Deciding how to pay employees takes careful consideration. Not only do you need to think about what payment methods for employees you will use (e.g., direct deposit vs. paper checks), but you also need to consider the types of wages you will provide.

Some types of pay you offer employees can depend on your industry, business, and preference, like commissions. There are also mandatory wages, such as overtime.

Read on to learn about the types of salaries and wages you may need to pay employees.

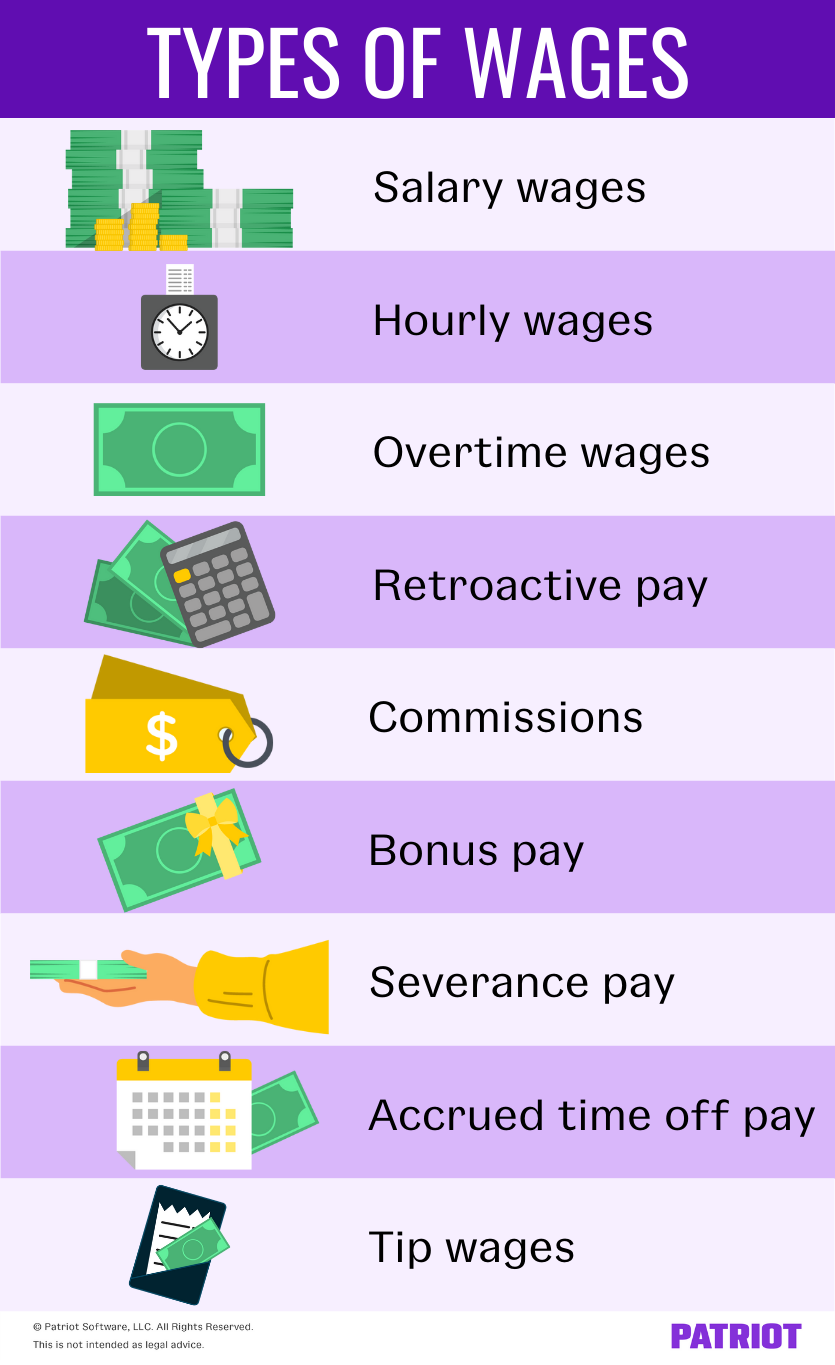

Types of wages

You may use a few payment methods to compensate employees. Wages can generally be split into two categories: regular and supplemental wages.

Regular wages

An employee’s regular wages are fixed amounts they earn each pay period. You can pay an employee salary vs. hourly wages.

1. Salary wages

Employees who earn a salary receive a fixed, regular payment per year. To determine an employee’s wages per period, divide their annual salary by the number of pay periods in your chosen pay frequency. For example, if you pay an employee biweekly, divide their annual salary by 26.

2. Hourly wages

If you pay employee hourly wages, you must multiply their hourly rate by the number of hours they work per pay period. An employee paid hourly might work varying hours, therefore changing their paycheck each period.

Supplemental wages

Supplemental wages are typically additional, non-regular wages you pay employees.

There are several supplemental wages you can use to compensate employees. Some supplemental wages are mandatory while others are optional.

1. Overtime wages

If you have nonexempt employees, you must follow overtime laws. Under the Fair Labor Standards Act (FLSA), you are required to pay overtime wages to nonexempt employees who work more than 40 hours in one workweek.

Overtime pay is time and a half, or 1.5 times, the employee’s regular wages. Provide overtime pay for each hour an employee works over 40 during the workweek.

2. Retroactive pay

Retroactive pay is compensation that you owe an employee from a previous pay period.

You may need to compensate employees with retro pay for a number of reasons, including miscalculating the employee’s regular wages, failing to pay overtime, forgetting to account for a raise, or neglecting a shift differential.

Paying retro wages is mandatory because the employee is entitled to the compensation you neglected to pay.

3. Commissions

Commission pay is money employees earn when they make a sale or accomplish another goal. You might give commissions as a percentage of a sale or a fixed amount depending on the sales volume.

For some jobs, commissions are common. You might pay commissions to employees who work in sales positions, such as a car salesman.

You might provide an employee with both regular and commission wages. That way, the employee is guaranteed to earn a set amount per pay period, regardless of if they don’t earn commissions.

Or, you can forego regular wages and pay employees solely with commissions. Keep in mind that you must pay the employee at least the minimum wage.

4. Bonus pay

You can choose to pay employees bonus wages, which is money an employee earns in addition to their regular wages. You might give an employee bonus pay as a reward or gift.

Unless an employee’s employment agreement explicitly promises them bonuses, you can give bonus pay at your discretion. For example, you may give an employee a holiday bonus.

5. Severance pay

If you must terminate an employee, you may consider offering severance pay. Employees earn severance pay after leaving a business in lieu of their regular wages.

You can decide how much severance pay to offer a terminated employee. Generally, an employee earns severance for a period that is proportional to how long they worked for the business.

You might be required to provide an employee severance pay depending on state laws and whether you include severance in the employee’s contract.

6. Accrued time off pay

Another type of pay you might give employees is accrued time off wages. Accrued time off pay, or PTO accrual, is when an employee has earned paid time off from work but has not used it.

Some businesses pay out the employee’s accrued time off as taxable wages when the year ends or the employee leaves rather than rolling over or removing the accrued time.

7. Tip wages

Your employees might be eligible for earning tips, depending on your business. Tips are supplemental wages an employee earns from customers in addition to regular wages you pay them.

Employees must report tip earnings to you if they earn more than $20 per month in tips.

Types of pay and taxes

Regardless of the types of pay you use to compensate employees, you must withhold income, Social Security, and Medicare taxes from employee wages.

However, how you calculate taxes may vary depending on whether you pay an employee regular or supplemental wages.

You can combine supplemental and regular wages and withhold taxes according to the income tax withholding tables. Or, you can withhold taxes from supplemental wages separately at a flat rate of 22%.

You know you need to withhold taxes from all types of wages. Make things easier on yourself by using Patriot’s online payroll software. After entering employee information, we’ll calculate payroll and income taxes with guaranteed calculations. Get your free trial now!

This article has been updated from its original publication date of January 28, 2019.

This is not intended as legal advice; for more information, please click here.