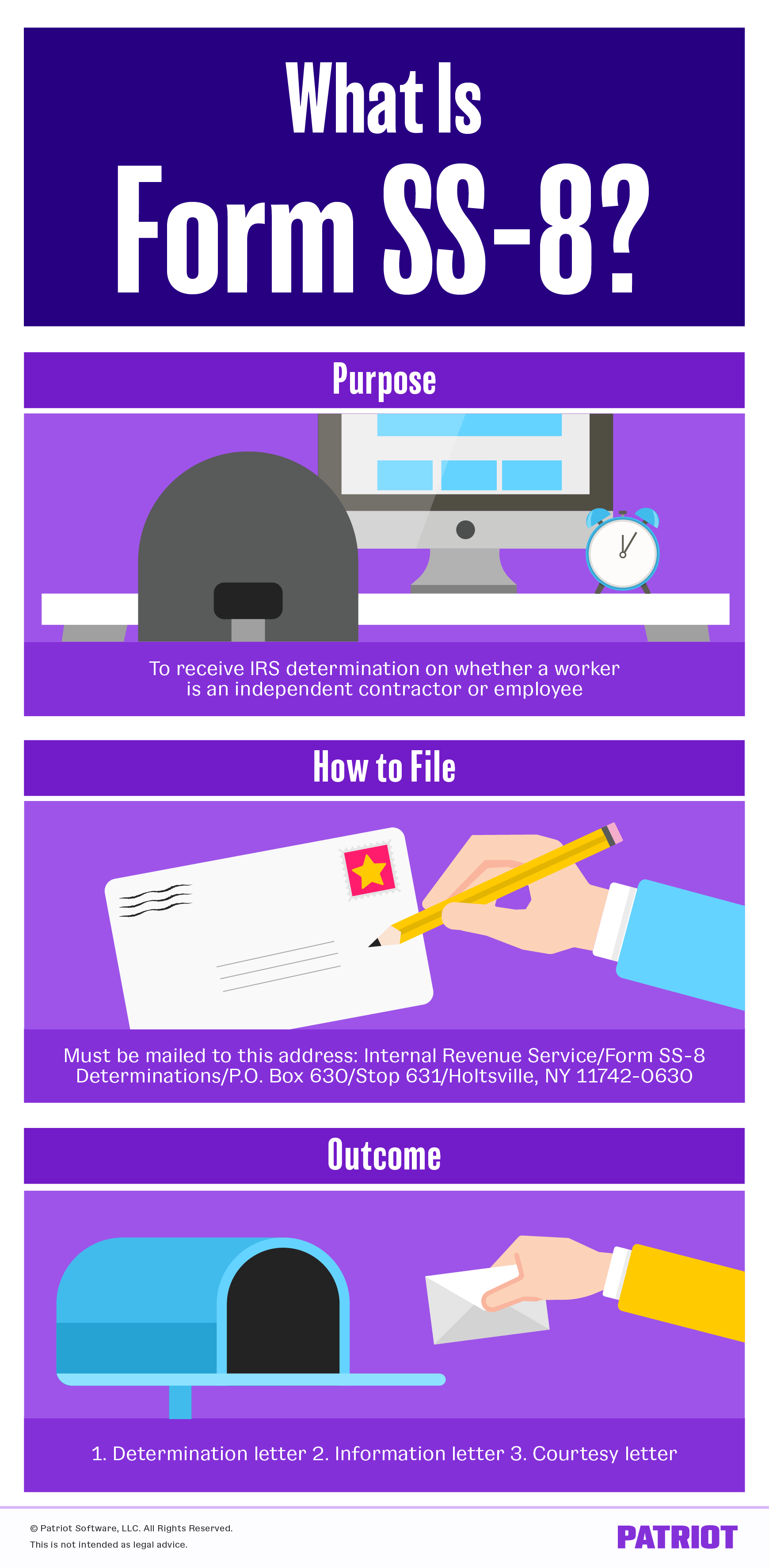

As a business owner, you might hire workers to help streamline your business processes. When you bring someone on board, one of your responsibilities is to decide whether they are an independent contractor or employee. If you have trouble with this determination, you can file Form SS-8. What is Form SS-8?

File Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, to determine a worker’s status at your small business.

You can file Form SS-8, or your worker can file the form if they think you have misclassified them. If you file Form SS-8, the IRS will then ask your worker to file the form as well, and vice versa.

When you file this form, provide information about your business and the services your worker offers.

Independent contractor vs. employee

Understanding what determines a worker’s status can be tricky. But, correctly classifying a worker is important. Misclassifying a worker can be detrimental to your business and its finances.

Employee

An employee is included on your payroll. You are responsible for withholding payroll and income taxes from employee wages and depositing them with the IRS.

One tax you need to withhold is FICA tax. FICA is made up of Social Security and Medicare taxes. With FICA, you withhold a percentage of your employee’s wages (7.65%), and you pay a matching employer portion (7.65%).

Each year, you report the employee’s wages and tax deductions on Form W-2, and give a copy to the employee, Social Security Administration, and state, city, or local tax departments. Keep a copy for your payroll records.

Independent contractor

Independent contractors are not your employees. They are workers you hire to fulfill a certain task. You do not withhold taxes from their wages. Independent contractors are responsible for paying self-employment tax.

Self-employment tax is comprised of Social Security and Medicare taxes, like FICA. Unlike FICA, the independent contractor is responsible for paying the full percentage (15.3%). You are not responsible for paying any part of their independent contractor taxes.

Each year, you report an independent contractor’s wages on Form 1099-NEC and give a copy to them, the IRS, and applicable state tax departments. Keep a copy for your records.

How to decide between independent contractors and employees

The Department of Labor recognizes the difficulty of determining a worker’s status, so they released six economic realities to help determine a worker’s status.

The problem with misclassification

If you misclassify a worker as an independent contractor when they are an employee, the employee could miss out on minimum wage and overtime pay, protection covered by anti-discrimination and related laws, workers’ compensation, unemployment insurance, and benefits. And, the misclassified employee paid twice the amount for Social Security and Medicare taxes since you did not contribute half.

Since a misclassified employee misses out on so much, the business is responsible for paying unpaid wages, unpaid taxes, and penalties.

Form SS-8 instructions

Form SS-8 is a four-page form, broken down into five parts:

- General Information

- Behavioral Control

- Financial Control

- Relationship of the Worker and Firm

- For Service Providers or Salespersons

On the form, you will provide contact information for your business and the worker in question, and talk about why you are filing the form. You will also describe the worker’s job and their duties, as well as how finances are handled in regard to the worker. The form asks questions about your business’s relationship with the worker and the worker’s relationship with customers.

When you complete the form, you will be prompted to attach supporting documentation, so make sure you always keep accurate records. Examples of supporting documents include Forms W-2 or 1099-NEC, contracts, and invoices.

How to file Form SS-8

You cannot electronically file Form SS-8 or send it via fax. Send Form SS-8 on its own. Though filing is free, you are required to send the completed form to the following address:

Internal Revenue Service

Form SS-8 Determinations

P.O. Box 630

Stop 631

Holtsville, NY 11742-0630

Form SS-8 outcomes

The IRS will send one of three letters on SS-8 determination to your business and the worker:

- Determination letter: This is a binding notice that urges the business to change the worker’s classification.

- Information letter: Though not binding, this notice could help the worker complete their federal tax obligations.

- Courtesy letter (rare): This is not binding and is used for the worker to complete their federal tax obligations.

Form 8919

If you classified your worker as an independent contractor and the IRS determines they are an employee, you must change their status immediately. And, the employee must file Form 8919, Uncollected Social Security and Medicare Tax on Wages.

Need help figuring out tax withholding for employees? Patriot’s online payroll tax services deposit and file federal, state, and local payroll taxes. Get back to running your business and avoid the hassle of dealing with taxes. Try it for free today!

This article has been updated from its original publication date of June 5, 2017.

This is not intended as legal advice; for more information, please click here.