As an employer, you must withhold certain taxes from employees’ wages. Then, file and deposit them with the proper agencies. One form your business may need to file to report payroll taxes withheld from employee wages is Form 944. Read on to get the scoop on what is Form 944 and whether or not your business must use it.

What is Form 944 used for?

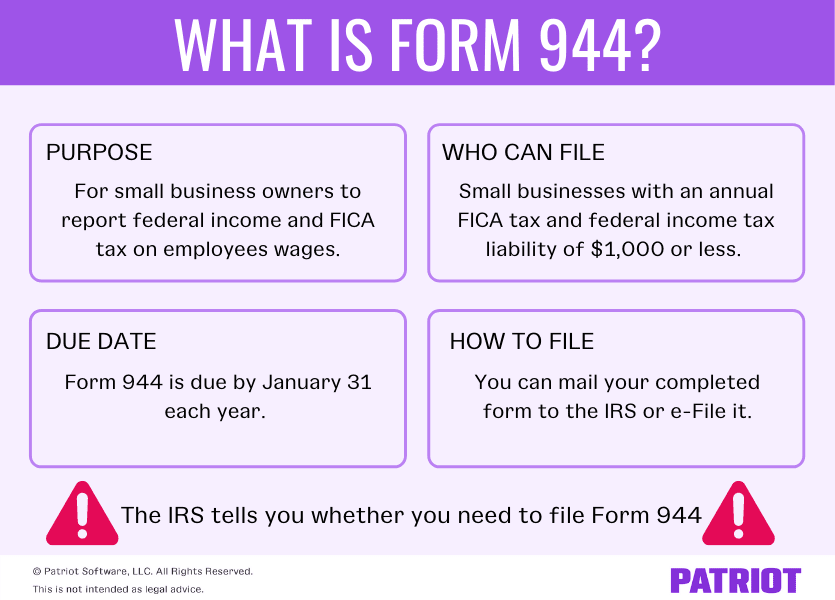

Form 944, Employer’s Annual Federal Tax Return, is a form that eligible small businesses file annually to report federal income tax and FICA tax (Social Security and Medicare taxes) on employee wages.

Small business owners also use IRS Form 944 to calculate and report their employer Social Security and Medicare tax liability.

The IRS designed the form especially for small businesses with fewer employees and a smaller tax liability than other companies.

Form 944 vs. 941

At this point you may be thinking, Hey, this 944 tax form sounds eerily similar to Form 941. If you’re thinking this, you’re not wrong.

Form 944 and Form 941 are used for the same purpose: to report employee wages and withheld federal income and FICA taxes.

So, what’s the difference between Form 944 vs. 941? The main difference between the two forms is that employers must file Form 941 quarterly. Again, if you must file Form 944, you only do so on an annual basis.

Employers cannot use both forms. And, you do not get to choose between using Form 941 or 944. The IRS determines which form you need to report wages and payroll taxes on.

Who needs to file Form 944?

Not every business owner can use Form 944 to report wages and taxes. In fact, only a specific group of small businesses can.

The IRS tells you whether you need to file a 944 form. Typically, if your annual liability for Social Security, Medicare, and federal income taxes is $1,000 or less for the year, the IRS notifies you to file Form 944. Usually, this comes in the form of a written notice.

If you have not received a notice but believe your business meets eligibility requirements, contact the IRS to request to file a 944. You can contact the IRS by calling 1-800-829-4933 or sending a written request.

Keep in mind that you must submit your request within the first few months of the year. The IRS will notify you if you can file Form 944 following your request.

Who can’t file Form 944?

You cannot file Form 944 if the IRS did not tell you to. If you request to file Form 944 and the IRS does not reply, you must file Form 941.

Also, if you employ only household or agricultural employees, you cannot file Form 944.

What about new employers?

Some new employers might be able to file Form 944.

Before you hire employees, apply for an EIN (Employer Identification Number). The EIN identifies your business when you report taxes. To apply, file Form SS-4, Application for Employer Identification Number.

When filling out Form SS-4, indicate whether or not you expect your employment tax liability to be $1,000 or less in box 14.

Requesting to file Form 941 instead of Form 944

If you’re eligible to file Form 944 but would prefer to file Form 941 instead, you can elect to change your filing method.

To request to file Form 941, call the IRS (1-800-829-4933) or send a written request at the beginning of the year.

How to fill out Form 944

Before you can fill out Form 944, you need to gather the following information:

- FEIN

- Number of employees you had during the year

- Wages paid to employees for the tax year

- Tips

- The total amount withheld from employee pay

- Total taxable Social Security and Medicare wages for the year

- Tax deposits you made throughout the year

There are five parts to Form 944, including:

- Part 1: Answering questions about the year, including total wages, federal tax withheld, and taxable Social Security and Medicare wages and tips

- Part 2: Deposit schedule and tax liability for this year

- Part 3: Business information, including coronavirus-related information for tax year 2020

- Part 4: Third-party designee information (if applicable)

- Part 5: Signature

If you’re filling out the form by hand, double-check your calculations to ensure they’re correct.

For more information on how to fill out Form 944, read the IRS’s Instructions for Form 944.

Filing Form 944

You have a couple of options when it comes to filing Form 944. You can either:

- Mail a physical copy to the IRS

- Electronically file the form

If you mail your completed 944 form to the IRS, follow the instructions carefully. The IRS’s instructions specify where you need to send your form based on your state and whether or not you’re filing with a payment.

To e-File Form 944, use the IRS’s e-Filing system. When e-Filing, you have two options:

- Submit the forms yourself

- Use a tax professional to file on your behalf

What is the Form 944 due date?

Form 944 is due by January 31 each year. If January 31 falls on a weekend, then it’s due the following business day.

Make a mistake on your form? File Form 944-X

File Form 944-X, Adjusted Employer’s Annual Federal Tax Return or Claim for Refund, if you made a mistake on Form 944.

Paying your Form 944 balance

You can pay federal taxes with an electronic funds transfer using the Electronic Federal Tax Payment System (EFTPS). If you don’t use EFTPS, a third party (e.g., payroll provider) can make electronic deposits on your behalf.

Even if you file Form 944, your total employment tax liability could potentially exceed $1,000. The amount of tax liability you actually have determines your deposit requirements.

Employers with a tax liability of less than $2,500 for the year don’t have to make a deposit. They can pay the tax amount along with their return.

If your tax liability is $2,500 or more for the year, but less than $2,500 for the quarter, you can deposit by the last day of the month after the end of a quarter. However, if your Quarter 4 tax liability is less than $2,500, you may pay Q4’s tax liability with Form 944.

If your tax liability is $2,500 or more for the quarter, deposit monthly or semiweekly depending on your deposit schedule. Your deposit schedule is based on the IRS lookback period.

Stressed about depositing and filing federal payroll taxes? Well, stress no more. Patriot’s Full Service payroll services will collect, deposit, and file federal, state, and local payroll taxes for you. To say goodbye to time-consuming and daunting tax filings, start your free trial of Patriot’s payroll software today!

This article has been updated from its original publication date of December 1, 2014.

This is not intended as legal advice; for more information, please click here.