Employers are responsible for withholding, remitting, and filing payroll taxes on behalf of their employees. And, there are some taxes you contribute on behalf of your employees. Social Security tax is one of those essential taxes that impacts both the employer and the employee.

Table of Contents

- What is Social Security tax?

- What are Social Security taxes used for?

- How much is Social Security tax?

- How do you calculate Social Security taxes?

- Where and how do you report Social Security tax?

What is Social Security tax?

Social Security is a mandatory payroll tax paid by employers and employees. Employers and employees in the United States must pay the tax. This means that not only do employers need to withhold Social Security taxes from employee wages, but they also need to pay social security match, which equals the employee tax, and deposit both portions to the Social Security Administration.

Social Security is one of the two Federal Insurance Contributions Act (FICA) taxes. The other is Medicare tax.

If you are self-employed, you do not pay Social Security tax. Instead, you pay self-employment tax. Self-employment tax is similar to paying both the employer and employee portion of the total FICA tax. The Self-Employed Contributions Act (SECA) mandates self-employed individuals to pay this tax.

What are Social Security taxes used for?

The federal government uses Social Security taxes to fund Social Security benefits. The Social Security Administration (SSA) administers the program and uses the tax funds to support:

- Retired individuals

- Widows and widowers

- Individuals with disabilities

- Children and survivors of individuals

The official name for Social Security is Old-Age, Survivors, and Disability Insurance (OASDI). Most individuals who receive the tax benefit are 65 years or older. Survivors’ payments are for the surviving spouses or children of deceased workers or retired workers.

How much is Social Security tax?

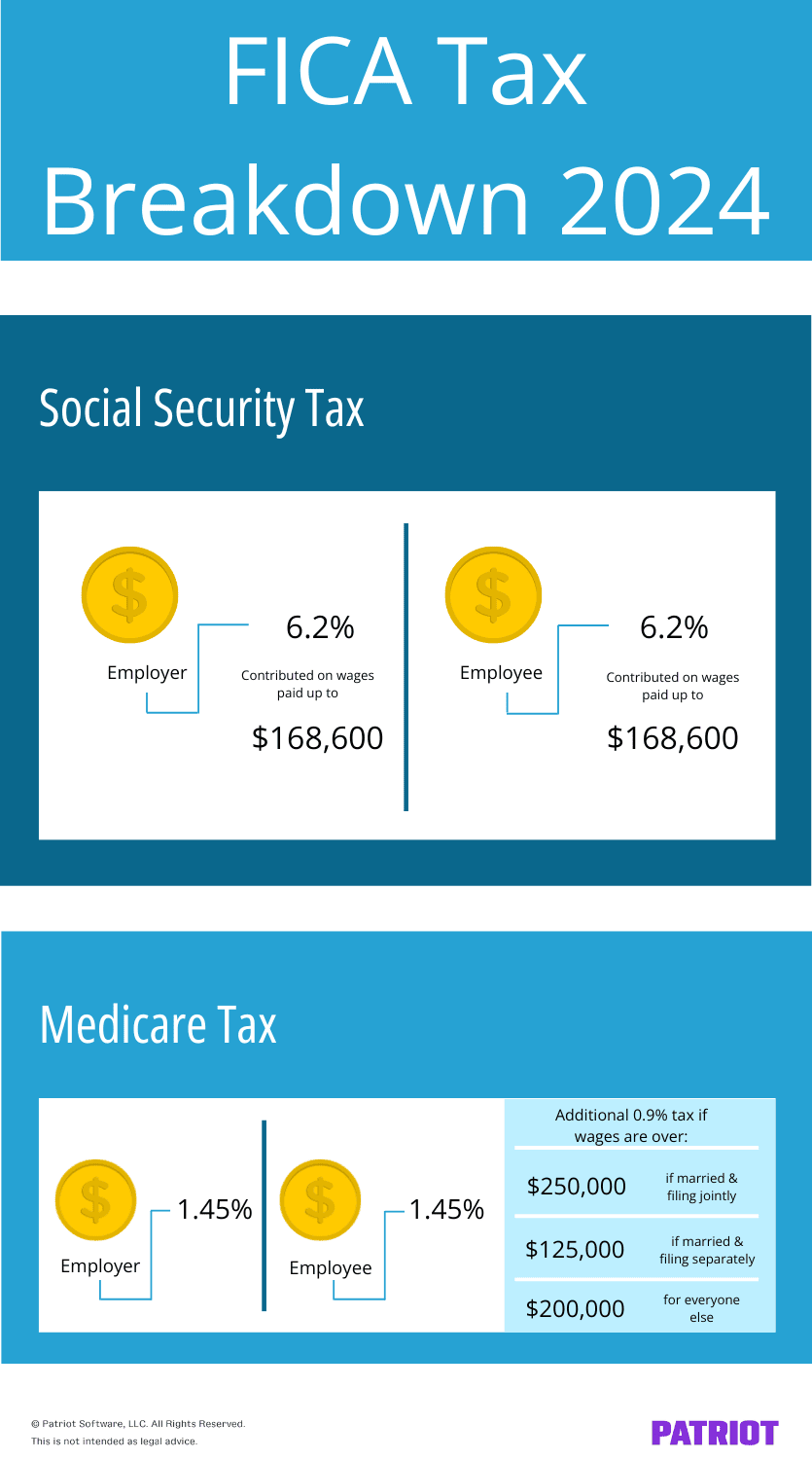

So, what is the Social Security tax rate? The total amount of Social Security tax is a flat rate of 12.4%. But, both the employer and employee pay half of the tax. The employer pays 6.2%, and the Social Security employee tax is also 6.2%. Withhold the percentage from the employee’s gross taxable wages and contribute your half based on the employee’s gross taxable wages.

Social Security taxes have a wage base. So, only a certain amount of employee wages are subject to Social Security tax. The Social Security tax limit 2024 is $168,600.

What does a wage base mean? The wage base for Social Security means that you stop withholding and contributing to the tax for an employee once their wages reach the wage base for the calendar year. Wage bases tend to increase every year to accommodate the rising cost of living.

The combined (Social Security and Medicare) FICA tax rate is 15.3%. Like Social Security, Medicare tax is split in half and paid by both employers and employees (2.9% total, 1.45% each). The wage base for Social Security does not apply to Medicare tax. You must continue withholding Medicare tax once an employee’s wages hit the Social Security wage base. Medicare includes an additional tax rate of 0.9% (employee portion only) on wages over $200,000.

Typically, Social Security tax is paid on an employee’s wages regardless of their age or if they are receiving Social Security benefits. However, some wages, such as employee expense reimbursements, are exempt from Social Security tax. You can learn more about exempt wages in Publication 15.

How do you calculate Social Security tax?

To calculate the Social Security tax, multiply the employee’s gross taxable wage by the Social Security tax rate. Pay frequency does not matter. You always calculate the tax the same way.

Say you pay an employee $1,000 in gross wages. Multiply the $1,000 by 6.2% to determine how much to withhold from the employee’s wages. Because you contribute the same amount, use the calculated amount to determine how much you contribute.

Social Security tax = $1,000 X 0.062 = $62

Withhold $62 from the employee’s wages and contribute $62 for the employer portion of the tax.

Once the employee earns $168,600 in 2024, stop withholding and contributing Social Security tax on their wage. If the employee’s wages never reach the annual wage base, do not stop withholding and contributing the tax.

Where and how do you report Social Security tax?

Most employers must report FICA taxes and federal income tax withholding on a quarterly basis using Form 941, Employer’s Quarterly Federal Tax Return. Report the total amount withheld and contributed for Social Security for all employees.

Some employers can use Form 944, Employer’s Annual Federal Tax Return, to report Social Security taxes withheld and contributed. The annual form also reports Medicare and federal income taxes. The IRS notifies applicable employers if their business qualifies to use Form 944. Typically, applicable employers are those with a total federal income, Social Security, and Medicare tax liability of less than $1000 annually. Do not use Form 944 unless the IRS tells you to.

After you complete the appropriate form, mail it to the IRS. Use the IRS Form 941 website to determine where to file your quarterly return. Annual filers can use the IRS Form 944 website for more information on where to mail their return.

By January 31 each year, you will give each of your employees a Form W-2. This form lists the amount of all the employment taxes you withheld from their wages during the previous year.

You will also submit Form W-2 and Form W-3 (the summary transmittal form) to the Social Security Administration, which records the taxes withheld for the year. Forms W-2 and W-3 must be filed by January 31. You may also have to submit these forms to the state tax agency.

How do you pay Social Security taxes?

Deposit Social Security taxes (along with Medicare and federal income taxes) on either a monthly or semiweekly basis. Your deposit schedule is based on a lookback period of the taxes you previously reported on Form 941 or Form 944. You can learn more about the lookback period and how to determine your deposit schedule in Publication 15. Your lookback period can change, so make sure you verify your lookback period before the beginning of every calendar year.

You must use EFTPS to deposit your payroll taxes. Late tax deposits may be subject to a fee.

This article has been updated from its original publication date of October 19, 2015.

This is not intended as legal advice; for more information, please click here.