As an employer, you have a few options for paying your employees. Common options include direct deposit, cash, or check. Some employers may handwrite checks while others print them. Other employers may opt for early wage access for their employees. But, there is another option: pay cards.

This article will answer questions such as:

- What is a pay card?

- How do pay cards work?

- Are there laws about pay cards?

- What are the pros and cons of pay cards?

What is a pay card?

Payroll cards for employees act like prepaid cards that employers can use to pay employees their wages. Each payday, the employer loads the card with the employee’s earnings for the pay period. A pay card is also known as a payroll debit card or payroll card.

Pay cards are like reloadable debit cards. Employers direct deposit workers’ earnings onto the card instead of into their bank account.

How do payroll cards work?

If an employer chooses to use payroll cards for employees’ wages, they work with a card issuer to receive cards for their employees. The cards are physical plastic cards similar to debit or credit cards. Employers distribute the cards to employees who choose pay cards as a payment option. Think of it like a direct deposit paycheck to credit card instead of to a bank account.

When paying payroll, the employer issues an electronic fund transfer (EFT) to the employee’s pay card. The employee can access their wages with the card as soon as the funds are loaded.

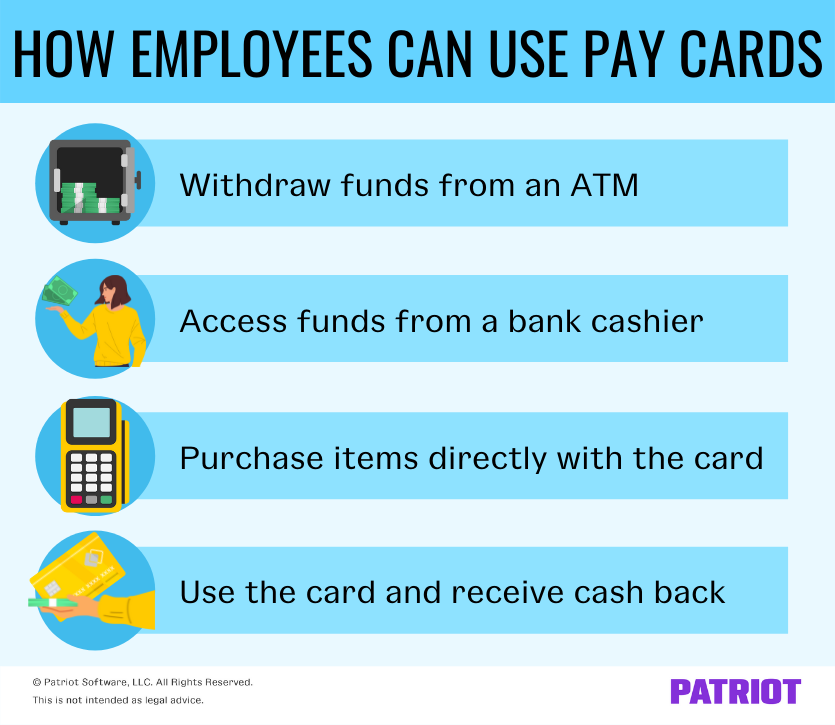

Employees have the option to do the following with a pay card:

- Withdraw funds from an ATM

- Access funds from a bank cashier

- Purchase items with the card directly

- Use the card and receive cash back where applicable

Pay cards, like direct deposit, are subject to the National Automated Clearing House Association (NACHA) rules and regulations. And, they may be subject to Automated Clearing House (ACH) timing. ACH timing can be as little as the same day or as many as four business days.

Are there laws about pay cards?

There are both federal and state laws about using payroll cards to pay your employees. The federal government regulates pay cards under the following:

- Fair Labor Standards Act (FLSA)

- Electronic Fund Transfer Act (EFTA)

- Regulation E

- Regulation Z

States may have their own rules and regulations.

Federal pay card laws

Employers must abide by all minimum wage laws under the FLSA when using payroll cards. Pay cards may have associated fees which lower an employee’s wages below the minimum wage. Notify employees about card replacement and fund withdrawal fees before using a pay card for direct deposit. And, continue to monitor the fees for the cards to ensure you don’t violate any minimum wage laws.

Additionally, employers must offer a minimum of one other form of payment to employees under the Electronic Fund Transfer Act and Regulations E and Z. The act prohibits employers from forcing employees to receive their wages via pay card. Regulations E and Z require employers to follow EFT regulations and the Truth in Lending Act. Employers must provide written disclosure of all pay card account-related information to their employees.

Other Federal Reserve Regulation E requirements under the EFTA include:

- Employees must know of any fees they could have from using a pay card.

- The card issuer must make the card’s transaction history available for review by the employee.

- The employee’s liability for unauthorized card use is limited.

- Financial institutions must respond to a consumer’s report of errors as long as it is within a certain amount of time.

State pay card laws

Federal laws are not the only laws to keep in mind before paying employees via payroll cards. Check out pay card laws by state before proceeding with the payment method.

Many states also have general laws that say workers should receive their pay in full and without reductions. The payroll card regulations have made this payment method controversial since employees cannot always receive their full pay from ATMs and because portions of their salary may be taken away in fees.

Check with your state authorities to find out if you need to follow any state-specific pay card rules.

What are the pros and cons of pay cards?

Still on the fence about pay cards? Take a look at a few facts:

- A 2019 survey showed that 28.5% of employers use payroll cards, an increase from 2% that used them in 2015.

- The Federal Deposit Insurance Corporation’s (FDIC) most recent survey shows that 5.4% of American households did not have a bank account.

- Another report showed that as many as 18.7% of Americans used non-bank alternatives.

With this information in mind, examine the pros and cons of payroll cards for employees.

Pros of payroll cards

Again, 5.4% of American households (approximately 7.1 million) did not have a checking or savings account in 2019, making them “unbanked.” Payroll cards show significant benefits to unbanked workers who cannot receive direct deposits. And, pay cards can reduce the large check-cashing fees for paper checks. So, employees can receive their pay and immediately use it.

Employers may also save money using pay cards. Why? Because, unlike check stock, payroll cards are reloadable. So, employers do not have to purchase new cards each payday or buy paper check stock.

Employees can also use their pay cards like debit cards at most businesses because they are distributed by common cards companies (e.g., Visa, MasterCard, etc.).

Cons of payroll cards

One of the most common cons to using payroll cards for employees is that employees can be hit with fees. These potential fees include ATM, replacement, inactivity, and balance inquiry fees. Over time, the fees could cause employees to lose significant portions of their wages.

Another drawback to pay cards is that ATMs do not disburse exact dollar and cent amounts. So, workers may not be able to withdraw their entire paycheck.

Additionally, employers may need to spend time ensuring that the fees and regulations for payroll cards do not change. If there are changes from the pay card issuer, the employer must notify employees in writing of any changes as soon as possible.

This article has been updated from its original publication date of August 18, 2015.

This is not intended as legal advice; for more information, please click here.