If you have employees, you likely need to fill out and file Form 941 each quarter. Form 941 is jam-packed with different sections and calculations, which leaves room for errors. Need Form 941 instructions? Avoid major Form 941 mistakes and here learn how to fill out Form 941 line by line here.

What is Form 941?

IRS Form 941, Employer’s Quarterly Federal Tax Return, reports payroll taxes and employee wages to the IRS. Form 941 reports federal income and FICA taxes each quarter.

You must file Form 941 unless you:

- Filed a final return

- Are a seasonal employer

- Employ a household employee (e.g., nanny)

- Have farm employees (e.g., Form 943)

- Are told by the IRS to file Form 944 instead

Information you report on Form 941 includes wages paid to employees, reported tips, federal income taxes withheld, Social Security and Medicare taxes (both employee and employer portions), and additional taxes withheld. You must also include adjustments to Social Security and Medicare taxes, sick pay, tips, and group-term life insurance.

Per the IRS, do not use an earlier version of Form 941 to report 2024 wage and tax information. If you need to report 2024 taxes, use the 2024 version of Form 941. The IRS may adjust the form throughout the year to reflect new rules and laws. So, be sure to keep an eye out for revised forms.

How to fill out your 941 tax form

Before you fill out Form 941, you must collect some payroll information, including:

- Basic business information, such as your business’s name, address, and Employer Identification Number (EIN)

- Number of employees you compensated during the quarter

- Total wages you paid to employees in the quarter

- Taxable Social Security and Medicare wages for the quarter

- Total federal income, Social Security, and Medicare taxes withheld from employees’ wages during the quarter

- Employment tax deposits you’ve already made for the quarter

Form 941 consists of a business information section and five parts. Learn how to fill out Form 941 by following the steps below.

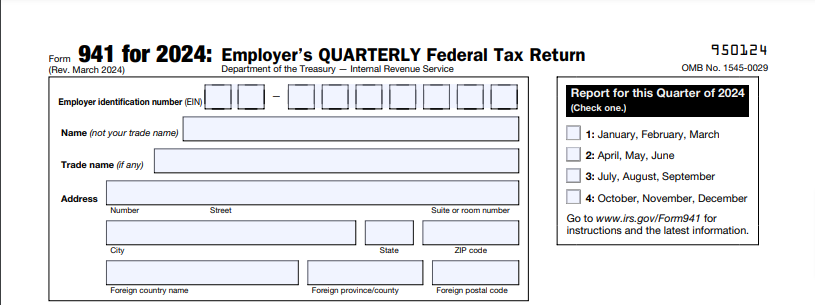

Business and quarter information

At the top portion of Form 941, fill in your EIN, business name, trade name (if applicable), and business address.

Off to the right side, mark which quarter the information is for. For example, put an “X” in the box next to “January, February, March” if the form is for the first quarter.

Part 1: Questions for the quarter

Part 1 has 15 lines. Some lines have multiple parts (i.e., 5a, 5b, etc.). Here are details about each line and what information you must provide.

Form 941 Line 1

The IRS is not known for straightforward fields, and this one is no exception. Enter the number of employees on your payroll for the pay period including March 12, June 12, September 12, or December 12, for the quarter indicated at the top of Form 941.

Per the IRS, this means only include the total number of those who worked on these dates or during pay periods that include these dates: March 12 (Q1), June 12 (Q2), September 12 (Q3), and December 12 (Q4). Do not include the following:

- Household employees

- Employees in non-pay status for the pay period

- Farm employees

- Pensioners

- Active members of the U.S. Armed Forces

Say you have 11 employees working during September. Only 10 employees work during the pay period of 9/1 – 9/13. Because only 10 employees worked on or through September 12, you would only report “10” on Line 1.

Form 941 Line 2

Report the total compensation you paid to the applicable employees during the quarter. Include all wages, tips, and other compensation. This also includes “ordinary” sick pay.

Form 941 Line 3

List the federal income tax withheld from employee wages, tips, and other compensation. This includes:

- Tips

- Taxable fringe benefits

- Supplemental unemployment compensation benefits

Don’t include any income tax withheld by a third-party sick payer, if applicable. And, do not include qualified health plan expenses.

Form 941 Line 4

If no employee compensation is subject to Social Security and Medicare taxes, mark an “X” next to “Check and go to line 6” on line 4. If you mark that box, you can skip lines 5a, 5b, 5c, 5d, 5e, and 5f.

If employees have compensation subject to Social Security and Medicare taxes, fill out lines 5a-5f next.

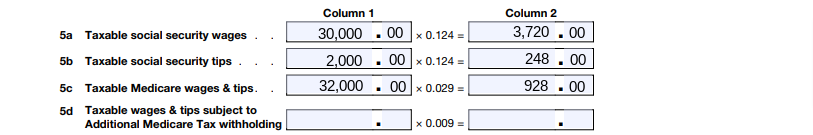

Form 941 Lines 5a-5d

The most confusing lines on Form 941 are 5a-5d. To calculate the totals for these lines correctly, break up the wages by type (e.g., regular wages or tips).

Lines 5a-5d are the totals for both the employee and employer portions of Social Security and Medicare taxes withheld from an employee’s wages.

On lines 5a and 5b, you must multiply taxable Social Security wages (5a) and taxable Social Security tips (5b) by 0.124.

The decimal represents the rate of Social Security tax on taxable wages. Both you and your employee must contribute 6.2% each paycheck for Social Security. Combined, you and your employee contribute 12.4%, which is the amount you multiply on lines 5a and 5b (0.124).

For 2024, the Social Security wage base is $168,600. An employee’s annual income is no longer subject to Social Security tax after they earn above the wage base. Do not include any wages above the wage base on lines 5a-5d.

On line 5c, multiply taxable Medicare wages and tips by 0.029. You and your employee must both contribute 1.45% each paycheck for Medicare taxes. Combined, you and your employee pay 2.9%, or 0.029.

Medicare tax does not have a wage base. However, you must withhold an additional 0.9% for Medicare tax once an employee earns above $200,000.

If applicable, account for the additional 0.9% on line 5d by multiplying taxable wages and tips subject to additional Medicare tax withholding by 0.009.

Let’s look at an example of calculating totals for lines 5a-5d for an employee. Say your employee earns $30,000 in regular wages and $2,000 in tips during the quarter.

Line 5a: Taxable Social Security wages x 0.124

Line 5b: Taxable Social Security tips x 0.124

Line 5c: Taxable Medicare wages and tips x 0.029

Line 5d: Leave blank if the employee doesn’t earn more than the applicable Medicare threshold

Line 5a: $30,000 x 0.124 = $3,720.00

Line 5b: $2,000 x 0.124 = $248.00

Line 5c: $32,000 x 0.029 = $928.00

Line 5d: Leave blank

Fill out Columns 1 and 2 with the correct totals based on your wages and calculations. Be sure to separate the dollar and cents amounts on the form. For example:

Form 941 Line 5e

Add the totals from Column 2 for 5a, 5b, 5c, and 5d together to fill in the total on line 5e. Using the same data from above, you would input $4,896.00 on line 5e ($3,720 + $248 + $928).

Form 941 Line 5f

Line 5f is specifically for documenting tax due on unreported tips.

The IRS may issue a Section 3121(q) Notice and Demand to employers. This notice tells you about the amount of tips received by employees that were unreported (e.g., employee failed to report tips or underreported tips to their employer).

If you receive a notice, fill in the amount the notice lists on line 5f. Do not fill out line 5f if you did not receive a notice from the IRS.

Form 941 Line 6

To get your total for line 6, add together totals from lines 3, 5e, and 5f (if applicable). Line 6 is the total amount of taxes you owe before any adjustments.

Form 941 Line 7

Fill out line 7 to adjust fractions of cents from lines 5a – 5d. At some point, you will probably have a fraction of a penny when you complete your calculations. The fraction adjustments relate to the employee share of Social Security and Medicare taxes withheld.

The employee portion of Social Security and Medicare taxes from lines 5a-5d may differ from the amounts you withheld from employees’ wages due to rounding.

Say your employee had a tax liability of $2,225.212. You can’t send 21.2 pennies to the IRS. Instead, you round the penny amount down to 21 cents.

Line 7 is for you to report these types of penny discrepancies. Say you paid $5,500.14. Your form states you should have paid $5,500.16. You would put -.02 on line 7 to show the penny discrepancy.

The fractions of cents adjustment can be either a positive or negative amount. Use the negative sign (not parentheses) to show a decrease.

Form 941 Line 8

Fill out line 8 if you have a third-party sick payer, such as an insurance company, that transfers the liability for the employer share of SS and Medicare taxes to you. Calculate third-party sick pay for the quarter and enter the total on line 8 as a negative (e.g., -$130).

Form 941 Line 9

Line 9 is for recording adjustments for tips and group-term life insurance.

On line 9, enter a negative amount for:

- Any uncollected employee share of Social Security and Medicare taxes on tips

- The uncollected employee share of Social Security and Medicare taxes on group-term life insurance premiums paid for former employees

Don’t fill in line 9 if you do not have any uncollected taxes for tips (Social Security and Medicare taxes) or group-term life insurance (employee share of taxes).

Form 941 Line 10

On line 10, fill in the total taxes after your adjustments (if applicable) from lines 6-9. Add the totals from lines 6-9 and fill in the sum on line 10.

Form 941 Line 11

Form 941 Line 11 is specifically for a payroll tax credit for increasing research activities. If this credit applies to you, enter the amount of credit from Form 8974, line 12.

You must also attach Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities, to Form 941.

Do not fill in line 11 if this credit does not apply to your business.

Form 941 Line 12

Record your total taxes after adjustments and nonrefundable credits on line 12. Subtract line 11 from line 10 and enter your total on line 12. The amount entered cannot be less than zero.

According to the IRS, You can either pay your amount with Form 941 or deposit the amount if both of the following are true:

- Line 12 is less than $2,500 or line 12 on your previous quarterly return was less than $2,500

- You didn’t incur a $100,000 next-day deposit obligation during the current quarter

You must follow a deposit schedule if both of the following apply to you:

- If line 12 is $2,500 or more and line 12 on your previous quarterly return was $2,500 or more

- You incurred a $100,000 next-day deposit obligation during the current quarter

Form 941 Line 13

List your total deposits for the quarter on line 13. If you had any overpayments from previous quarters that you’re applying to your return, include the overpayment amount with your total on line 13.

Also, include any overpayment you applied from filing Form 941-X, 941-X (PR), 944-X, or 944-X (SP) in the current quarter.

Form 941 Line 14

If line 12 is more than line 13, enter the difference on line 14. You do not have to pay if your line 14 total is less than one dollar.

Do not fill out line 14 if line 12 is less than line 13. Move on to line 15.

Form 941 Line 15

If line 13 is more than line 12, enter the difference on line 15.

Do not fill in both lines 14 and 15. Only fill out one of these lines.

Mark if you want the amount applied to your next return or if you want the IRS to send you a refund. If line 15 is under one dollar, the IRS will send a refund. Or, the IRS can apply it to your next return if you ask them to do so in writing.

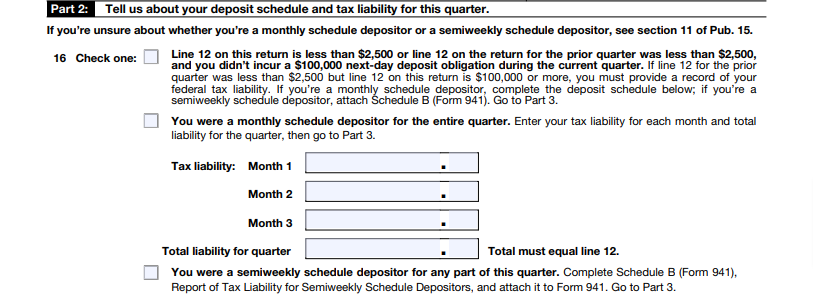

Part 2: Deposit schedule and tax liability for the quarter

In Part 2, fill out information about whether you’re a semiweekly or monthly depositor. If you’re not sure which type of depositor you are, check IRS Publication 15.

Next to line 16, you will see three boxes.

Mark an “X” next to the first box if:

- Line 12 on your Form 941 was less than $2,500 or line 12 on your previous quarterly return was less than $2,500 AND

- You didn’t incur a $100,000 next-day deposit obligation during the current quarter.

If you were a monthly depositor for the entire quarter, put an “X” next to the second box and fill out your tax liability for Months 1, 2, and 3. Your total liability for the quarter must equal line 12 on your form.

If you were a semiweekly depositor during any part of the quarter, mark an “X” next to the third box. You must also complete Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941 if you were a semiweekly depositor.

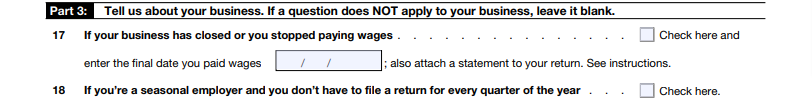

Part 3: About your business

Above the section for Part 3, enter your business name and EIN one more time.

Part 3 includes lines 17-18 and asks you certain questions about your business. If a question does not apply to your business, leave it blank.

Form 941 Line 17

Part 3, line 17 asks you whether your business closed or stopped paying wages during the quarter. If you did close your business or stopped paying wages in the quarter, place an “X” next to the box that says “Check here.” Then, enter the final date you paid wages. Also, attach a statement to your final return.

Form 941 Line 18

If you hire employees seasonally and you don’t have to file a return for every quarter of the year, check the box on line 18.

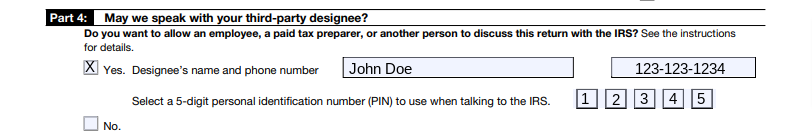

Part 4: Third-party designee

Part 4 asks permission for the IRS to speak with your third-party designee. Your third-party designee is the individual (e.g., employee or tax preparer) who prepared Form 941 and is typically responsible for payroll tax prep.

If you want your third-party designee to be able to discuss your return with the IRS, mark an “X” next to the “Yes” box. Then, fill in the designee’s name and phone number. You must also select a five-digit PIN to use when talking to the IRS (e.g., 12345).

If you do not want another person to be able to discuss the return with the IRS, check off the box next to “No” and move on to Part 5.

The example below shows what it would look like if you chose “Yes.”

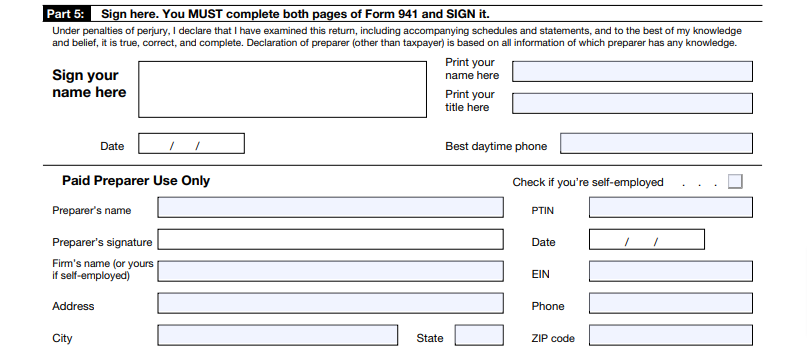

Part 5: Signature

After you complete all of the above sections, sign your form under Part 5.

The following people can sign Form 941:

- Sole proprietorship: Individual who owns the company

- Corporation or an LLC treated as a corporation: President, vice president, or other principal officer

- Partnership or an LLC treated as a partnership: Partner, member, or officer

- Single-member LLC: Owner of the LLC or a principal officer

- Trust or estate: The fiduciary

One of the authorized signers from above must sign Form 941 in the box next to “Sign your name here.” The signer must also print their name and title (e.g., president) and include the date and their phone number.

If you have someone else prepare Form 941 on your company’s behalf, the preparer must fill out the Paid Preparer Use Only section. This section includes the preparer’s name, signature, firm’s name, address, phone number, EIN, and date. Your preparer must also check off whether or not they’re self-employed.

After you complete all three pages of 941 and sign it, you’re ready to submit your form to the IRS.

How to submit Form 941

Where you file Form 941 depends on your state and whether you make a deposit with your filing. The IRS encourages businesses to electronically file Form 941. Check out the IRS’s website to find out where to mail Form 941.

File a new Form 941 with the IRS every quarter. Because Form 941 is a quarterly form, it has multiple due dates:

- April 30 for Quarter 1 (January 1 – March 31)

- July 31 for Quarter 2 (April 1 – June 30)

- October 31 for Quarter 3 (July 1 – September 30)

- January 31 for Quarter 4 (October 1 – December 31)

For additional details on completing Form 941 and sending it to the IRS, consult the IRS’s Form 941 Instructions.

How Patriot Software addresses Form 941

Patriot’s Basic Payroll software customers will get a prefilled version of Form 941 with all of the information we have available from them. It is the customer’s responsibility to review and file Form 941 with the IRS.

Full Service Payroll customers will also receive a prefilled Form 941 that Patriot will file with the IRS on the customer’s behalf. Full Service Payroll customers can view their Form 941 in their company tax packets.

This article has been updated from its original publication date of June 24, 2019.

This is not intended as legal advice; for more information, please click here.