Payroll Software for Small Business

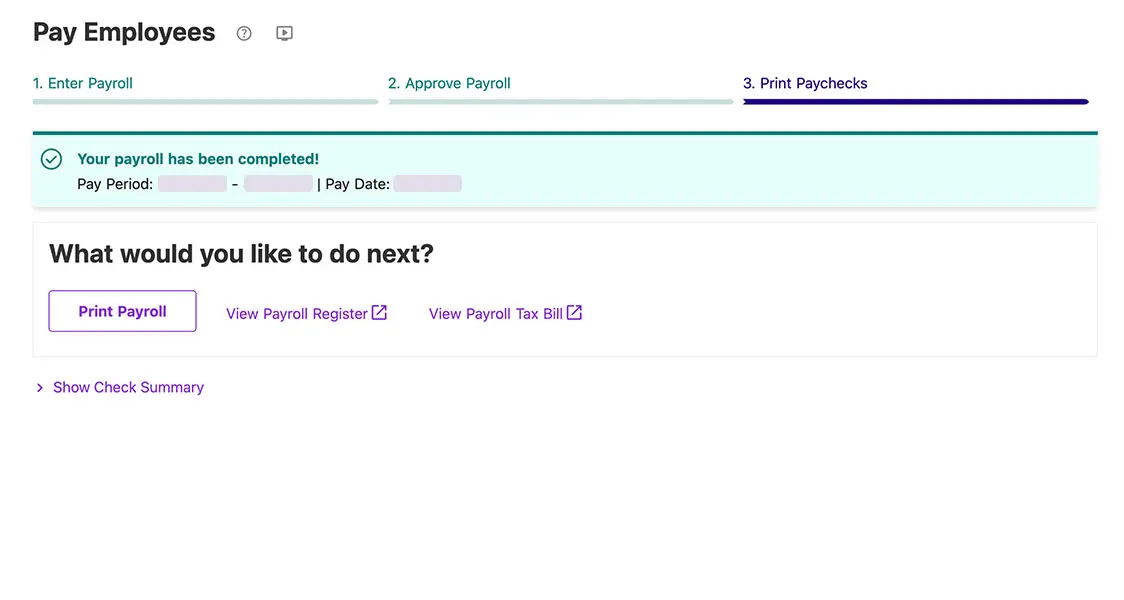

Run quick, seamless payroll with Patriot's Basic Payroll Software

See a Demo Create Account

Streamline Your Payroll Management With Patriot Payroll®

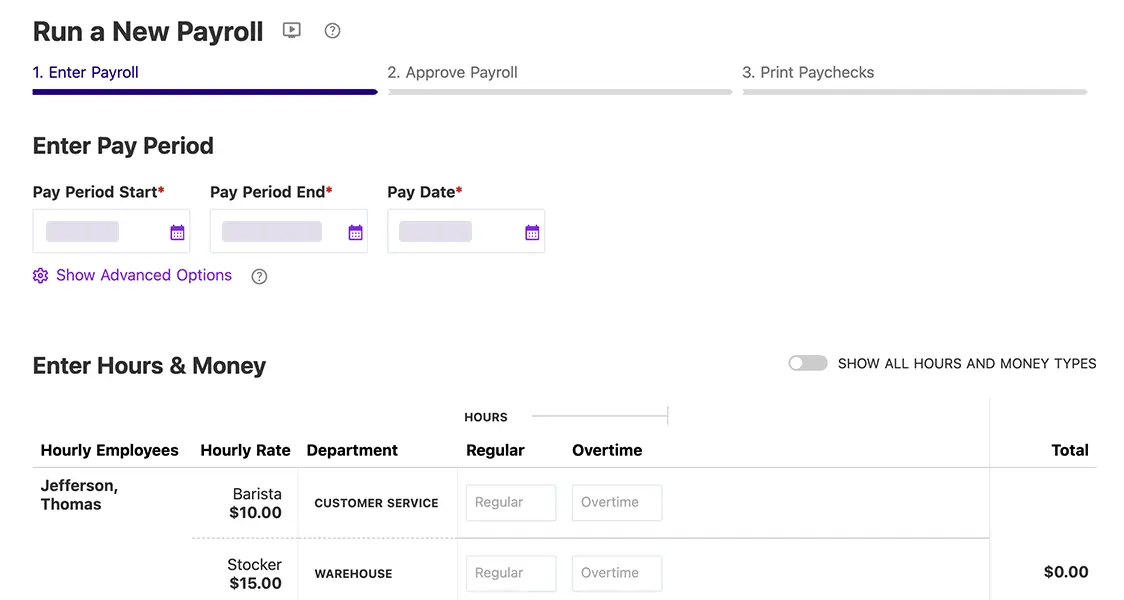

Flexible & Customizable Payroll

Create customizable deductions and contributions for your 401(k), health insurance, garnishments, and more.

Printable W-2s

Print W-2s at the end of the year. Use plain 8.5 x 11 office paper or W-2 forms. The choice is yours!

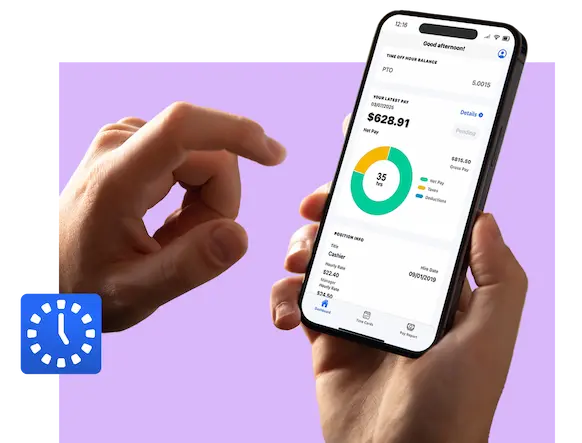

Free Employee Portal

Give your employees secure access to their paystubs, pay history, and payroll information.

Time-off Accruals

Have a PTO policy you want to automate? Set up time-off accrual rules that will automatically calculate time-off hours with each payroll.

Multiple Pay Rates

Add up to five pay rates for each hourly employee. You can differentiate pay rates for employees by adding a description to each rate.

HR Center

Get timely alerts and emails for federal, state, and local compliance. Plus, assess your company's HR strengths and potential risks with an HR assessment.

Lots of Payroll Reports Filter, sort, and export with Patriot Payroll

Meet the employee mobile app that simplifies everything! Employees can view their pay, update personal and tax details, and access W-2s with ease. Add our time and attendance software so employees can easily log their hours and manage their time.

Download the app for android or ios:

Don't want to deal with Payroll Tax Filings?

We can do them for you—if you select our Full Service Payroll

Compare Payroll OptionsPayroll Software FAQs

You got questions? We got answers!

No, we offer free direct deposit! There’s no additional software charge for providing standard or expedited direct deposit to your employees.

New customers can switch to Patriot at any time. When to switch is entirely up to you! We will help you get started whether you start fresh in the new year or switch mid-year or at the end of a quarter.

Patriot offers a few direct deposit options to meet our customers' needs: expedited 2-day direct deposit for qualifying customers, standard 4-day direct deposit payroll prefunding, or customer initiated funding through bank wires or Instant payments.

Learning how to set up payroll with Patriot Software’s payroll software is easy. Gathering this information ahead of time will ensure a quick and efficient setup. Learn what information you need to set up payroll here.

Our software is designed to guide you through the setup process with our easy payroll wizards. We offer free payroll setup for customers who would like assistance. We will enter your employee data and year-to-date payroll information. If you’d like to take advantage of this option, first sign up for a free trial. Then, call 877-968-7147 option 2, email our team at success@patriotsoftware.com, or chat us to request free setup assistance.

Payroll FAQs

New customers can switch to Patriot at any time. When to switch is entirely up to you! We will help you get started whether you start fresh in the new year or switch mid-year or at the end of a quarter.

Patriot offers a few direct deposit options to meet our customers' needs: expedited 2-day direct deposit for qualifying customers, standard 4-day direct deposit payroll prefunding, or customer initiated funding through bank wires or Instant payments.

Our Full Service Payroll will collect, file and deposit federal, state, and most local taxes, in the USA. Learn more here.

Yes, we file in all 50 states with our Full Service Payroll. However, there is a $12 fee for each additional state that we file in.

After you have completed your tax filing setup, Patriot Software will collect payroll taxes on approved payrolls usually the first banking day before the pay date.

We offer a convenient setup checklist to help you gather this information ahead of time and ensure a quick and efficient setup. Learn what information you need to set up payroll here.

Our software is designed to guide you through the setup process with our easy payroll wizards. We offer free payroll setup for customers who would like assistance. We will enter your employee data and year-to-date payroll information. If you’d like to take advantage of this option, first sign up for a free trial. Then, call 877-968-7147 option 2, email our team at success@patriotsoftware.com, or chat us to request free setup assistance.

No. You are charged the base monthly price and a per worker fee on the first of each month. If a worker does not have a payroll during certain months, you are not charged for them.

Our payroll software is online. You can access it anytime or anywhere you have data or internet access. There’s no software to download.

The software is designed for small to large businesses, from 1–500 employees, in all industries. Whether you are a seasoned business or just starting out, our software will help you keep your time and money.

Yes. You may run a payroll whenever you need to in the payroll software.

No–our software is only available to companies with employees working in the USA. It’s our passion to help American businesses by providing streamlined, easy, and affordable payroll management solutions.

In the months you don’t run payroll, you will only be charged the base price for the payroll.

Patriot Software accepts credit or debit cards from Visa, Mastercard, American Express, and Discover for your software and service fees.

You’ll need a commercial or business bank account to utilize our direct deposit or Full Service payroll.

We are SOC2 Type II compliant to ensure the industry gold-standards in keeping your data safe. We will also require you to set up multiple authentication methods to ensure your log in credentials are not compromised.

Patriot collects and files Workers’ Compensation Insurance for Washington and Wyoming. For other states, we do offer free integration with NEXT Insurance, who offers Pay-As-You-Go Workers’ Compensation Insurance.

Unfortunately, we don’t handle the IRS Form 943 with our Full Service Payroll at this time. However, you can use our Basic Payroll and file outside of the software if your business is required to file Form 943.

Patriot offers free integrations through our partners: Vestwell for 401(k) and Next Insurance for pay-as-you-go workers’ comp. We don’t handle payments for garnishments, health insurance, child support, or other retirement plans.