Payroll Software for Insurance Companies

Simplify payroll, pay contractors, and stay compliant

Insurance Payroll Software Made Simple

For independent agencies, regional insurers, and national brokers

Auto Payroll

Benefits Management

Tax Filing and Deposits

HR Software Integration

Key Payroll Features for Insurance Companies

Commissions & Bonuses

Easily include bonuses and commissions in or outside regular payroll runs.

Contractor Payments

Pay independent contractors quickly and accurately in payroll.

Multi-State Taxes

Stay compliant while paying employees across multiple states.

Payroll That Works for Your Insurance Company

...The [payroll] is easy to learn and navigate. I love the net to gross feature because we get an annual bonus that I used to have to manually manipulate to calculate the gross.”

-Colleen

Software That Makes Insurance Payroll a Breeze

Spend less time on back-office tasks and more time on your clients

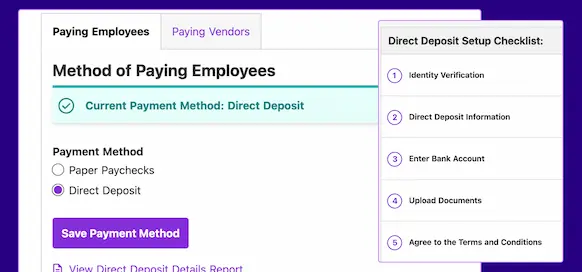

- Guided payroll setup and onboarding

- Transparent pricing (no hidden fees)

- Friendly, USA-based customer support

Insurance Company Payroll Resources

Ready to Simplify Your Insurance Company’s Payroll?

Frequently Asked Questions

Yes. You can run commissions and bonuses within Patriot’s payroll platform.

Absolutely. Patriot lets you pay both W-2 employees and 1099 contractors in the same payroll run.

Patriot’s Full Service Payroll handles tax filings and deposits, plus year-end payroll tax filings at no additional cost.

Yes, Patriot supports multi-state payroll. Keep in mind there is a $12 fee for each additional state we file in.