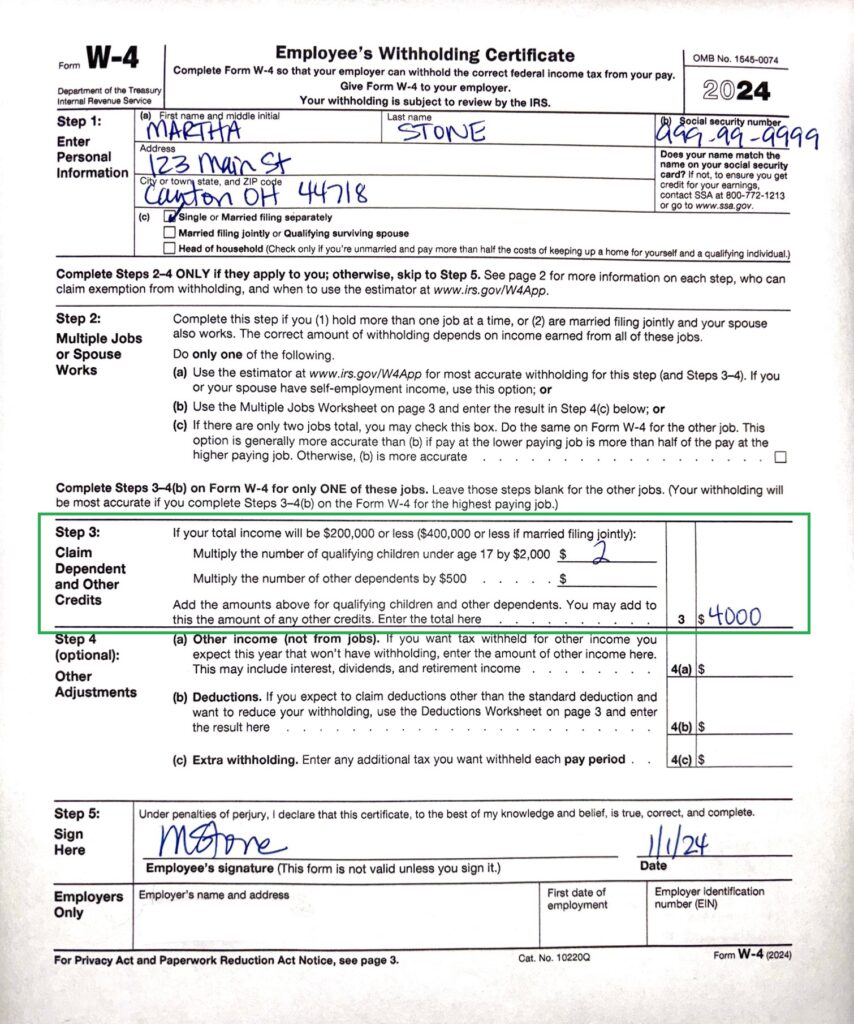

Here is what the employee’s paper W-4 looks like:

The employee’s first paycheck is $3,000, which is taxable.

What will the employee’s FIT withholding be? Here’s what we’ll need to do:

- Calculate the adjusted wages. First, use Worksheet 1A found on page 9 of IRS Pub 15-T to calculate the adjusted annual wage amount.

- Figure the tentative tax to withhold. Once you have the adjusted annual wages, you can use the tax table found on page 11 of IRS Pub 15-T and calculate the annual federal income tax amount.

- Account for dependents, other tax credits, and extra withholding. Finally, you can make any needed tax adjustments and determine the amount of tax per check.

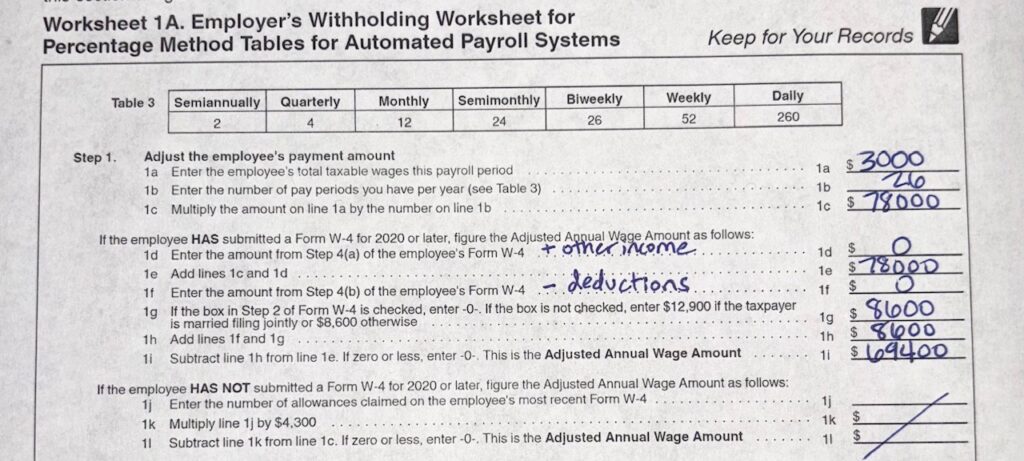

Step 1: Figure the Adjusted Wages

To get the adjusted annual wage amount, let’s look at this worksheet. It can be daunting (gotta love IRS tax forms), but we’ll break down each step. Note there’s a different process depending on if the employee’s W-4 is 2020 or later or if the employee’s W-4 is 2019 or earlier. It may help to have a copy of the most recent W-4 open in another window so you can refer to the form as we go down the worksheet.

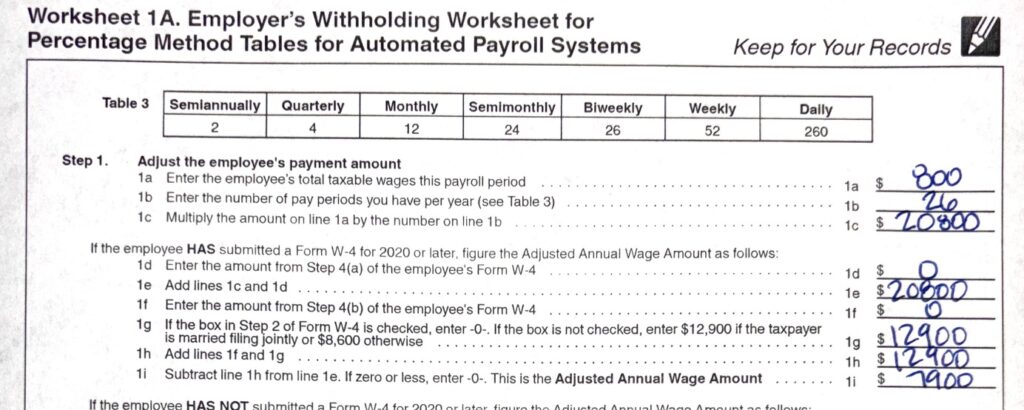

Remember to use Worksheet 1A on page 9 of IRS Pub 15-T, “Employer’s Withholding Worksheet for Percentage Method Tables for Automated Payroll Systems” if you are trying to verify Patriot’s FIT calculations.

- The biweekly wages are $3,000 (Line 1a)

- Multiply $3,000 by 26 pays for biweekly (Line 1b) to get the annual wages of $78,000 (Line 1c)

- If the employee had an amount on Step 4a of their W-4 with other income (Line 1d), add these two numbers together to increase their annual wages (Line 1e)

- If the employee had an amount on Step 4b of their W-4 with deductions (Line 1f), this would reduce their annual wages.

- If the employee checked the box in Step 2 of the new W-4 for multiple jobs, enter 0. Otherwise, since the employee is single, we’ll enter $8,600. This will reduce the employee’s annual wages (Line 1g).

- Get the total amount to reduce from the original annual amount (Line 1h). In this case, it’s $0 + $8,600 since there are no other deductions.

- Now that we know how much to reduce, take $78,000 – $8,600 = $69,400 (Line 1i)

- $69,400 is the adjusted annual wage amount that you’ll look up in the tax table.

- Note the 2019 or earlier W-4 is a simpler calculation. You’ll skip lines 1d through 1i and instead jump down to line 1j, take the number of allowances multiplied by $4,300, and deduct that amount from the annual wages.

Summary for 2020 or later W-4

Annual amount + Other Income – Deductions – the Step 2 variable = adjusted annual wage amount

- If Step 2 box is checked, no further deductions.

- If Step 2 box is unchecked and married filing jointly, deduct $12,900.

- If Step 2 box is unchecked and any other filing status, deduct $8,600.

Summary for 2019 or earlier W-4

Annual amount – ($4,300 x number of allowances) = adjusted annual wage amount

So now that we know our adjusted annual wage, let’s look at the tax table and calculate the preliminary tax to be withheld.

STEP 2: FIGURE THE TAX WITHHOLDING AMOUNT

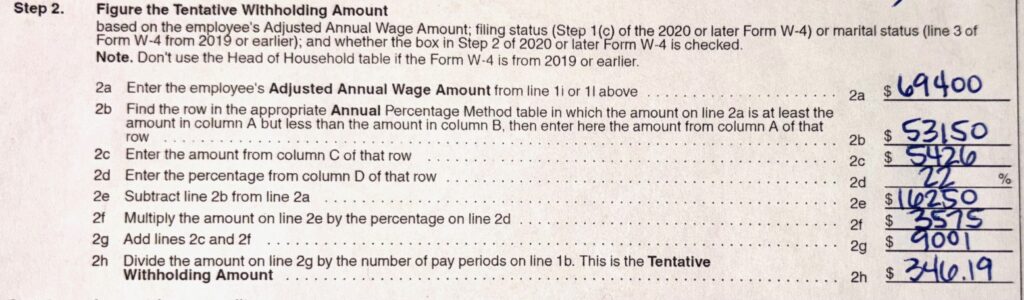

To recap from above, the adjusted annual wages are $69,400.

Let’s look at the tax table found on page 11 of IRS Pub 15-T.

Note there are six different tables on this page. The one you use depends on the employee’s filing status, the version of the W-4 they are using, and whether they have checked the multiple jobs box in Step 2 of their 2020 or later W-4 (everything in the right column). Since our example is using the 2020 or later W-4 and has the Step 2 box unchecked, we’re going to use the middle table in the left column.

- Looking in the Single or Married Filing Separately table, the employee’s taxable wages of $69,400 fall between the range of $53,150 (Column A) to $106,525 (Column B). See the highlighted row above.

- We can see in Column C, at least $5426 in FIT needs withheld for the year. The $5426 is a total of the following:

- 10% on wages between $6,000 and $17,600

- 12% on wages between $17,600 and $53,150

- In addition, you need to calculate 22% (Column D) of the earnings that are over $53,150 (Column E).

- $69,400 wages – $53,150 = $16,250 in wages taxed at 22%. This is $3575 in FIT.

- If we add up the two tax amounts: $5426 + $3575 = $9001 total FIT to be withheld from all checks this year.

- We’ll take the annual FIT amount and divide back down by 26 to get the FIT amount per check. $9001 / 26 = $346.19.

Here is what the worksheet would look like:

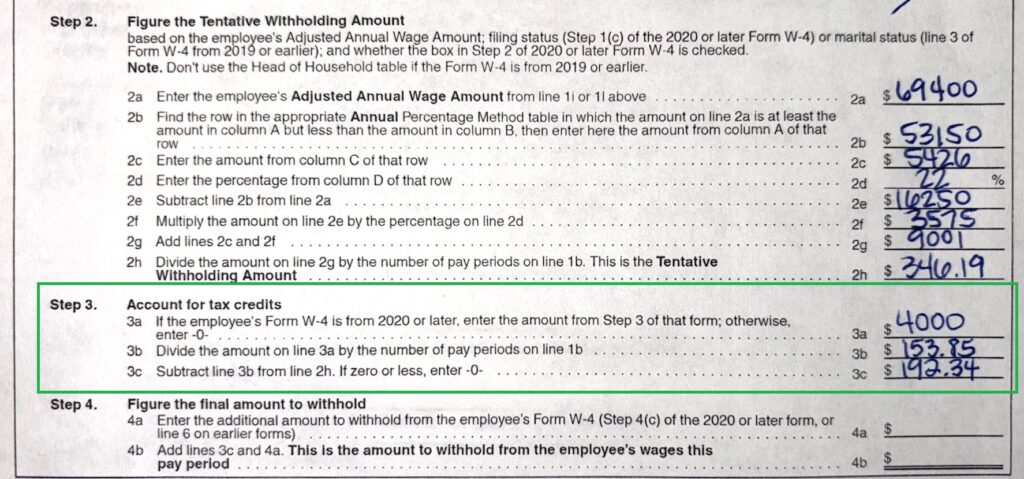

STEP 3: DEPENDENTS AND OTHER CREDITS

If an employee marked that they have dependents or other credits on their W-4, there is another step to calculate the tax credit they can take. Instead of reducing taxable wages like deductions, dependents and other credits reduce the actual tax owed. This is considered a tax credit.

- Deductions reduce taxable wages

- Dependents and other credits reduce actual FIT (tax credit)

In our previous example, our employee had no dependents, so our FIT calculation of $346.19 for that paycheck is accurate.

But let’s say the employee had two dependent children. Per the 2020 or later W-4 form, the employee would multiply $2,000 by the two kids to get $4,000.

Back in the worksheet on line 3a, enter the amount in Step 3 of the W-4, and divide by the number of pay periods.

$4000 / 26 = $153.85

The employee’s FIT amount per paycheck of $346.19 reduces by $153.85 for a new lower FIT of $192.34 per pay.

STEP 4: ADDITIONAL FIT WITHHOLDING

The last step in manually calculating FIT is to add any additional withholding to the FIT per pay amount.

- If an employee is using the 2020 or later W-4, they would indicate this in Step 4c.

- If the employee is using the 2019 or earlier W-4, they would indicate this in Line 6.

This amount is already in terms of each pay period, so there’s no need to divide by the number of pay periods.

The extra withholding amount is simply added to the FIT per pay amount.

So for example, if Martha’s FIT per pay is $192.34 and she wants an additional $20 per pay withheld, her FIT per pay would be $212.34.

LOW WAGE EXAMPLE: ADJUSTED ANNUAL WAGE

Let’s take a look at another example. This time around, the employee has the following:

- 2020 or later W-4

- Married filing jointly

- No other jobs

- No dependents

- No other adjustments

- Paid biweekly

The employee’s taxable wages for their biweekly paycheck are lower than the previous example, $800. Use the same process on Worksheet 1A as before to figure the adjusted annual wage.

The adjusted annual wage amount is $7,900 since they did not check the Step 2 box and the employee is married filing jointly which reduces the wages by $12,900. Next, use the table to find the FIT.

LOW WAGE EXAMPLE: NO FEDERAL TAX DEDUCTED

With an adjusted annual wage of $7,900, let’s find this in the table. In this example, the employee is married and filing jointly.

Because the taxable wages of $7,900 fall between the range of $0 and $16,300 in the tax table, this employee does not owe federal tax on this check. Column C in the table is $0.00. Column D is 0% and Column E is $0.

What’s the big takeaway from the previous example? It’s very possible that an employee may not have enough in taxable earnings to have FIT deducted. The first thing to do is look at the employee’s earnings for that paycheck.

As a general rule, if the employee earns about $20,000 or less in a year with no other adjustments needed, they will not have FIT withheld from their paychecks.

Summary

As we have seen, the process of calculating employee FIT withholding is not exactly simple! Let’s recap the important points:

- Patriot uses the percentage method in our software to calculate FIT

- Employees may not have FIT withheld if they do not make a certain amount

- There are two versions of the W-4 form that an employee may have completed

- How the employee completes the form determines exactly how much FIT is withheld

Not using Patriot Payroll Software yet? Why not try it free and save yourself time and brainpower?

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.