Picture this: You fill out your quarterly Form 941 and submit it to the IRS. Everything seems fine and dandy … until you realize you made a mistake on the form. The panic sets in, and you’re left wondering what to do. Instead of stressing about the blunder, learn how to use IRS Form 941-X to amend your original 941.

What is IRS Form 941-X?

Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, is the form employers use to correct errors on a previously filed IRS Form 941.

As a brief recap, employers use Form 941, Employer’s Quarterly Federal Tax Return, to report employee wages and payroll taxes each quarter. On Form 941, you must report things like wages paid to employees, FICA (Social Security and Medicare) tax, and federal income taxes.

If you discover an error on a filed Form 941, file Form 941-X to correct the mistake. You can use IRS 941-X to correct the following:

- Wages, tips, and other compensation

- Income tax withheld from wages, tips, and other compensation

- Taxable Social Security wages

- Taxable Social Security tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to additional Medicare tax withholding

- Qualified small business payroll tax credit for increasing research activities

Use Form 941-X to correct underreported and overreported amounts for the above. Do not file Form 941-X if you forgot to file Form 941. Instead, file Form 941.

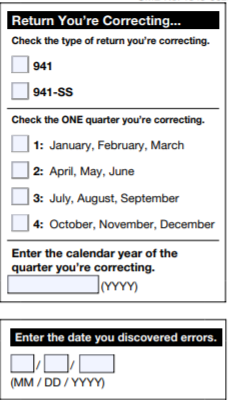

You can only use Form 941-X for one quarter. For example, if you are reporting errors for Q2 and Q3, you must use a separate 941-X for each quarter.

Form 941-X instructions

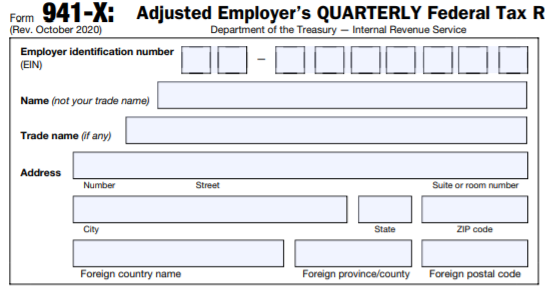

To fill out Form 941-X, you need the following information:

- Employer Identification Number (EIN)

- Business name

- Trade name, if applicable

- Business address

Specify the return you’re correcting by putting an “X” in the box next to Form 941. Check off the box next to the quarter you’re correcting (e.g., April, May, June for Quarter 2). Also include the calendar year of the quarter you’re correcting and the date you discovered the Form 941 errors.

Form 941-X has five parts. Review all parts and fill out the applicable information in each section when completing your form. Here is a breakdown of the five parts on Form 941-X:

- Part 1: Mark whether the form is for an adjusted employment tax return or claim (you can only check off one)

- Part 2: Complete the certifications and answer questions about why you’re filing the form.

- Part 3: Enter the corrections for this quarter. Include the total corrected amount, the previously reported amount, and the difference. Double-check your calculations in this section to ensure they are accurate.

- Part 4: Explain your corrections for this quarter.

- Part 5: Print and sign your name along with the date. Don’t fill out the “Paid Preparer Use Only” section if you did not use a paid preparer.

For more information about how to fill out Form 941-X, check out the IRS’s Instructions for Form 941-X.

Where to mail form 941-X

You can mail your completed 941-X form to the IRS. The mailing address you use depends on your business’s location. Check out the IRS’s “Where to File Your Taxes” table to find out where to mail your form.

What is the IRS Form 941-X due date?

The due date for filing Form 941-X depends on if you underreported or overreported tax.

Underreported tax

For underreported taxes, you can submit a Form 941 correction and pay taxes by the due date for the quarter when you discovered the error. The due dates for filing Form 941-X for underreported taxes are:

- April 30 for errors discovered in Q1

- July 31 for errors discovered in Q2

- October 31 for errors discovered in Q3

- January 31 for errors discovered in Q4

So, are there any penalties for underreported taxes? Typically, correcting an underreported amount will not result in penalties or interest as long as you do the following:

- File Form 941-X by the due date

- Pay the amount you owe (line 27) by the time you file

- Enter the date you discovered the error

- Explain your corrections in detail

You may have to pay interest if you knowingly underreported taxes, received a notice and demand for payment, or received a notice of determination under section 7436.

Overreported tax

For overreported taxes, you can submit Form 941-X within three years from the date you filed the incorrect Form 941, or within two years from the date you paid the tax reported on Form 941, whichever is later.

When it comes to overreported tax, you can either apply the overpaid taxes as a credit to Form 941 or claim a refund.

To apply the overpaid taxes as a credit to Form 941, file Form 941-X soon after you discover the error, but at least 90 days before the period of limitations expires (e.g., three-year period).

If you want to claim a refund for the overpaid taxes, file Form 941-X any time before the period of limitations expires.

Form 941-X and COVID-19

COVID-19 has shaken plenty of things up in the business world, including what you need to report on Forms 941 and 941-X. Thanks to COVID-19, the IRS revised Form 941-X and its instructions for the third and fourth quarters of 2020.

So, what kind of changes will you see on Form 941-X? Employers must now use line 24 to correct the deferral of the employer and employee share of Social Security taxes for Q3 and Q4 2020. In Q2 2020, line 24 was used to only correct the deferral of the employer share of Social Security tax.

Line 33 on Form 941-X also got revamped. However, line 33 was only renumbered to line 33a. And, the IRS added another line, 33b, to the form.

Use line 33a to report qualified wages paid March 13, 2020 – March 31, 2020 for the Employee Retention Credit for Q2 of 2020. Use line 33b to correct the portion of the deferred amount of the employee’s share of Social Security tax for the third and fourth quarters of 2020.

According to the IRS, employers can correct the following coronavirus-related information on the revised Form 941-X 2020:

- Deferred amount of the employer share of Social Security tax

- Deferred amount of the employee share of Social Security tax

- Amounts reported on Form 941 for the qualified sick and family leave wage(s) credit, including adjustments to Form 941, lines 5a(i), 5a(ii), 11b, 13c, 19, and 20

- Amounts reported on Form 941 for the Employee Retention Credit, including adjustments to Form 941, lines 11c, 13d, 21, and 22, (for the second quarter of 2020, also Form 941, lines 24 and 25).

Stop right there! Make sure you are using the correct version of the 2020 Form 941-X. Use the most recent version (Rev. October 2020) for quarters 3 and 4 of 2020.

For more information about correcting coronavirus-related information using a Form 941 amended return, contact the IRS.

We understand how painful running payroll can be. That’s why Patriot’s payroll software is easy-to-use, affordable, and built to save you time and money. Want to see what the hype is about? Try it out for free today with a no-obligation trial!

This article has been updated from its original publication date of May 19, 2011.

This is not intended as legal advice; for more information, please click here.