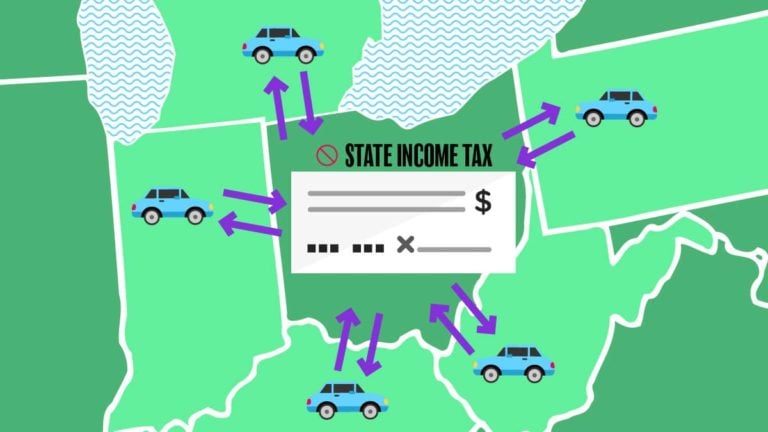

Do you have an employee who lives in one state but works in another? If so, you typically withhold state and local taxes for the work state. The employee would still owe taxes to their home state, which could turn into a hassle for them. Or could it? Cue reciprocal agreements.

Read More Which States Have Reciprocal Agreements … and What Does That Mean?