Accounting Software for Small Business

Easier and more affordable Accounting Software

See a Demo Create Account 30 Days Free!

Features

Accounting Basic

Accounting Premium

No robots here. Our expert (and friendly!) support wants to help answer your accounting questions, 9a.m. - 7p.m. EST, Monday - Friday. Whether you call in, chat us, or shoot us an email, rest assured someone will be there for you.

Got room for another app on your phone? Of course not. We’ve designed our software so you can access your account on your phone anywhere—all without the hassle of downloading and updating an app.

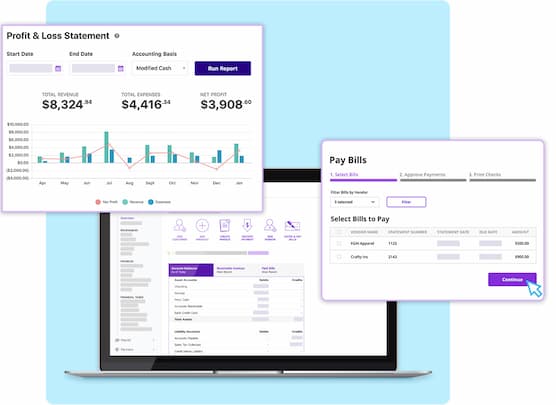

Do you work with vendors? You’re a business owner—of course you do! So, you need an easy way to pay those vendors and track payments. Simply select a vendor, enter payment details, approve it, and print paychecks. Add as many vendors as you need … there are no limits (we wouldn’t do that to you!)

If you paid contractors during the year, don’t forget to take care of the necessary Forms 1099 and 1096. You can create and track as many 1099s and 1096s as your heart desires (we don’t charge extra), all within your account.

Empower your 1099 contractors with their own portal! Let them take control of their contact details and effortlessly view payments and direct deposit info.

Are you ready to go digital? If you opt into 1099 e-Filing, you can file your forms in our software with just a few clicks (nominal fees may apply). We’ll shoot it over to the IRS and states that participate in the e-Filing program for you!

The Chart of Accounts is the backbone of your books. You can easily add, track, and manage asset, liability, equity, income, and expense accounts to keep your COA straight from the get-go.

Are you guilty of losing track of customer invoices? You wear a million and one hats, so it’s OK to admit it … but now it’s time to get paid. Create, send, and track invoices to as many customers as you need.

News flash: Your customers are craving a frictionless way to pay you. With our Stripe integration, you can get started in minutes and make it convenient for your customers to pay you via credit card, Apple Pay, or Google Pay.

With our Stripe integration, your customers can securely make ACH payments on invoices. And with lower transaction fees than credit card payments, you’ll boost your bottom line.

There’s nothing better than when the money rolls in. Capture the moment by recording payments in your books. Recording payments is easy in your account—simply apply the money you receive to the correct product or service and get back to business to get some more.

Importing bank transactions and saving your time has never been easier. Connect your bank account or credit card so that all your activity automatically flows into the software. If automatic imports aren’t for you, you can opt to manually record journal entries or upload a file.

When it comes to your business, every department counts. Break down expenses and income by departments to see what’s making you money and where you need to tighten the belt.

Our accounting software integrates seamlessly with Patriot Full Service or Basic Payroll.

We know that getting started is half the battle, so we made importing your data from your previous software a breeze. Import Chart of Accounts, trial balance, customers, vendors and contractors, and you’ll be up and running in no time flat.

You know when you made a mistake, but now you don’t have to live with it forever. Go ahead and edit or delete transactions to make things right. We’ll keep track of changes you made in a handy Modified Transactions Report…but it still will be our little secret.

Have someone else who helps manage your books? This one’s for you. Have a whole crew? No problem. Adding unlimited users to your account is a breeze.

Some things in life are irreconcilable. Your statements and accounting books shouldn’t be one of them. Compare your statements to your recorded software transactions for any asset, equity, or liability accounts and reconcile those differences.

Want to limit the accounting tasks your added users can access? We've got that, too! Simply choose which permissions you would like for each user and voila!

Let your inner itemizer out to play and add up to 8 levels of subaccounts to further categorize transactions. Adding and nesting subaccounts will give you greater detail to your transactions.

Want to give your customers a preview of what their bill may look like? You can do that by creating and sending estimates in your account. And the best part is, you can seamlessly convert it into an invoice when you’re ready with the click of a button—no magic wand needed.

Do you hear invoices when you’re trying to sleep? The first step to a good night’s rest is to set up recurring invoices. Choose your start and end date, select your frequency, and catch a few ‘z’s.

Let our software do the nagging for you. Decide when automatic payment reminders will be triggered for customers with past due invoices. So go ahead, give your customer the gentle nudge they need—without having to do it yourself.

Your business is unique. Your templates should be, too. Keep it professional while also adding some flair. Customize estimates, invoices, and credit memos by picking a template, adding your logo, and selecting an accent color.

Securely upload files and receipts & attach to any transactions to keep records stored and at your fingertips for easy access.

Accounting Software That's Easy and Grows With You

Your words ... not ours!

Lots of Accounting Reports ... with filtering, sorting, and exporting capabilities.

Accounting Reports

We crunch the numbers so you don’t have to.

Account Reconciliation

Customer Estimates

Customer Payment History

Check Register

Profit and Loss Statement

Accounts Receivable Aging

Account Trial Balances

Balance Sheet

General Ledger

Unpaid Customer Invoices

Bill Listing

Accounts Payable Aging

Vendor Payment History

Sales Tax Report

Invoices

Invoice Details

Online Accounting Software FAQs

Asked ... and answered

Accounting Premium includes everything in our Basic option, plus added features like user-based permissions, subaccounts, custom invoice templates, and much more!

Relax! Our cloud-based accounting software is designed to be easy for small business owners, yet powerful enough for accountants. Our software is simple, and there are plenty of guides, tutorials, and videos built right in if you need help.

Patriot makes it easy. Get started with a free, no-obligation 30-day free trial of Accounting. There are no strings attached—cancel anytime! And, you can import Vendors, Contractors, customers, chart of accounts, trial balance report, and bank transactions to pick up right where you left off.

If you have questions, call our customer support department for help. We offer free routine support for all customers. You can also find quick answers with our online chat feature or search for answers on your own in our Help Center.

No. You can add (and invoice) an unlimited number of customers through our online accounting software.

If you have Accounting Premium or Accounting Basic, here are the 1099 e-Filing fees:

| Number of 1099s | Fee |

|---|---|

| 1 to 5 | $20.00 |

| 6 to 35 | Additional $2.00 per 1099 |

| 36+ | No additional charge |

For more information, check out our help article, Electronically Filing Your 1099s.

Accounting Overview

We made this accounting solution simple by design. You do not need any special training to track income and expenses, generate customer invoices, or print reports for your accountant. There are plenty of help articles and videos to learn how to use the software.

Yes! You can easily import data from your previous accounting software provider. Our accounting software allows for importing of vendors and contractors, customers, trial balance, and charts of accounts.

Yes, our Accounting Basic Software and Accounting Premium Software are both stand-alone products. While we’d love for you to try our award-winning payroll products, they are not required to use our accounting software.

Yes. We integrate with Stripe, a third-party processor to provide you and your customers with a seamless payment experience. You can sign up with Stripe, through our software.

Patriot Software does not charge for credit card processing in the accounting software; however, Stripe has a standard fee schedule.

You can add (and invoice) an unlimited number of customers in the software.

Yes! With Accounting Premium, you can send recurring invoices to your customers on your desired schedule at no additional charge.

With Accounting Premium, you can set up multiple logins to give to your accountant and/or others as needed at no additional cost!

There is no limit to the number of bank transactions you can import from your bank account.

We use a third party to securely and seamlessly integrate your bank transactions, Plaid, Inc. Plaid supports most major banks and credit unions. However, you will need online banking access with your bank.

Patriot Software has a unique patented cash-to-accrual basis toggle that will display your financial reports in cash or accrual basis with the simple click of a button. This means you can use the easy-to-understand cash basis for everyday entries, but can give your accountant the needed information in accrual-basis reporting.

This toggle doesn’t “convert” the cash-basis entries to cash- or accrual-basis accounting. It makes entries in each format and stores the data so it is ready for accurate reporting.

Patriot’s Accounting Basic and Accounting Premium both integrate seamlessly with Patriot Basic Payroll and Patriot Full Service Payroll.

Ridiculously Easy Accounting Software ... No training required!

Don’t want to waste your weekend sitting through a webinar to learn confusing or complicated software? We don’t blame you ... and you don’t have to!

Simply put ... Patriot’s Accounting Software is ridiculously easy. Enjoy your weekend.

—Team Patriot

Powerful Accounting Software ... Yet Easy!

Who knew that you could have both?!

Easy Start

Want to get up and running at warp speed? We get it. We’ve simplified the onboarding process so you can get started with one-click accounting settings or customize them to meet your needs.

Patented Dual-Ledger Accounting

Our Dual-Ledger Accounting feature makes it easy for you (and your accountant!) to switch between cash-basis, modified cash basis, and accrual accounting—without messy conversions.

Patriot Smart Suggestion

Our online accounting for small business uses breakthrough machine learning technology to save you clicks and precious time.

Easy & Unlimited Invoicing

Send and track an unlimited number of invoices to an unlimited number of customers. Sounds like a win-win.

Drill-down Financial Reporting

See more details about your financial reports without the hassle of leaving the page.

Receive Credit Card Payments

Accounting customers can accept customer credit card payments for open invoices.

Set Up Invoice Payment Reminders

Let us do the nagging for you. Automatically send an invoice reminder via email to customers with past due invoices.

Manage Receipts and Documents

Say goodbye to bulky files and lost receipts, and hello to hassle-free organization. Effortlessly link your receipts and documents to related transactions, keeping all your data perfectly aligned.

Subaccounts

Attention all organizers, outliners, and itemizers, this one’s for you! Add up to eight levels of subaccounts to further categorize transactions and give greater detail to your accounts.