Adding Employee Standard Occupational Classification (SOC) Codes

In this article:

What are SOC codes?

SOC stands for Standard Occupational Classification. These codes help government agencies and private businesses compare occupational data and will only show in your software if your state requires reporting for SOC codes.

What if my employee works more than one job type for me?

Only one code can be reported each quarter. Choose one that fits the majority of the employee’s work.

Which employees need a SOC code?

Any employee who had earnings subject to SUTA for that quarter will need to have a SOC code reported, including employees who are currently inactive. Employees who are exempt from SUTA will not have the option to enter the SOC code because it is not needed.

How to Add SOC Codes to an Employee

Finding your employee SOC code for SUTA reporting is easy. Patriot offers an on-page search tool.

- Go to Payroll > Employee List > {Employee Name} > Pay Info.

- Click Edit.

- Scroll down the page, find the section labeled “Position Info” and then “Standard Occupational Classification (SOC).”

- Enter your employee’s SOC code, or you can begin searching by keyword or SOC code by clicking in the field box. See our SOC lookup tool info below.

- Select the SOC code that applies to your employee.

- Click “Save Employee” at the bottom of the page.

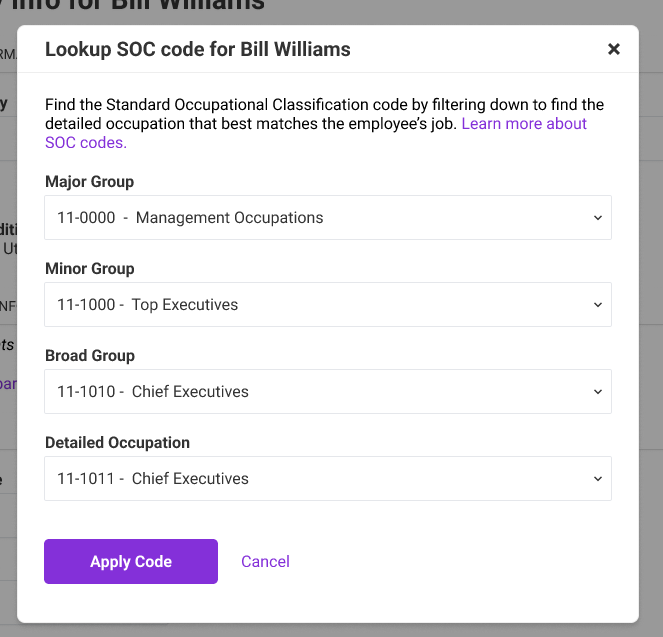

Using the SOC Lookup Tool

If you don’t know your employee SOC code, click the “Use SOC Code Lookup Tool” link beneath the SOC input field. The lookup tool module will give you a list of 4 drop downs that progressively narrow down to the code you need to enter. Once you find the employee SOC code, click “Apply Code” and “Save Employee.”

How to Do a Bulk Entry of SOC Codes for Employees

You can also use our “bulk entry” page to add all of your employee SOC codes at once. Go to Settings > Payroll Settings > SOC Bulk Upload.

SOC Reporting

You can find your employee SOC codes under Reports > Payroll Tax Reports > Payroll Tax Liabilities. Under the “SUTA Taxes” section, you will find the SOC for each employee. As a Full-Service Payroll customer, Patriot will report these SOC codes when we file your SUTA taxes. Basic Payroll customers can use this report to do their own filing.

Also check out our help article, “What are NAICS Codes?“

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.