How to Pay a Bonus or Commission

In this Article:

- How to Pay a Bonus or Commission in a Regular Payroll

- How to Pay a Bonus or Commission Outside of a Regular Payroll

Background

Bonuses and commissions can easily be paid to an employee in Patriot. The software already has these “Money types” set up for you.

You can pay a bonus or commission with your normal payroll by adding an amount in the appropriate money type box or separate it from your normal payroll run.

Paying a Bonus or Commission in a Regular Payroll

Here’s how to pay additional money such as a “Bonus” or “Commission” when you are entering a standard payroll for an employee.

- Go to Payroll > Run a New Payroll.

- On Step 1: Payroll Entry, all frequently used money types will appear. These can be changed under Settings > Payroll Settings > Hour & Money Types.

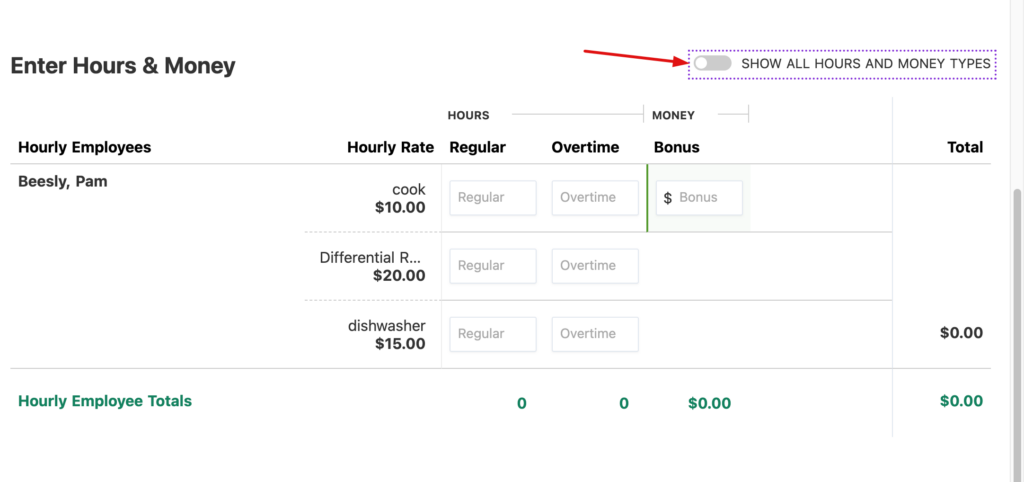

- If you need to pay additional money and it does not appear in your frequently used list, toggle the “Show all Hours and Money Types” toggle. Any active Money Types in your Payroll Settings will appear.

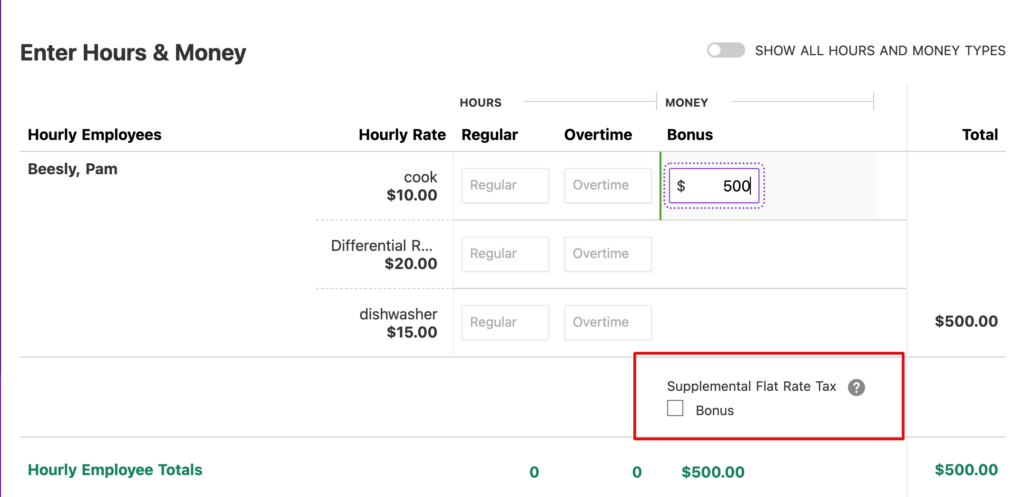

- Enter the dollar amount of the additional money type(s).

- You can choose to tax money at the IRS supplemental tax rate of 22% by checking the box under the money type. See How to Tax Supplemental Pay for more information about this tax rate.

How to Pay a Bonus or Commission Outside of a Regular Payroll

You’ll need to determine whether or not you want to pay the bonus or commission in a regular payroll or if you want to “gross up” the money. “Grossing up” starts with the “net payroll,” and is convenient if you want an employee to receive an exact take-home pay amount. Read our help article, “How to Run a Net to Gross Payroll,” for more information.

To run a regular payroll for a bonus or commission go to Payroll > Run a New Payroll.

- Step 1, Payroll Entry, displays commonly used money types. You can modify these under Settings > Payroll Settings > Hour & Money Types.

- If you need to pay additional money not listed, toggle “Show all Hours and Money Types.” This will display any active Money Types in your Payroll Settings. See our help article, “How to Set Up Money Types,” or “How to Set Up Hour Types,” if needed.

- Enter the dollar amount of the additional money type(s).

- You can choose to tax money at the IRS supplemental tax rate of 22% by checking the box under the money type. See How to Tax Supplemental Pay for more information about this tax rate.

See Also:

Paying Additional Hours in Patriot Software

How Do I Pay My Employees Commission Only?

[RELATED ARTICLE: What Is Bonus Pay?]

[RELATED ARTICLE: Types of Incentive Pay Plans]

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.