Miles spent driving to meet clients, going to an office supply store, and depositing a customer’s check at the bank can add up. If you use a vehicle for small business purposes, you might qualify for a business mileage deduction from the IRS.

You might be thinking that a business mileage deduction is only going to save you loose change. But, you could end up with a substantial tax break.

In this article, you’ll learn what is a business mileage deduction, how to calculate mileage deduction, and how to report mileage on taxes.

What is a business mileage deduction?

The business mileage deduction is a tax break small business owners can claim for business miles driven. Mileage deduction rates apply to those who are self-employed.

Due to the Tax Cuts and Jobs Act of 2017, your employees cannot claim the deduction. However, you can continue or start providing mileage reimbursement to your employees.

You can claim a business mileage deduction when you use any four-wheeled vehicle for business purposes. However, your business cannot revolve around using cars, such as a taxi service.

Mileage deduction for business purposes

Before learning how to calculate mileage for taxes, make sure you know what you can claim. So, what types of trips are considered business miles?

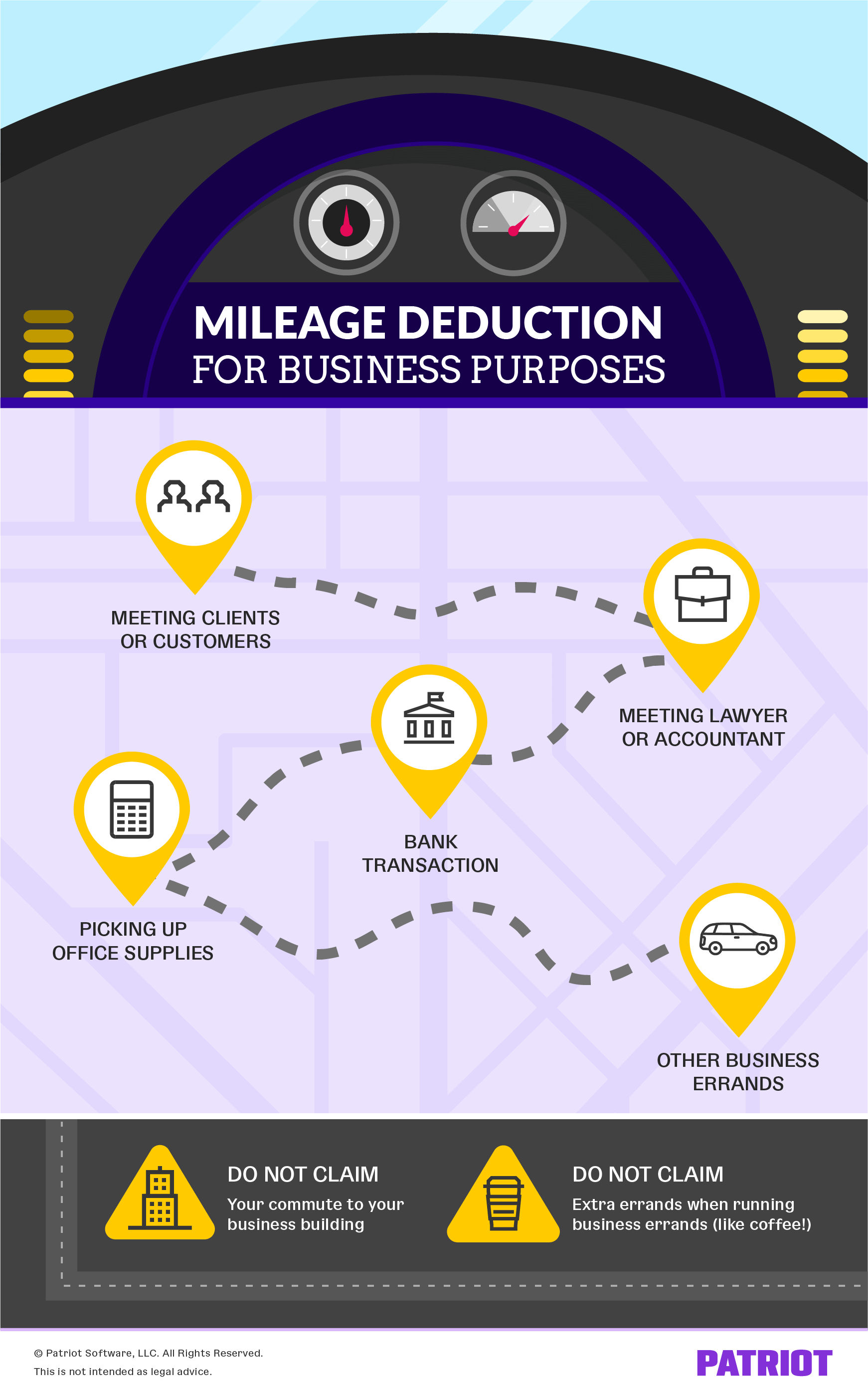

Here are some common business purposes for vehicles:

- Driving to meet clients or customers

- Driving to meet with your accountant or small business lawyer

- Driving to the bank for a business transaction

- Driving to the store to pick up office supplies

- Any other business-related errand

You should not claim:

- Your commute to your business building (e.g., driving from your home to your business location, lunch, etc.)

- Extra errands when making business-related runs (e.g., grabbing coffee when you go to the bank)

How to calculate business mileage

When it comes to calculating mileage for taxes, you have two options. You can either use the standard mileage rate or the actual expense method.

Before choosing a business mileage deduction calculation method, consider calculating your deduction with both. That way, you can determine which method gets you the larger tax deduction.

Both methods let you deduct parking fees and tolls for qualifying business purposes. But, you must calculate those costs separately.

Regardless of which method you choose, keep accurate records that back up your business mileage deduction claim. Consider keeping a log in your car to help you organize your records. The more supporting documents you have, the better.

1. How to calculate standard mileage rate

The standard mileage rate is one tax deduction method you can use. If you use this method, you can claim a standard amount per mile driven.

The standard mileage rate is easier to use than the actual expense method. Rather than determining each of your actual costs, you use the IRS standard mileage deduction rate.

Calculating mileage for taxes using the standard method is a three-step process:

- Determine if you can use the standard mileage rate

- Know the mileage deduction rate

- Multiply business miles driven by the rate

Determine if you can use the standard mileage rate

Not all business owners can use the standard mileage method. First, you must own or lease the car you put business miles on.

If you own the car and want to use the standard mileage rate, you must choose this method during the first year you put business miles on it. You can opt for the actual expense method later.

If you lease the car and select the standard mileage rate, you must use this method during the entire lease period.

According to the IRS, you cannot use the standard mileage rate if you do any of the following:

- Operate five or more cars at the same time (i.e., fleet operation)

- Claim a depreciation deduction for the car using any method other than straight-line

- Claim the Section 179 deduction on the car

- Claim the special depreciation allowance on the car

- Claim actual expenses after 1997 for a car you lease

- Are a rural mail carrier who received a “qualified reimbursement”

Know the mileage deduction rate

Each year, the IRS sets a standard mileage deduction rate. The 2023 standard mileage rate is 65.5 cents per business mile driven. The 2024 standard mileage rate is 67 cents per business mile driven, up 1.5 cents from 2023’s rate.

Multiply business miles driven by the IRS rate

To find out your business tax deduction amount, multiply your business miles driven by the IRS mileage deduction rate.

Let’s say you drove 30,000 miles for business in 2023. Multiply 30,000 by the mileage deduction rate of 65.5 cents (30,000 X $0.655). You could claim $19,650 for the year.

2. Actual expense method for mileage tax deduction

If you use the actual expense method, keep track of what it costs to operate your car. From there, you can record what portion of the overall expenses applies to business use.

Again, you cannot use the actual expense method if you previously used the standard mileage rate on a leased vehicle.

For the actual expense method, include the following expenses:

- Gas

- Oil

- Repairs

- Tires

- Insurance

- Registration fees

- Licenses

- Depreciation

- Lease payments

When you record what you spend on the above expenses, also include the date and a description of the costs.

How to calculate your actual expenses for business

To calculate actual expenses, figure out what percentage of your car you used for business purposes. You can do this by dividing your business miles driven by your total annual miles.

Next, multiply your business use percentage by your total car expenses.

Let’s say your total car expenses for the year were $6,850:

- Lease payments: $3,600

- Gas: $2,000

- Repairs: $1,000

- Tires: $250

You drove a total of 60,000 miles during the year. Of those 60,000 miles, 20,000 were for business purposes.

First, divide your business miles by your total miles:

20,000 business miles / 60,000 total miles = 33%

Now, multiply your business mileage percentage by your total car expenses:

33% X $6,850 = $2,260.50

You can claim approximately $2,260.50 for the business mileage deduction using the actual expense method.

How to report mileage on taxes

So, how do you claim mileage on your taxes?

When you file your taxes, you use Form 1040. Form 1040 is your U.S. Individual Income Tax Return, which lets the IRS know whether you owe more taxes or should be reimbursed.

Use Schedule C to claim business mileage expenses as a sole proprietor. Complete Part II, Line 9 on Schedule C.

Enter either the actual expenses or the standard mileage for your car’s business purposes. You will also add parking fees and tolls to the number.

Part IV, Information on Your Vehicle, asks you further questions about the business use of your car. Fill out Part IV if you use the standard mileage rate. You can also fill Part IV out for the actual expense method if you do not claim depreciation.

If you include depreciation for the actual expense method, enter the depreciation in Part II, Line 13.

Form 4562

If you use the actual expense method and claim depreciation, you need to complete Part V of Form 4562, Depreciation and Amortization. Part V asks you for information about your vehicle.

Advisory

When filing taxes for your small business, only deduct a car’s business use. Do not claim 100% business deduction on a vehicle unless you use all 100% for business purposes, or you could end up with an IRS audit.

Keep careful records of your vehicle expenses to claim the business mileage deduction. Patriot’s online accounting software lets you easily track expenses and income. And, we offer free support. Get your free trial today!

This article has been updated from its original publication date of December 20, 2016.

This is not intended as legal advice; for more information, please click here.